Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help PART 2: Assume that S is not dissolved and that P acquired all of the outstanding common stock of S for $600,000 cash

please help

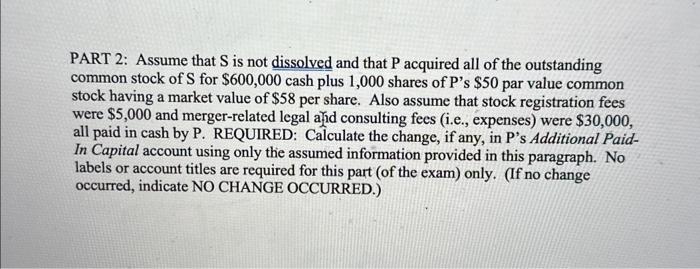

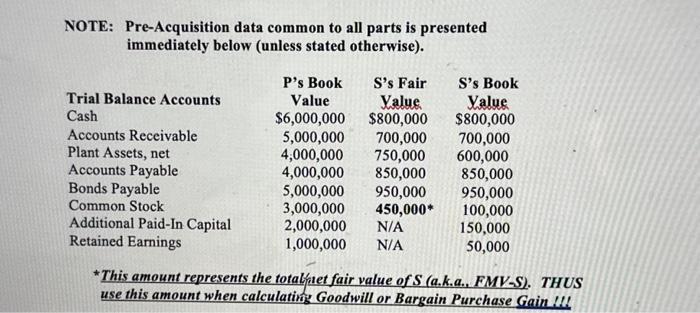

PART 2: Assume that S is not dissolved and that P acquired all of the outstanding common stock of S for $600,000 cash plus 1,000 shares of P's $50 par value common stock having a market value of $58 per share. Also assume that stock registration fees were $5,000 and merger-related legal ahd consulting fees (i.e., expenses) were $30,000, all paid in cash by P. REQUIRED: Calculate the change, if any, in P's Additional PaidIn Capital account using only the assumed information provided in this paragraph. No labels or account titles are required for this part (of the exam) only. (If no change occurred, indicate NO CHANGE OCCURRED.) NOTE: Pre-Acquisition data common to all parts is presented immediately below (unless stated otherwise). *This amount represents the totalfat fair value of S (a.k.a., FMV-S). THUS use this amount when calculating Goodwill or Bargain Purchase Gain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started