Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help. I'll leave thumbs up Suppose that you are a dealer at CitiBank. Your duty is to make a profit through financial transactions. Sometimes,

please help. I'll leave thumbs up

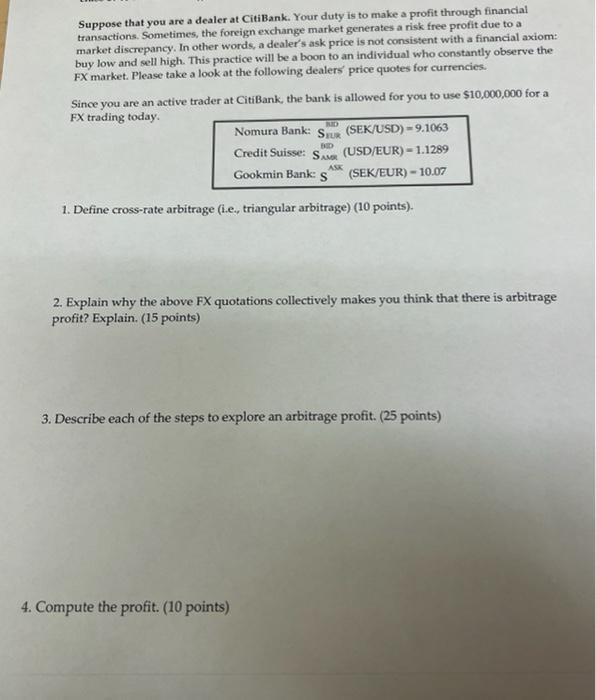

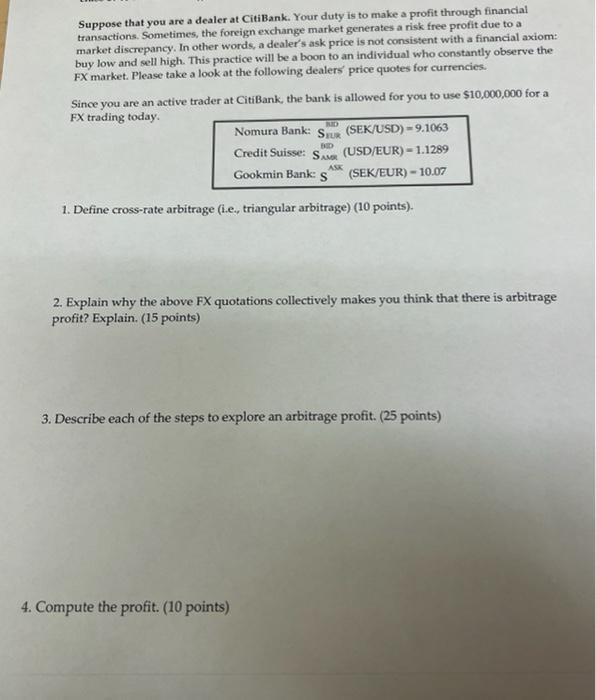

Suppose that you are a dealer at CitiBank. Your duty is to make a profit through financial transactions. Sometimes, the foreign exchange market generates a risk free profit due to a market discrepancy. In other words, a dealer's ask price is not consistent with a financial axiom: buy low and sell high. This practice will be a boon to an individual who constantly observe the FX market. Please take a look at the following dealers price quotes for currencies. Since you are an active trader at Citibank, the bank is allowed for you to use $10,000,000 for a FX trading today Nomura Bank: SX (SEK/USD) -9.1063 Credit Suisse: SA (USD/EUR) - - 1.1289 Gookmin Bank: (SEK/EUR) - 10.07 ASK S 1. Define cross-rate arbitrage (i.e., triangular arbitrage) (10 points) 2. Explain why the above FX quotations collectively makes you think that there is arbitrage profit? Explain. (15 points) 3. Describe each of the steps to explore an arbitrage profit. (25 points) 4. Compute the profit. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started