Answered step by step

Verified Expert Solution

Question

1 Approved Answer

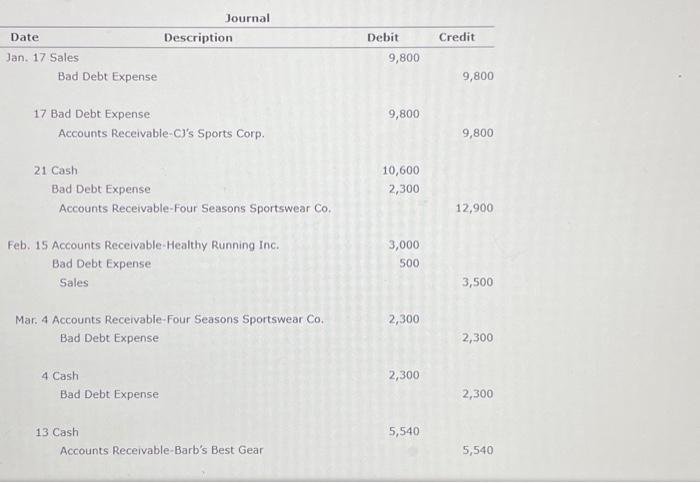

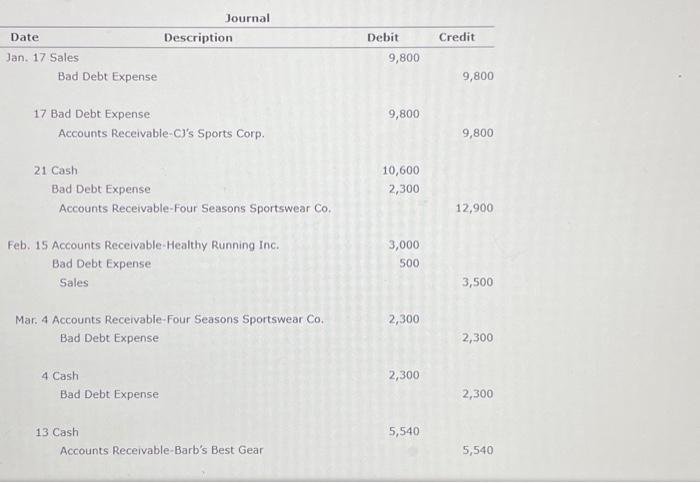

please help Journal Feb. 15 Accounts Receivable-Healthy Running Inc. Bad Debt Expense Mar. 4 Accounts Receivable-Four Seasons Sportswear Co. 2,300 Bad Debt Expense 4 Cash

please help

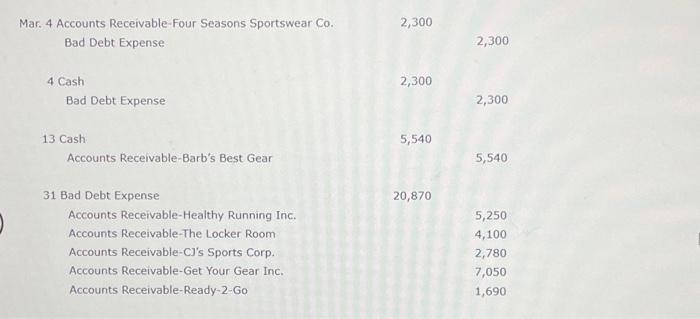

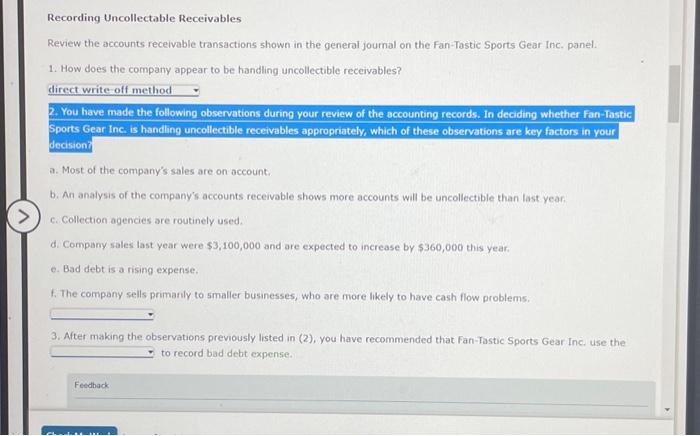

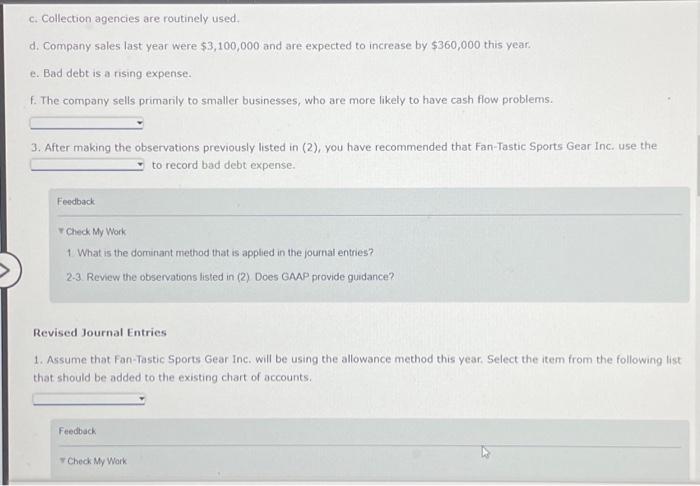

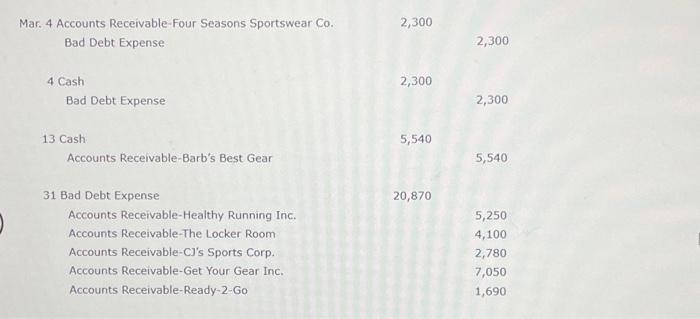

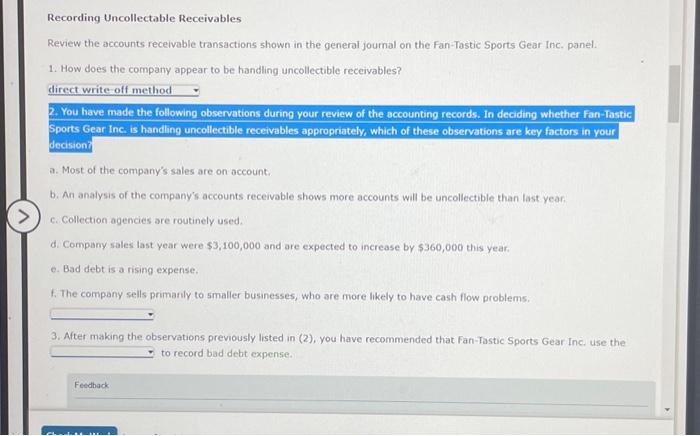

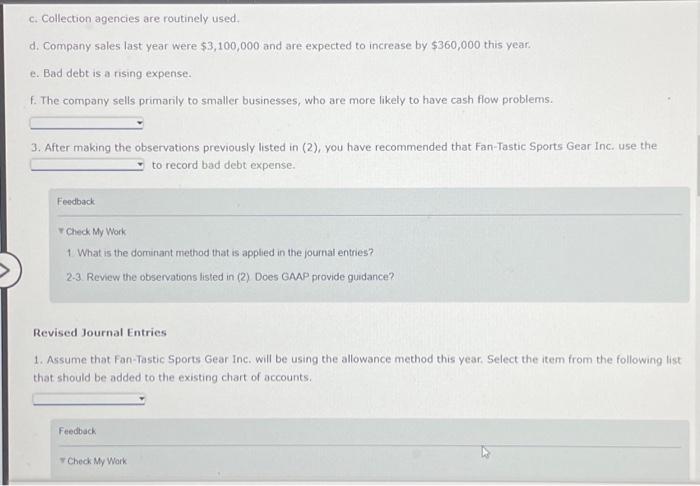

Journal Feb. 15 Accounts Receivable-Healthy Running Inc. Bad Debt Expense Mar. 4 Accounts Receivable-Four Seasons Sportswear Co. 2,300 Bad Debt Expense 4 Cash 2,300 Bad Debt Expense 2,300 13 Cash 5,540 Accounts Receivable-Barb's Best Gear 5,540 Mar. 4 Accounts Receivable-Four Seasons Sportswear Co. 2,300 Bad Debt Expense 4 Cash 2,300 Bad Debt Expense 2,300 13 Cash 5,540 Accounts Receivable-Barb's Best Gear 5,540 31 Bad Debt Expense 20,870 Accounts Receivable-Healthy Running Inc. Accounts Receivable-The Locker Room Accounts Receivable-CJ's Sports Corp. Accounts Receivable-Get Your Gear Inc. Accounts Receivable-Ready-2-Go 5,250 4,100 2,780 7,050 1,690 Recording Uncollectable Receivables Review the accounts receivable transactions shown in the general joumal on the Fan-Tastic Sports Gear Inc. panel. 1. How does the company appear to be handling uncollectible receivables? direct write-off method 2. You have made the following observations during your review of the accounting records. In deciding whether fan-Tastic Sports Gear Inc. is handling uncollectible receivables appropriately, which of these observations are key factors in your decision a. Most of the company's sales are on account. b. An analysis of the company's accounts receivable shows more accounts will be uncollectible than last year. c. Collection agencies are routinely used. d. Company sales last year were $3,100,000 and are expected to increase by $360,000 this year. e. Bad debt is a rising expense. f. The company sells primanly to smaller businesses, who are more likely to have cash flow problems. 3. After making the observations previously listed in (2), you have recommended that Fan-Pastic Sports Gear Inc. use the to record bad debt expense. c. Collection agencies are routinely used. d. Company sales last year were $3,100,000 and are expected to increase by $360,000 this year. e. Bad debt is a rising expense. f. The company sells primarily to smaller businesses, who are more likely to have cash flow problems. 3. After making the observations previously listed in (2), you have recommended that Fan-Tastic Sports Gear Inc. use the to record bad debt expense. Fendback voheck My Work 1. What is the dominant method that is applied in the journal entries? 2-3. Review the observations listed in (2) Does GAAP provide guidance? Revised Journal Entries 1. Assume that Fan-Tastic Sports Gear Inc. will be using the allowance method this year. Select the item from the following list that should be added to the existing chart of accounts. Journal Feb. 15 Accounts Receivable-Healthy Running Inc. Bad Debt Expense Mar. 4 Accounts Receivable-Four Seasons Sportswear Co. 2,300 Bad Debt Expense 4 Cash 2,300 Bad Debt Expense 2,300 13 Cash 5,540 Accounts Receivable-Barb's Best Gear 5,540 Mar. 4 Accounts Receivable-Four Seasons Sportswear Co. 2,300 Bad Debt Expense 4 Cash 2,300 Bad Debt Expense 2,300 13 Cash 5,540 Accounts Receivable-Barb's Best Gear 5,540 31 Bad Debt Expense 20,870 Accounts Receivable-Healthy Running Inc. Accounts Receivable-The Locker Room Accounts Receivable-CJ's Sports Corp. Accounts Receivable-Get Your Gear Inc. Accounts Receivable-Ready-2-Go 5,250 4,100 2,780 7,050 1,690 Recording Uncollectable Receivables Review the accounts receivable transactions shown in the general joumal on the Fan-Tastic Sports Gear Inc. panel. 1. How does the company appear to be handling uncollectible receivables? direct write-off method 2. You have made the following observations during your review of the accounting records. In deciding whether fan-Tastic Sports Gear Inc. is handling uncollectible receivables appropriately, which of these observations are key factors in your decision a. Most of the company's sales are on account. b. An analysis of the company's accounts receivable shows more accounts will be uncollectible than last year. c. Collection agencies are routinely used. d. Company sales last year were $3,100,000 and are expected to increase by $360,000 this year. e. Bad debt is a rising expense. f. The company sells primanly to smaller businesses, who are more likely to have cash flow problems. 3. After making the observations previously listed in (2), you have recommended that Fan-Pastic Sports Gear Inc. use the to record bad debt expense. c. Collection agencies are routinely used. d. Company sales last year were $3,100,000 and are expected to increase by $360,000 this year. e. Bad debt is a rising expense. f. The company sells primarily to smaller businesses, who are more likely to have cash flow problems. 3. After making the observations previously listed in (2), you have recommended that Fan-Tastic Sports Gear Inc. use the to record bad debt expense. Fendback voheck My Work 1. What is the dominant method that is applied in the journal entries? 2-3. Review the observations listed in (2) Does GAAP provide guidance? Revised Journal Entries 1. Assume that Fan-Tastic Sports Gear Inc. will be using the allowance method this year. Select the item from the following list that should be added to the existing chart of accounts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started