Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me to calculate the dividend received reduction according to following facts: Falcon received the following amount of dividend income from other corporations in

Please help me to calculate the dividend received reduction according to following facts:

Falcon received the following amount of dividend income from other corporations in the current year:

Blue and Gold Industries, a New York corporation in which Falcon owns 1,000 of the 1,000,000 shares outstanding $10,000

I need the DRD to calcuate the book-tax difference.

Please let me know if you need more information.

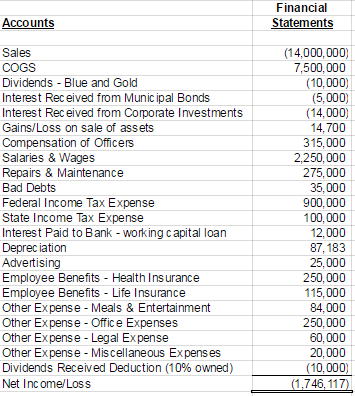

Financial tatements 7 (14,000,000) 7,500,000 (10,000) (5,000) (14,000) 14,700 315,000 2,250,000 275,000 35,000 900,000 100,000 12,000 87,183 25.000 250,000 115,000 84,000 250,000 60,000 20,000 Sales Dividends Blue and Gold Interest Received from Munic ipal Bonds Interest Received from Corporate Investments Gains/Loss on sale of ass ets Compensation of Officers Salaries & Wages Repairs & Maintenance Bad Debts Federal Income Tax Expense State Income Tax Expense Interest Paid to Bank working capital loan Deprec iation Advertising Employee Benefits Health Insurance Employee Benetits Life Insurance Other Expense Meals & Entertainment Other Expense Offic e Expenses Other Expense Legal Expense Other Expense Miscellaneous Expens es Dividends Received Deduction (10% owned) Net Inc ome/Loss 2 1,746,117)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started