Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help. need answers in an hour On March 1, 2024, Gold Examiner receives $147,000 from a local bank and promises to deliver 100 units

Please help. need answers in an hour

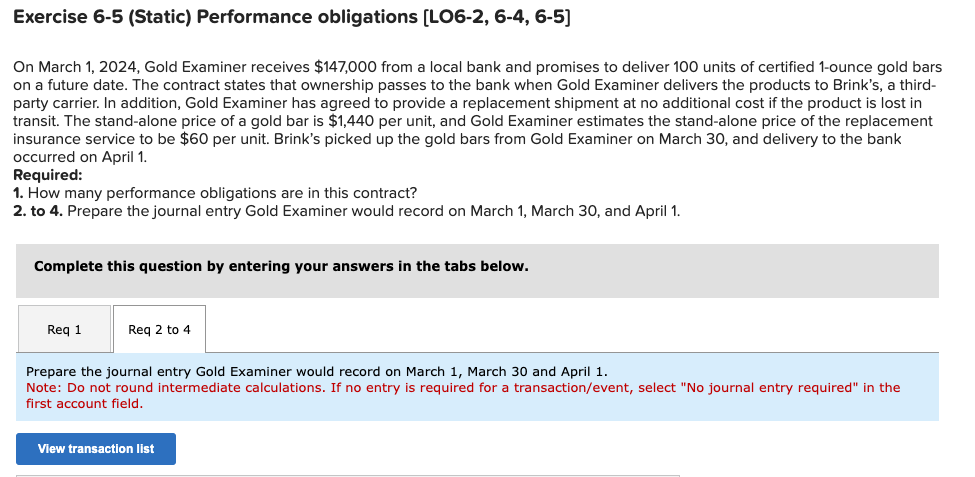

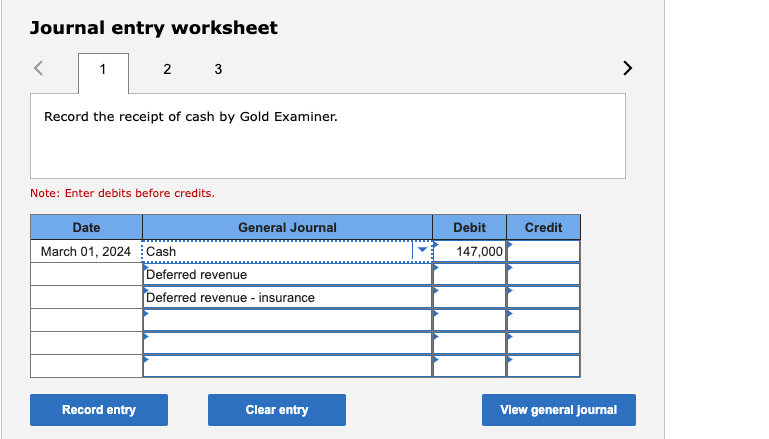

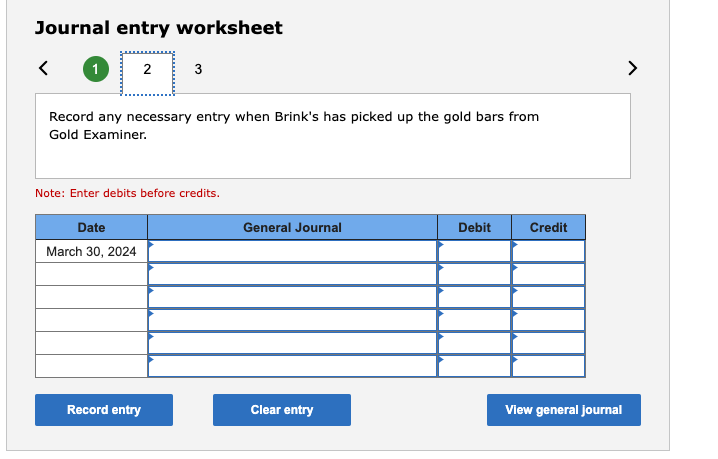

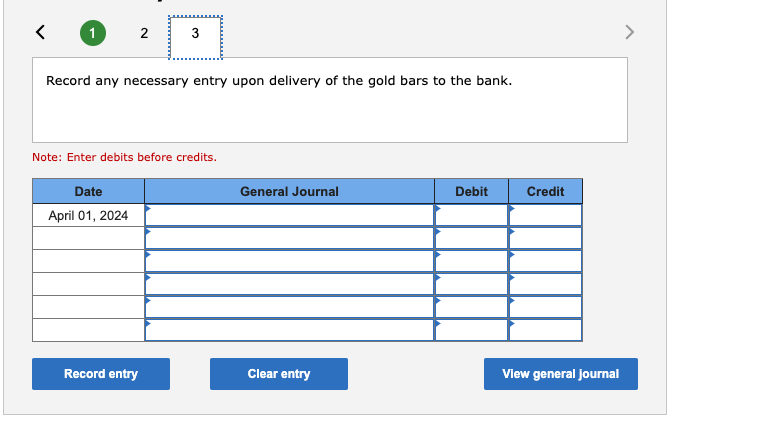

On March 1, 2024, Gold Examiner receives $147,000 from a local bank and promises to deliver 100 units of certified 1-ounce gold bars on a future date. The contract states that ownership passes to the bank when Gold Examiner delivers the products to Brink's, a thirdparty carrier. In addition, Gold Examiner has agreed to provide a replacement shipment at no additional cost if the product is lost in transit. The stand-alone price of a gold bar is $1,440 per unit, and Gold Examiner estimates the stand-alone price of the replacement insurance service to be $60 per unit. Brink's picked up the gold bars from Gold Examiner on March 30 , and delivery to the bank occurred on April 1. Required: 1. How many performance obligations are in this contract? 2. to 4. Prepare the journal entry Gold Examiner would record on March 1, March 30, and April 1. Complete this question by entering your answers in the tabs below. Prepare the journal entry Gold Examiner would record on March 1, March 30 and April 1. Note: Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the receipt of cash by Gold Examiner. Note: Enter debits before credits. Journal entry worksheet Record any necessary entry when Brink's has picked up the gold bars from Gold Examiner. Note: Enter debits before credits. Record any necessary entry upon delivery of the gold bars to the bank. Note: Enter debits before credits

On March 1, 2024, Gold Examiner receives $147,000 from a local bank and promises to deliver 100 units of certified 1-ounce gold bars on a future date. The contract states that ownership passes to the bank when Gold Examiner delivers the products to Brink's, a thirdparty carrier. In addition, Gold Examiner has agreed to provide a replacement shipment at no additional cost if the product is lost in transit. The stand-alone price of a gold bar is $1,440 per unit, and Gold Examiner estimates the stand-alone price of the replacement insurance service to be $60 per unit. Brink's picked up the gold bars from Gold Examiner on March 30 , and delivery to the bank occurred on April 1. Required: 1. How many performance obligations are in this contract? 2. to 4. Prepare the journal entry Gold Examiner would record on March 1, March 30, and April 1. Complete this question by entering your answers in the tabs below. Prepare the journal entry Gold Examiner would record on March 1, March 30 and April 1. Note: Do not round intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet Record the receipt of cash by Gold Examiner. Note: Enter debits before credits. Journal entry worksheet Record any necessary entry when Brink's has picked up the gold bars from Gold Examiner. Note: Enter debits before credits. Record any necessary entry upon delivery of the gold bars to the bank. Note: Enter debits before credits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started