Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help Jamal, Kareem, Rashid and Associates are in the process of evaluating its new client services for the business consulting division - Estate Planning,

please help

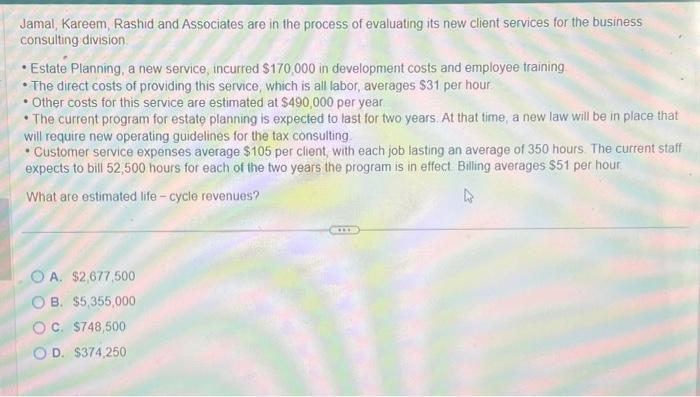

Jamal, Kareem, Rashid and Associates are in the process of evaluating its new client services for the business consulting division - Estate Planning, a new service, incurred $170,000 in development costs and employee training - The direct costs of providing this service, which is all labor, averages $31 per hour - Other costs for this service are estimated at $490,000 per year - The current program for estate planning is expected to last for two years. At that time, a new law will be in place that will require new operating guidelines for the tax consulting - Customer service expenses average $105 per client, with each job lasting an average of 350 hours. The current staff expects to bill 52,500 hours for each of the two years the program is in effect. Billing averages $51 per hour. What are estimated life-cycle revenues? A. $2,677,500 B. $5,355,000 C. $748,500 D. $374,250

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started