Answered step by step

Verified Expert Solution

Question

1 Approved Answer

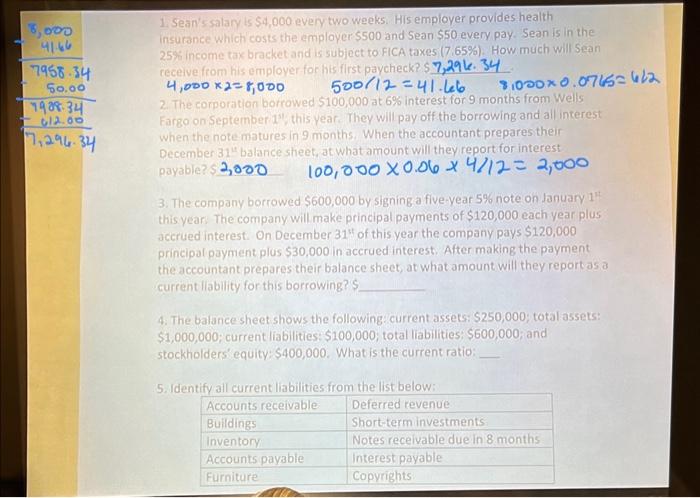

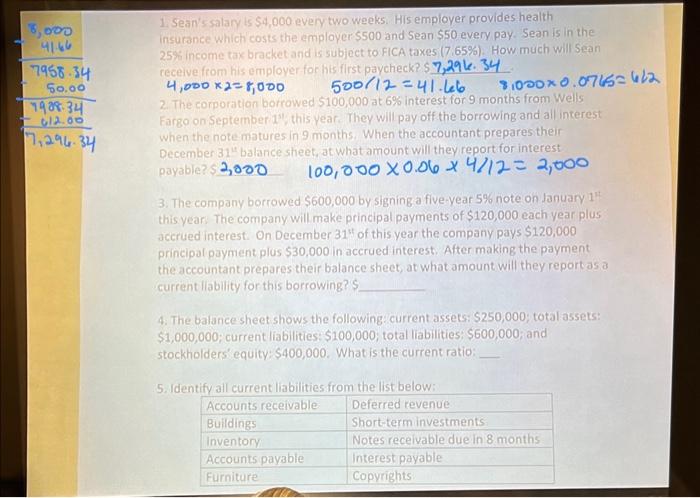

please help show how to get correct answers 1. Sean's salary is $4,000 every two weeks. His empioyer provides health insurance which costs the employer

please help show how to get correct answers

1. Sean's salary is $4,000 every two weeks. His empioyer provides health insurance which costs the employer $500 and Sean $50 every pay. Sean is in the 25 s. income tax bracket and is subject to FICA taxes (7,65%). How much will Sean receive from his emplover for his flrst paycheck? $7,29L.34 4,0002=8,000500/12=41.66810000.076=62 2. The corporation borrowed 5100,000 at 6% interest for 9 months from Wells Fargo on September 1"l/ this year. They will pay off the borrowing and all interest when the note matures in 9 months. When the accountant prepares their December 314 balance sheet, at what amount will they report for interest payable? 2,000100,0000.064112=2,000 3. The company borrowed $600,000 by signing a flve-year 5% note on January 1th this year. The company will make principal payments of $120,000 each year plus accrued interest. On December 3134 of this year the company pays $120,000 principal payment plos $30,000 in accrued interest. After making the payment the accountant prepares their balance sheet, at what amount will they report as a current liability for this borrowing? \$ 4. The balance sheet shows the following: current assets: $250,000; total assets: $1,000,000; current liabilities: $100,000; total liabilities; $600,000; and stockholders' equity: $400,000. What is the current ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started