Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me complete the missing and incorrect entries on the Balance sheet with the information given. Formulas for reference: begin{tabular}{ll} multicolumn{1}{c}{ Liquidity and Solvency

Please help me complete the missing and incorrect entries on the Balance sheet with the information given.

Formulas for reference:

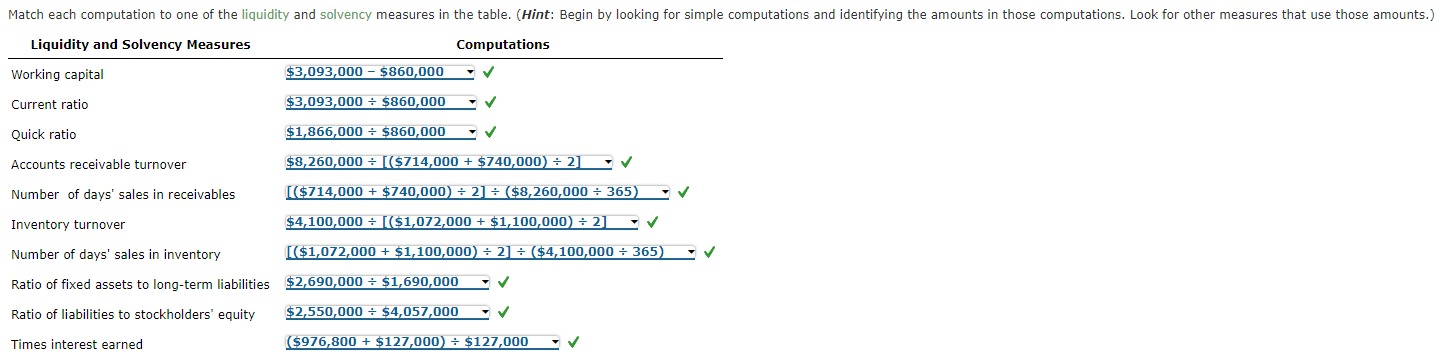

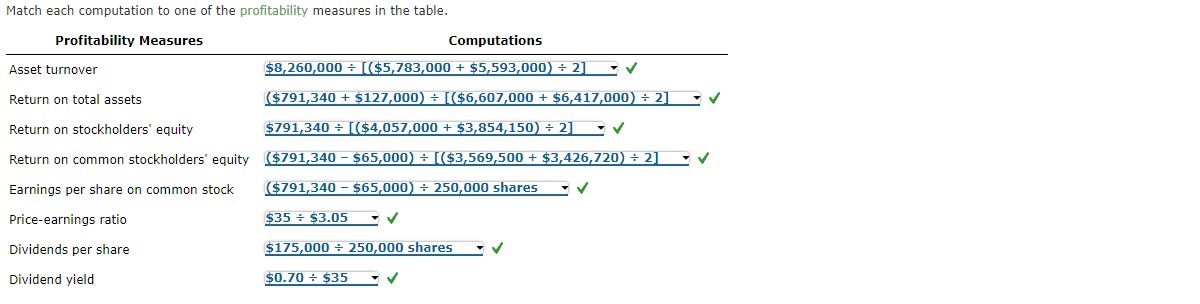

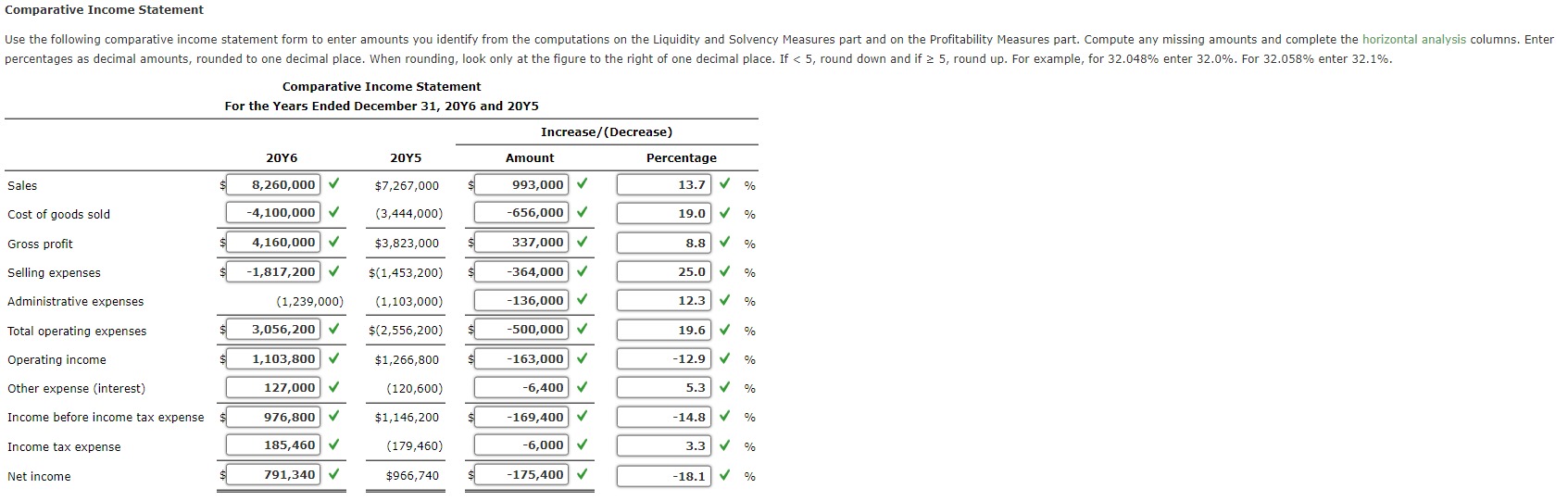

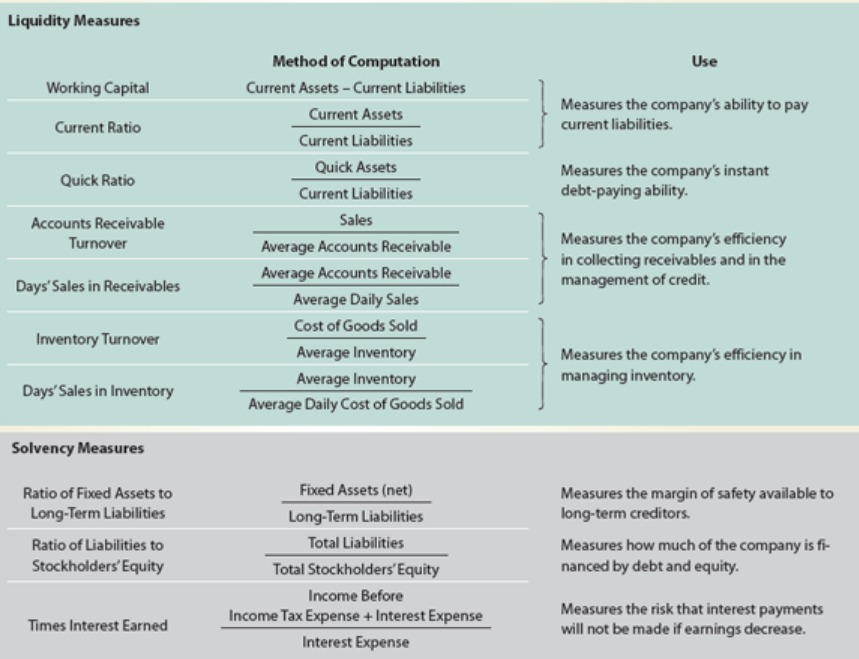

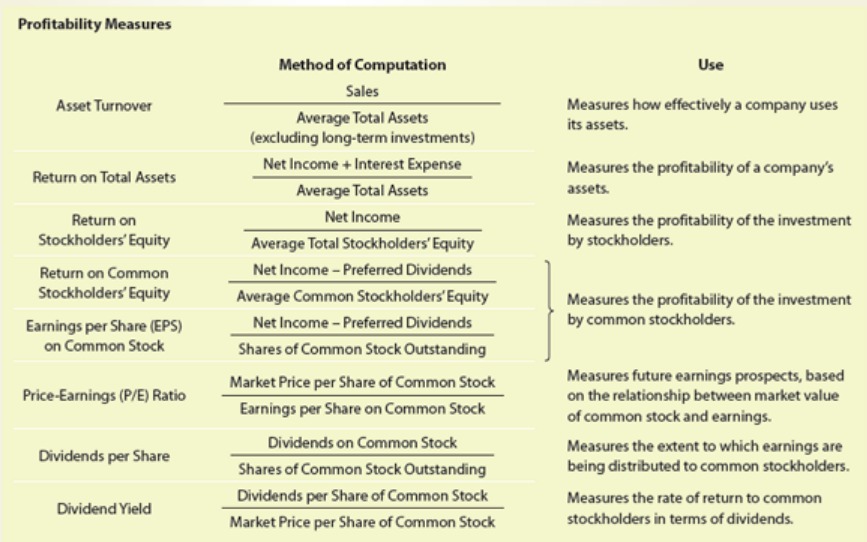

\begin{tabular}{ll} \multicolumn{1}{c}{ Liquidity and Solvency Measures } & Computations \\ \hline Working capital & $3,093,000$860,000 \\ Current ratio & $3,093,000$860,000 \\ Quick ratio & $1,866,000$860,000 \\ Accounts receivable turnover & $8,260,000[($714,000+$740,000)2] \\ Number of days' sales in receivables & {[($714,000+$740,000)2]($8,260,000365)} \\ Inventory turnover & $4,100,000[($1,072,000+$1,100,000)2] \\ Number of days' sales in inventory & {[($1,072,000+$1,100,000)2]($4,100,000365)} \\ Ratio of fixed assets to long-term liabilities & $2,690,000$1,690,000 \\ Ratio of liabilities to stockholders' equity & $2,550,000$4,057,000 \\ Times interest earned & ($976,800+$127,000)$127,000 \end{tabular} amount in the ratio is for the end of the year. Compute any missing amounts. Balance Sheet December 31, 20Y6 December 31, 20r6sets Current assets: Cash Marketable securities Accounts receivable (net) Inventory Prepaid expenses Total current assets Long-term investments Property, plant, and equipment (net) Total assets Liabilities Current liabilities Long-term liabilities Total liabilities Stockholders' Equity Preferred stock, $10 par x Common stock, $5 par x Retained earnings Total stockholders' equity Total liabilities and stockholders' equity 6,607,000 Match each computation to one of the profitability measures in the table. Comparative Income Statement Measures the company's ability to pay current liabilities. Measures the company's instant debt-paying ability. Measures the company's efficiency in collecting receivables and in the management of credit. Measures the company's efficiency in managing inventory. Measures the margin of safety available to long-term creditors. Measures how much of the company is financed by debt and equity. Measures the risk that interest payments will not be made if earnings decrease. Use Measures how effectively a company uses its assets. Measures the profitability of a company's assets. Measures the profitability of the investment by stockholders. Measures the profitability of the imvestment by common stockholders. Measures future earnings prospects, based on the relationship between market value of common stock and earnings. Measures the extent to which earnings are being distributed to common stockholders. Measures the rate of return to common stockholders in terms of dividends

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started