Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help me with this case. case Question: Section 2 and 3. Thanks On December 21, 2012, Matt Pearson, a recently hired financial planner with

please help me with this case.

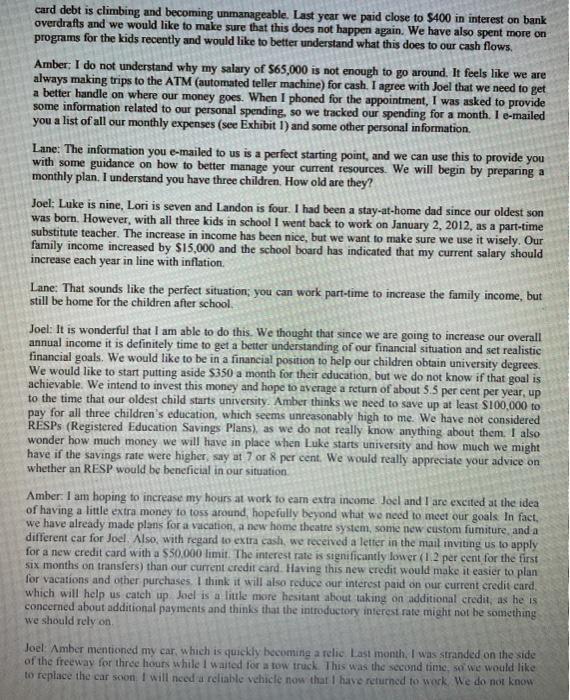

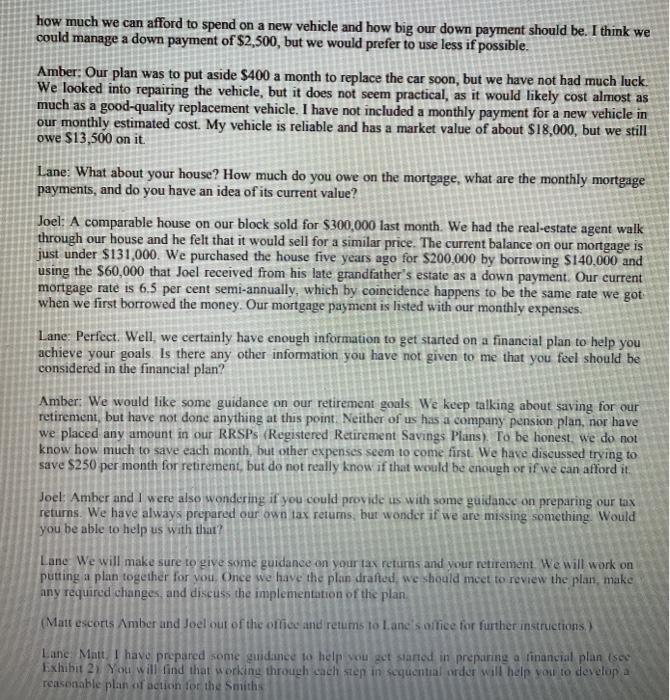

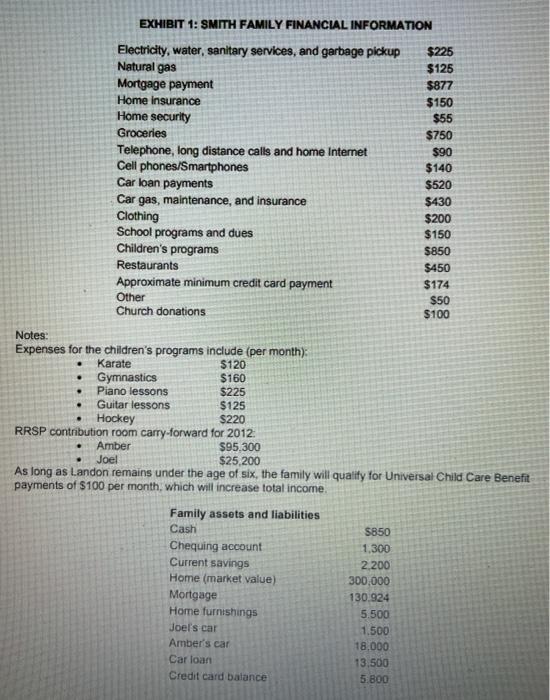

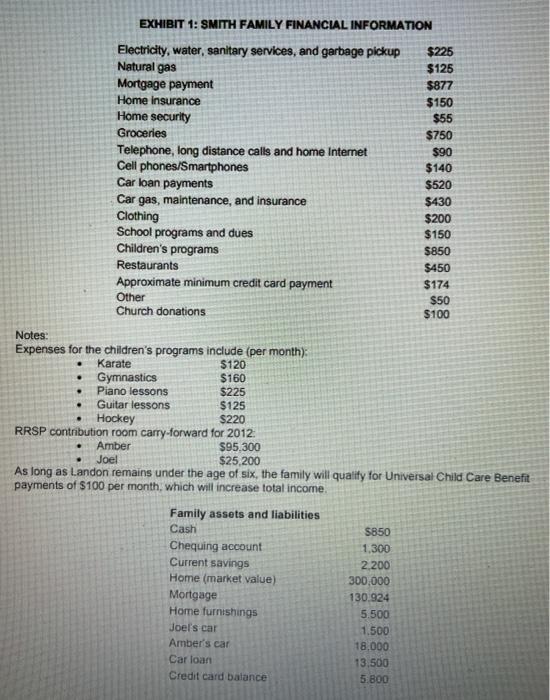

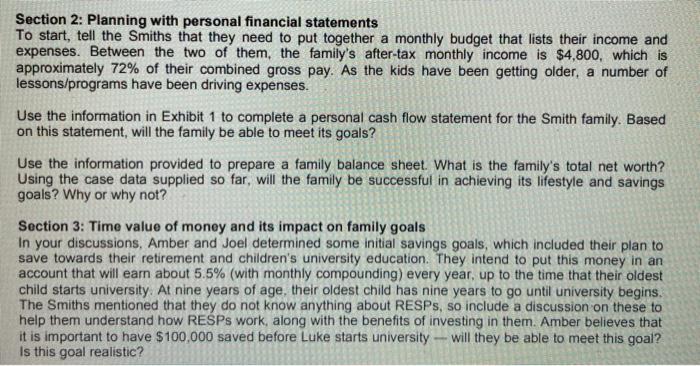

On December 21, 2012, Matt Pearson, a recently hired financial planner with J & L Financial Advisors, was sitting in on an initial meeting with Lane Young, one of J & L's founding partners, and Joel and Amber Smith. The group was meeting in a sixteenth-floor boardroom in Saskatoon, Saskatchewan, that had a breathtaking view of the city's Meewasin Park, adjacent to the South Saskatchewan River. The purpose of the meeting was to discuss the Smith family's financial needs and develop a plan for their financial future. The Smith family was in a cash crunch. Even with a combined gross family income of $80,000 per year, their monthly cash outflows were greater than their inflows. Joel and Amber were aware that they had cash flow problems, but they did not understand where their money went. As a result of struggling with current cash flows, they were having trouble setting and meeting future goals. They did not know if their financial goals were realistic. MEETING WITH THE SMITH FAMILY (Lane made the initial introductions and opened the meeting.) Lane: Welcome to our office, Joel and Amber. It is a pleasure to meet with you. Matt and I will be working together on your account. I understand you are looking for financial advice that will help you to meet your current and future goals. Joel, you look like you're ready to dive right in. Joel: I definitely am. Amber and I have been discussing our financial situation and we thought it was time to seek professional advice in order to gain an understanding of our finances. We have been married for 11 years, have both lived in Saskatoon, Saskatchewan, all of our lives, are both 32 years old, and believe we need to make some changes to meet our current and future goals. To be honest, neither of us really understands where all of our money goes. We would like to start saving for retirement and our children's college education, but never seem to have enough extra money to put aside. For the past few months, we have only been able to make the minimum payments on our credit card. We have talked about putting together a monthly budget before, but it was not until we took a good look at our credit card statement recently that we realized that we need a budget sooner than later, if you know what I mean. Our credit card debt is climbing and becoming unmanageable. Last year we paid close to $400 in interest on bank overdrafts and we would like to make sure that this does not happen again. We have also spent more on programs for the kids recently and would like to better understand what this does to our cash flows. Amber: I do not understand why my salary of $65,000 is not enough to go around. It feels like we are always making trips to the ATM (automated teiler machine) for cash. I agree with Joel that we need to get a better handle on where our money goes. When I phoned for the appointment, I was asked to provide some information related to our personal spending, so we tracked our spending for a month. I e-mailed you a list of all our monthly expenses (see Exhibit 1) and some other personal information. Lane: The information you e-mailed to us is a perfect starting point, and we can use this to provide you with some guidance on how to better manage your current resources. We will begin by preparing a monthly plan. I understand you have three children. How old are they? Joel: Luke is nine, Lori is seven and Landon is four. I had been a stay-at-home dad since our oldest son was born. However, with all three kids in school I went back to work on January 2, 2012, as a part-time substitute teacher. The increase in income has been nice, but we want to make sure we use it wisely. Our family income increased by $15,000 and the school board has indicated that my current salary should increase each year in line with inflation. Lane: That sounds like the perfect situation; you can work part-time to increase the family income, but still be home for the children after school Joel: It is wonderful that I am able to do this. We thought that since we are going to increase our overall annual income it is definitely time to get a better understanding of our financial situation and set realistic financial goals. We would like to be in a financial position to help our children obtain university degrees. We would like to start putting aside $350 a month for their education, but we do not know if that goal is achievable. We intend to invest this money and hope to average a return of about 5.5 per cent per year, up to the time that our oldest child starts university. Amber thinks we need to save up at least S100.000 to pay for all three children's education, which seems unreasonably high to me. We have not considered RESPs (Registered Education Savings Plans) as we do not really know anything about them. I also wonder how much money we will have in place when Luke starts university and how much we might have if the savings rate were higher say at 7 or 8 per cent. We would really appreciate your advice on whether an RESP would be beneficial in our situation Amber. I am hoping to increase my hours at work to earn extra income. Joel and I are excited at the idea of having a little extra money to toss around hopefully beyond what we need to meet our goals In fact, we have already made plans for a vacation, a new home theatre system, some new custom fumiture and a different car for Joel. Also, with regard to extra cash, we received a letter in the mail inviting us to apply for a new credit card with a $50,000 limit. The interest rate is significantly lower (1.2 per cent for the first six months on transfers) than our current credit card. Having this new credit would make it easier to plan for vacations and other purchases. I think it will also reduce our interest paid on our current credit card which will help us catch up Joel is a little more hesitant about taking on additional credit, as he is concerned about additional payments and thinks that the introductory interest rate might not be something we should rely on Joel Amber mentioned my car, which is quickly becoming a relic Last month. I was stranded on the side of the freeway for three hours while I waited for a tow truck. This was the second time, so we would like to replace the car scon I will need a reliable vehicle now that I have returned to work. We do not know how much we can afford to spend on a new vehicle and how big our down payment should be. I think we could manage a down payment of $2,500, but we would prefer to use less if possible. Amber: Our plan was to put aside $400 a month to replace the car soon, but we have not had much luck. We looked into repairing the vehicle, but it does not seem practical, as it would likely cost almost as much as a good-quality replacement vehicle. I have not included a monthly payment for a new vehicle in our monthly estimated cost. My vehicle is reliable and has a market value of about $18,000, but we still owe $13,500 on it Lane: What about your house? How much do you owe on the mortgage, what are the monthly mortgage payments, and do you have an idea of its current value? Joel: A comparable house on our block sold for $300,000 last month. We had the real-estate agent walk through our house and he felt that it would sell for a similar price. The current balance on our mortgage is just under $131,000. We purchased the house five years ago for $200,000 by borrowing $140,000 and using the $60,000 that Joel received from his late grandfather's estate as a down payment. Our current mortgage rate is 6.5 per cent semi-annually, which by coincidence happens to be the same rate we got when we first borrowed the money. Our mortgage payment is listed with our monthly expenses. Lane Perfect. Well, we certainly have enough information to get started on a financial plan to help you achieve your goals Is there any other information you have not given to me that you feel should be considered in the financial plan? Amber: We would like some guidance on our retirement goals. We keep talking about saving for our retirement, but have not done anything at this point. Neither of us has a company pension plan, nor have we placed any amount in our RRSPs (Registered Retirement Savings Plans). To be honest, we do not know how much to save each month, but other expenses seem to come first. We have discussed trying to save $250 per month for retirement, but do not really know if that would be enough or if we can afford it Joel: Amber and I were also wondering if you could provide us with some guidance on preparing our tax returns. We have always prepared our own lax returns, but wonder if we are missing something. Would you be able to help us with that? Lane We will make sure to give some guidance on your tax returns and your retirement. We will work on putting a plan together for you. Once we have the plan drafted, we should meet to review the plan, make any required changes, and discuss the implementation of the plan (Matt escorts Amber and Joel out of the office and retums to Lane soffice for further instructions) Lane Matt I have prepared some guidance to help you get started in preparing a financial plan (see Exhibit 2) You will find that working through cach step in sequential order will help you to develop a reasonable plan of action for the Smiths EXHIBIT 1: SMITH FAMILY FINANCIAL INFORMATION Electricity, water, sanitary services, and garbage pickup $225 Natural gas $125 Mortgage payment $877 Home insurance $150 Home security $55 Groceries $750 Telephone, long distance calls and home Internet $90 Cell phones/Smartphones $140 Car loan payments $520 Car gas, maintenance, and insurance $430 Clothing $200 School programs and dues $150 Children's programs $850 Restaurants $450 Approximate minimum credit card payment $174 Other $50 Church donations $100 . . Notes: Expenses for the children's programs include (per month): Karate $120 Gymnastics $160 . Piano lessons $225 Guitar lessons $125 Hockey $220 RRSP contribution room carry-forward for 2012 Amber $95.300 Joel $25,200 As long as Landon remains under the age of six, the family will qualify for Universal Child Care Benefit payments of $100 per month, which will increase total income. Family assets and liabilities Cash $850 Chequing account 1,300 Current savings 2.200 Home (market value) 300,000 Mortgage 130.924 Home furnishings 5.500 Joel's car 1.500 Amber's car 18.000 Car loan 13,500 Credit card balance 5.800 Section 2: Planning with personal financial statements To start, tell the Smiths that they need to put together a monthly budget that lists their income and expenses. Between the two of them, the family's after-tax monthly income is $4,800, which is approximately 72% of their combined gross pay. As the kids have been getting older, a number of lessons/programs have been driving expenses. Use the information in Exhibit 1 to complete a personal cash flow statement for the Smith family. Based on this statement, will the family be able to meet its goals? Use the information provided to prepare a family balance sheet. What is the family's total net worth? Using the case data supplied so far, will the family be successful in achieving its lifestyle and savings goals? Why or why not? Section 3: Time value of money and its impact on family goals In your discussions, Amber and Joel determined some initial savings goals, which included their plan to save towards their retirement and children's university education. They intend to put this money in an account that will earn about 5.5% (with monthly compounding) every year, up to the time that their oldest child starts university. At nine years of age, their oldest child has nine years to go until university begins. The Smiths mentioned that they do not know anything about RESPs, so include a discussion on these to help them understand how RESPs work, along with the benefits of investing in them. Amber believes that it is important to have $100.000 saved before Luke starts university -- will they be able to meet this goal? Is this goal realistic? On December 21, 2012, Matt Pearson, a recently hired financial planner with J & L Financial Advisors, was sitting in on an initial meeting with Lane Young, one of J & L's founding partners, and Joel and Amber Smith. The group was meeting in a sixteenth-floor boardroom in Saskatoon, Saskatchewan, that had a breathtaking view of the city's Meewasin Park, adjacent to the South Saskatchewan River. The purpose of the meeting was to discuss the Smith family's financial needs and develop a plan for their financial future. The Smith family was in a cash crunch. Even with a combined gross family income of $80,000 per year, their monthly cash outflows were greater than their inflows. Joel and Amber were aware that they had cash flow problems, but they did not understand where their money went. As a result of struggling with current cash flows, they were having trouble setting and meeting future goals. They did not know if their financial goals were realistic. MEETING WITH THE SMITH FAMILY (Lane made the initial introductions and opened the meeting.) Lane: Welcome to our office, Joel and Amber. It is a pleasure to meet with you. Matt and I will be working together on your account. I understand you are looking for financial advice that will help you to meet your current and future goals. Joel, you look like you're ready to dive right in. Joel: I definitely am. Amber and I have been discussing our financial situation and we thought it was time to seek professional advice in order to gain an understanding of our finances. We have been married for 11 years, have both lived in Saskatoon, Saskatchewan, all of our lives, are both 32 years old, and believe we need to make some changes to meet our current and future goals. To be honest, neither of us really understands where all of our money goes. We would like to start saving for retirement and our children's college education, but never seem to have enough extra money to put aside. For the past few months, we have only been able to make the minimum payments on our credit card. We have talked about putting together a monthly budget before, but it was not until we took a good look at our credit card statement recently that we realized that we need a budget sooner than later, if you know what I mean. Our credit card debt is climbing and becoming unmanageable. Last year we paid close to $400 in interest on bank overdrafts and we would like to make sure that this does not happen again. We have also spent more on programs for the kids recently and would like to better understand what this does to our cash flows. Amber: I do not understand why my salary of $65,000 is not enough to go around. It feels like we are always making trips to the ATM (automated teiler machine) for cash. I agree with Joel that we need to get a better handle on where our money goes. When I phoned for the appointment, I was asked to provide some information related to our personal spending, so we tracked our spending for a month. I e-mailed you a list of all our monthly expenses (see Exhibit 1) and some other personal information. Lane: The information you e-mailed to us is a perfect starting point, and we can use this to provide you with some guidance on how to better manage your current resources. We will begin by preparing a monthly plan. I understand you have three children. How old are they? Joel: Luke is nine, Lori is seven and Landon is four. I had been a stay-at-home dad since our oldest son was born. However, with all three kids in school I went back to work on January 2, 2012, as a part-time substitute teacher. The increase in income has been nice, but we want to make sure we use it wisely. Our family income increased by $15,000 and the school board has indicated that my current salary should increase each year in line with inflation. Lane: That sounds like the perfect situation; you can work part-time to increase the family income, but still be home for the children after school Joel: It is wonderful that I am able to do this. We thought that since we are going to increase our overall annual income it is definitely time to get a better understanding of our financial situation and set realistic financial goals. We would like to be in a financial position to help our children obtain university degrees. We would like to start putting aside $350 a month for their education, but we do not know if that goal is achievable. We intend to invest this money and hope to average a return of about 5.5 per cent per year, up to the time that our oldest child starts university. Amber thinks we need to save up at least S100.000 to pay for all three children's education, which seems unreasonably high to me. We have not considered RESPs (Registered Education Savings Plans) as we do not really know anything about them. I also wonder how much money we will have in place when Luke starts university and how much we might have if the savings rate were higher say at 7 or 8 per cent. We would really appreciate your advice on whether an RESP would be beneficial in our situation Amber. I am hoping to increase my hours at work to earn extra income. Joel and I are excited at the idea of having a little extra money to toss around hopefully beyond what we need to meet our goals In fact, we have already made plans for a vacation, a new home theatre system, some new custom fumiture and a different car for Joel. Also, with regard to extra cash, we received a letter in the mail inviting us to apply for a new credit card with a $50,000 limit. The interest rate is significantly lower (1.2 per cent for the first six months on transfers) than our current credit card. Having this new credit would make it easier to plan for vacations and other purchases. I think it will also reduce our interest paid on our current credit card which will help us catch up Joel is a little more hesitant about taking on additional credit, as he is concerned about additional payments and thinks that the introductory interest rate might not be something we should rely on Joel Amber mentioned my car, which is quickly becoming a relic Last month. I was stranded on the side of the freeway for three hours while I waited for a tow truck. This was the second time, so we would like to replace the car scon I will need a reliable vehicle now that I have returned to work. We do not know how much we can afford to spend on a new vehicle and how big our down payment should be. I think we could manage a down payment of $2,500, but we would prefer to use less if possible. Amber: Our plan was to put aside $400 a month to replace the car soon, but we have not had much luck. We looked into repairing the vehicle, but it does not seem practical, as it would likely cost almost as much as a good-quality replacement vehicle. I have not included a monthly payment for a new vehicle in our monthly estimated cost. My vehicle is reliable and has a market value of about $18,000, but we still owe $13,500 on it Lane: What about your house? How much do you owe on the mortgage, what are the monthly mortgage payments, and do you have an idea of its current value? Joel: A comparable house on our block sold for $300,000 last month. We had the real-estate agent walk through our house and he felt that it would sell for a similar price. The current balance on our mortgage is just under $131,000. We purchased the house five years ago for $200,000 by borrowing $140,000 and using the $60,000 that Joel received from his late grandfather's estate as a down payment. Our current mortgage rate is 6.5 per cent semi-annually, which by coincidence happens to be the same rate we got when we first borrowed the money. Our mortgage payment is listed with our monthly expenses. Lane Perfect. Well, we certainly have enough information to get started on a financial plan to help you achieve your goals Is there any other information you have not given to me that you feel should be considered in the financial plan? Amber: We would like some guidance on our retirement goals. We keep talking about saving for our retirement, but have not done anything at this point. Neither of us has a company pension plan, nor have we placed any amount in our RRSPs (Registered Retirement Savings Plans). To be honest, we do not know how much to save each month, but other expenses seem to come first. We have discussed trying to save $250 per month for retirement, but do not really know if that would be enough or if we can afford it Joel: Amber and I were also wondering if you could provide us with some guidance on preparing our tax returns. We have always prepared our own lax returns, but wonder if we are missing something. Would you be able to help us with that? Lane We will make sure to give some guidance on your tax returns and your retirement. We will work on putting a plan together for you. Once we have the plan drafted, we should meet to review the plan, make any required changes, and discuss the implementation of the plan (Matt escorts Amber and Joel out of the office and retums to Lane soffice for further instructions) Lane Matt I have prepared some guidance to help you get started in preparing a financial plan (see Exhibit 2) You will find that working through cach step in sequential order will help you to develop a reasonable plan of action for the Smiths EXHIBIT 1: SMITH FAMILY FINANCIAL INFORMATION Electricity, water, sanitary services, and garbage pickup $225 Natural gas $125 Mortgage payment $877 Home insurance $150 Home security $55 Groceries $750 Telephone, long distance calls and home Internet $90 Cell phones/Smartphones $140 Car loan payments $520 Car gas, maintenance, and insurance $430 Clothing $200 School programs and dues $150 Children's programs $850 Restaurants $450 Approximate minimum credit card payment $174 Other $50 Church donations $100 . . Notes: Expenses for the children's programs include (per month): Karate $120 Gymnastics $160 . Piano lessons $225 Guitar lessons $125 Hockey $220 RRSP contribution room carry-forward for 2012 Amber $95.300 Joel $25,200 As long as Landon remains under the age of six, the family will qualify for Universal Child Care Benefit payments of $100 per month, which will increase total income. Family assets and liabilities Cash $850 Chequing account 1,300 Current savings 2.200 Home (market value) 300,000 Mortgage 130.924 Home furnishings 5.500 Joel's car 1.500 Amber's car 18.000 Car loan 13,500 Credit card balance 5.800 Section 2: Planning with personal financial statements To start, tell the Smiths that they need to put together a monthly budget that lists their income and expenses. Between the two of them, the family's after-tax monthly income is $4,800, which is approximately 72% of their combined gross pay. As the kids have been getting older, a number of lessons/programs have been driving expenses. Use the information in Exhibit 1 to complete a personal cash flow statement for the Smith family. Based on this statement, will the family be able to meet its goals? Use the information provided to prepare a family balance sheet. What is the family's total net worth? Using the case data supplied so far, will the family be successful in achieving its lifestyle and savings goals? Why or why not? Section 3: Time value of money and its impact on family goals In your discussions, Amber and Joel determined some initial savings goals, which included their plan to save towards their retirement and children's university education. They intend to put this money in an account that will earn about 5.5% (with monthly compounding) every year, up to the time that their oldest child starts university. At nine years of age, their oldest child has nine years to go until university begins. The Smiths mentioned that they do not know anything about RESPs, so include a discussion on these to help them understand how RESPs work, along with the benefits of investing in them. Amber believes that it is important to have $100.000 saved before Luke starts university -- will they be able to meet this goal? Is this goal realistic case

Question: Section 2 and 3.

Thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started