Answered step by step

Verified Expert Solution

Question

1 Approved Answer

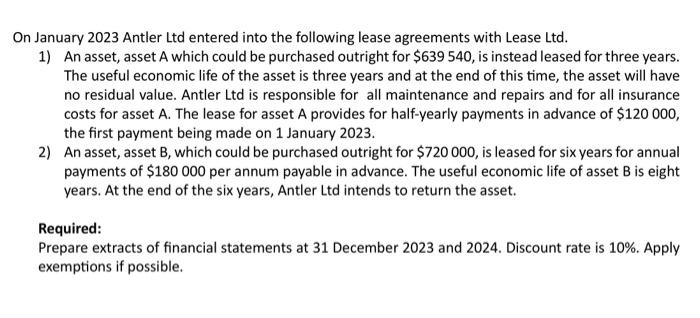

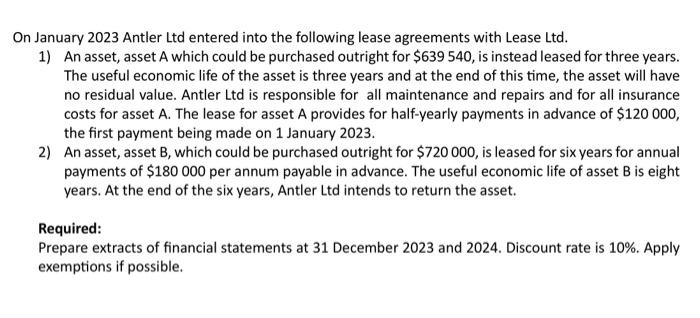

please help me with this task On January 2023 Antler Ltd entered into the following lease agreements with Lease Ltd. 1) An asset, asset A

please help me with this task

On January 2023 Antler Ltd entered into the following lease agreements with Lease Ltd. 1) An asset, asset A which could be purchased outright for $639540, is instead leased for three years. The useful economic life of the asset is three years and at the end of this time, the asset will have no residual value. Antler Ltd is responsible for all maintenance and repairs and for all insurance costs for asset A. The lease for asset A provides for half-yearly payments in advance of $120000, the first payment being made on 1 January 2023. 2) An asset, asset B, which could be purchased outright for $720000, is leased for six years for annual payments of $180000 per annum payable in advance. The useful economic life of asset B is eight years. At the end of the six years, Antler Ltd intends to return the asset. Required: Prepare extracts of financial statements at 31 December 2023 and 2024. Discount rate is 10%. Apply exemptions if possible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started