Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help me with this question, it states that I should assume Modigliani-Miller (mm) World. Antivaxer, PaleoBro and Boop are three similar companies in the

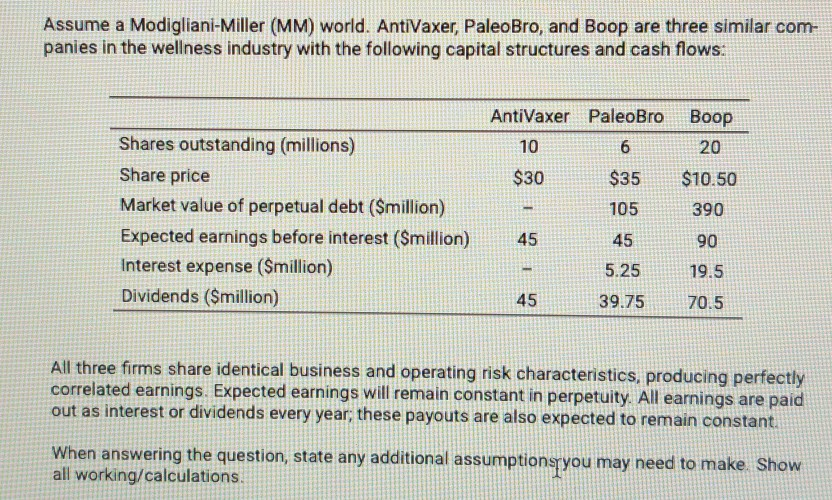

Please help me with this question, it states that I should assume Modigliani-Miller (mm) World. Antivaxer, PaleoBro and Boop are three similar companies in the wellness industry with the following capital structures and cash flows.

I am looking to work out what the market value minus Dividends values are for Boop.

Assume a Modigliani-Miller (MM) world. AntiVaxer, Paleo Bro, and Boop are three similar com- panies in the wellness industry with the following capital structures and cash flows: AntiVaxer PaleoBro Boop 10 6 20 $30 $35 $10.50 105 390 Shares outstanding (millions) Share price Market value of perpetual debt ($million) Expected earnings before interest (Smillion) Interest expense (Smillion) Dividends ($million) 45 90 45 5.25 19.5 45 39.75 70.5 All three firms share identical business and operating risk characteristics, producing perfectly correlated earnings. Expected earnings will remain constant in perpetuity. All earnings are paid out as interest or dividends every year, these payouts are also expected to remain constant. When answering the question, state any additional assumptionstyou may need to make Show all working/calculationsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started