Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help! i need to fill this out in microsoft excel. please help in microsoft excel Due Sunday by 11:59pm Points 100 Submitting a file

please help! i need to fill this out in microsoft excel. please help in microsoft excel

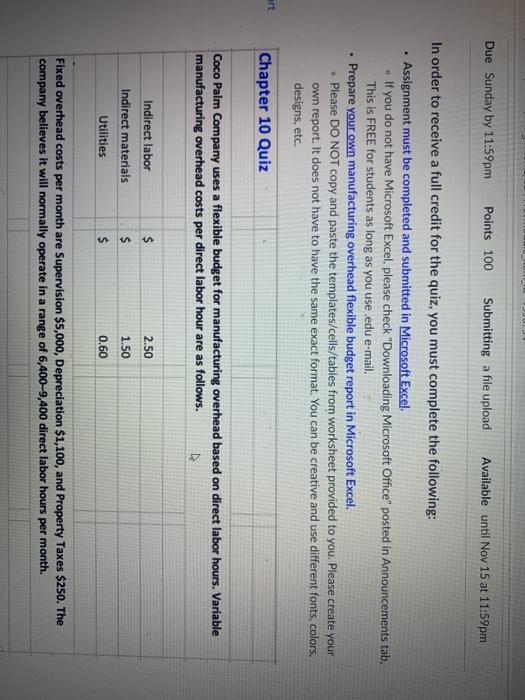

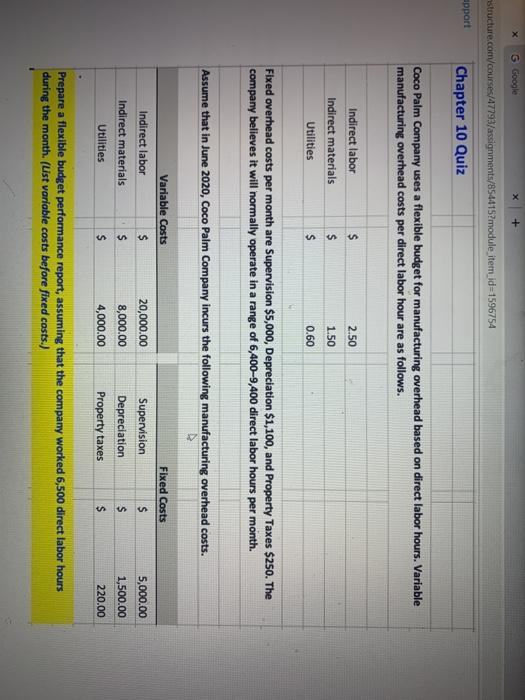

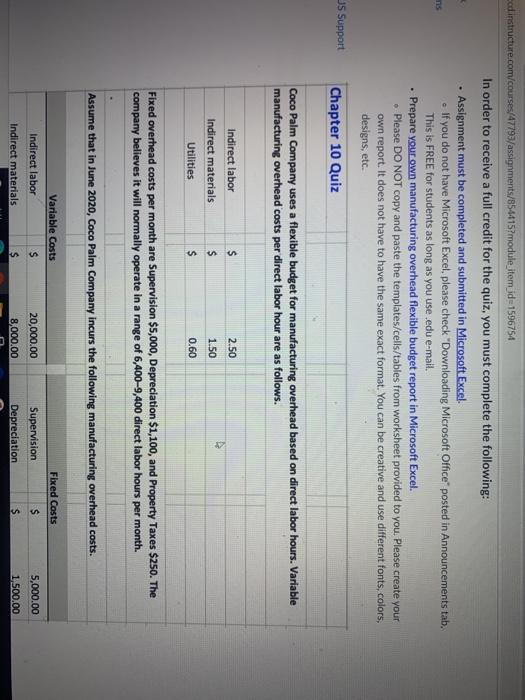

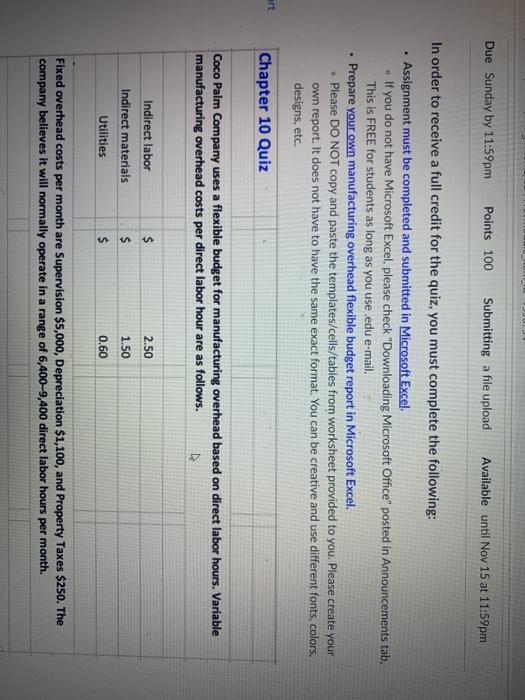

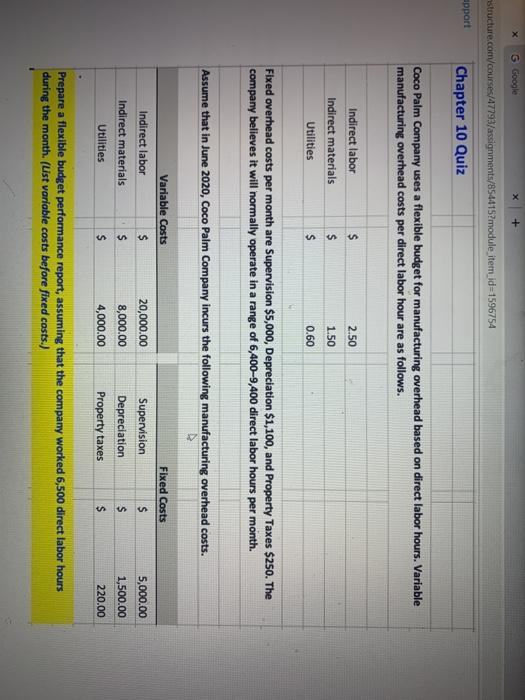

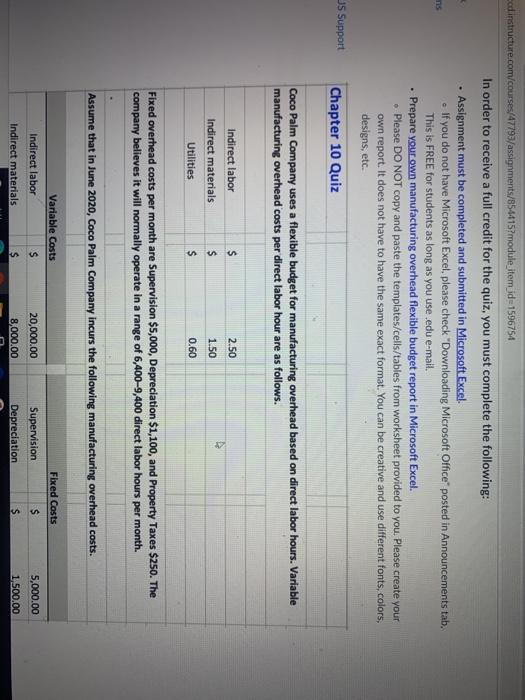

Due Sunday by 11:59pm Points 100 Submitting a file upload Available until Nov 15 at 11:59pm In order to receive a full credit for the quiz, you must complete the following: Assignment must be completed and submitted in Microsoft Excel. . If you do not have Microsoft Excel, please check "Downloading Microsoft Office" posted in Announcements tab, This is FREE for students as long as you use edu e-mail. Prepare your own manufacturing overhead flexible budget report in Microsoft Excel. . Please DO NOT copy and paste the templates/cells/tables from worksheet provided to you. Please create your own report. It does not have to have the same exact format. You can be creative and use different fonts, colors, designs, etc. ort Chapter 10 Quiz Coco Palm Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows. 2.50 Indirect labor Indirect materials Utilities $ $ $ 1.50 0.60 Fixed overhead costs per month are Supervision $5,000, Depreciation $1,100, and Property Taxes $250. The company believes it will normally operate in a range of 6,400-9,400 direct labor hours per month. G Google + structure.com/courses/47793/assignments/854415?module_item_id=1596754 apport Chapter 10 Quiz Coco Palm Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows. $ 2.50 Indirect labor Indirect materials Utilities $ 1.50 s 0.60 Fixed overhead costs per month are Supervision $5,000, Depreciation $1,100, and Property Taxes $250. The company believes it will normally operate in a range of 6,400-9,400 direct labor hours per month. Assume that in June 2020, Coco Palm Company incurs the following manufacturing overhead costs. Fixed Costs $ 5,000.00 Variable costs Indirect labor $ Indirect materials $ Utilities 20,000.00 8,000.00 4,000.00 Supervision Depreciation Property taxes $ 1,500.00 $ s 220.00 Prepare a flexible budget performance report, assuming that the company worked 6,500 direct labor hours during the month. (List variable costs before fixed costs.) ms ed instructure.com/courses/47793/assignments/854415?module_item_id=1596754 In order to receive a full credit for the quiz, you must complete the following: Assignment must be completed and submitted in Microsoft Excel . If you do not have Microsoft Excel. please check "Downloading Microsoft Office" posted in Announcements tab. This is FREE for students as long as you use.edu e-mail, Prepare your own manufacturing overhead flexible budget report in Microsoft Excel. . Please DO NOT copy and paste the templates/cells/tables from worksheet provided to you. Please create your own report. It does not have to have the same exact format. You can be creative and use different fonts, colors, designs, etc. 5 Support Chapter 10 Quiz . Coco Palm Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows. $ 2.50 Indirect labor Indirect materials Utilities 1.50 $ $ 0.60 Fixed overhead costs per month are Supervision $5,000, Depreciation $1,100, and Property Taxes $250. The company believes it will normally operate in a range of 6,400-9,400 direct labor hours per month. Assume that in June 2020, Coco Palm Company incurs the following manufacturing overhead costs. Variable Costs Indirect labor $ Indirect materials $ Fixed Costs $ 20,000.00 Supervision Depreciation 5,000.00 1,500.00 8,000.00 $ Due Sunday by 11:59pm Points 100 Submitting a file upload Available until Nov 15 at 11:59pm In order to receive a full credit for the quiz, you must complete the following: Assignment must be completed and submitted in Microsoft Excel. . If you do not have Microsoft Excel, please check "Downloading Microsoft Office" posted in Announcements tab, This is FREE for students as long as you use edu e-mail. Prepare your own manufacturing overhead flexible budget report in Microsoft Excel. . Please DO NOT copy and paste the templates/cells/tables from worksheet provided to you. Please create your own report. It does not have to have the same exact format. You can be creative and use different fonts, colors, designs, etc. ort Chapter 10 Quiz Coco Palm Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows. 2.50 Indirect labor Indirect materials Utilities $ $ $ 1.50 0.60 Fixed overhead costs per month are Supervision $5,000, Depreciation $1,100, and Property Taxes $250. The company believes it will normally operate in a range of 6,400-9,400 direct labor hours per month. G Google + structure.com/courses/47793/assignments/854415?module_item_id=1596754 apport Chapter 10 Quiz Coco Palm Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows. $ 2.50 Indirect labor Indirect materials Utilities $ 1.50 s 0.60 Fixed overhead costs per month are Supervision $5,000, Depreciation $1,100, and Property Taxes $250. The company believes it will normally operate in a range of 6,400-9,400 direct labor hours per month. Assume that in June 2020, Coco Palm Company incurs the following manufacturing overhead costs. Fixed Costs $ 5,000.00 Variable costs Indirect labor $ Indirect materials $ Utilities 20,000.00 8,000.00 4,000.00 Supervision Depreciation Property taxes $ 1,500.00 $ s 220.00 Prepare a flexible budget performance report, assuming that the company worked 6,500 direct labor hours during the month. (List variable costs before fixed costs.) ms ed instructure.com/courses/47793/assignments/854415?module_item_id=1596754 In order to receive a full credit for the quiz, you must complete the following: Assignment must be completed and submitted in Microsoft Excel . If you do not have Microsoft Excel. please check "Downloading Microsoft Office" posted in Announcements tab. This is FREE for students as long as you use.edu e-mail, Prepare your own manufacturing overhead flexible budget report in Microsoft Excel. . Please DO NOT copy and paste the templates/cells/tables from worksheet provided to you. Please create your own report. It does not have to have the same exact format. You can be creative and use different fonts, colors, designs, etc. 5 Support Chapter 10 Quiz . Coco Palm Company uses a flexible budget for manufacturing overhead based on direct labor hours. Variable manufacturing overhead costs per direct labor hour are as follows. $ 2.50 Indirect labor Indirect materials Utilities 1.50 $ $ 0.60 Fixed overhead costs per month are Supervision $5,000, Depreciation $1,100, and Property Taxes $250. The company believes it will normally operate in a range of 6,400-9,400 direct labor hours per month. Assume that in June 2020, Coco Palm Company incurs the following manufacturing overhead costs. Variable Costs Indirect labor $ Indirect materials $ Fixed Costs $ 20,000.00 Supervision Depreciation 5,000.00 1,500.00 8,000.00 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started