Answered step by step

Verified Expert Solution

Question

1 Approved Answer

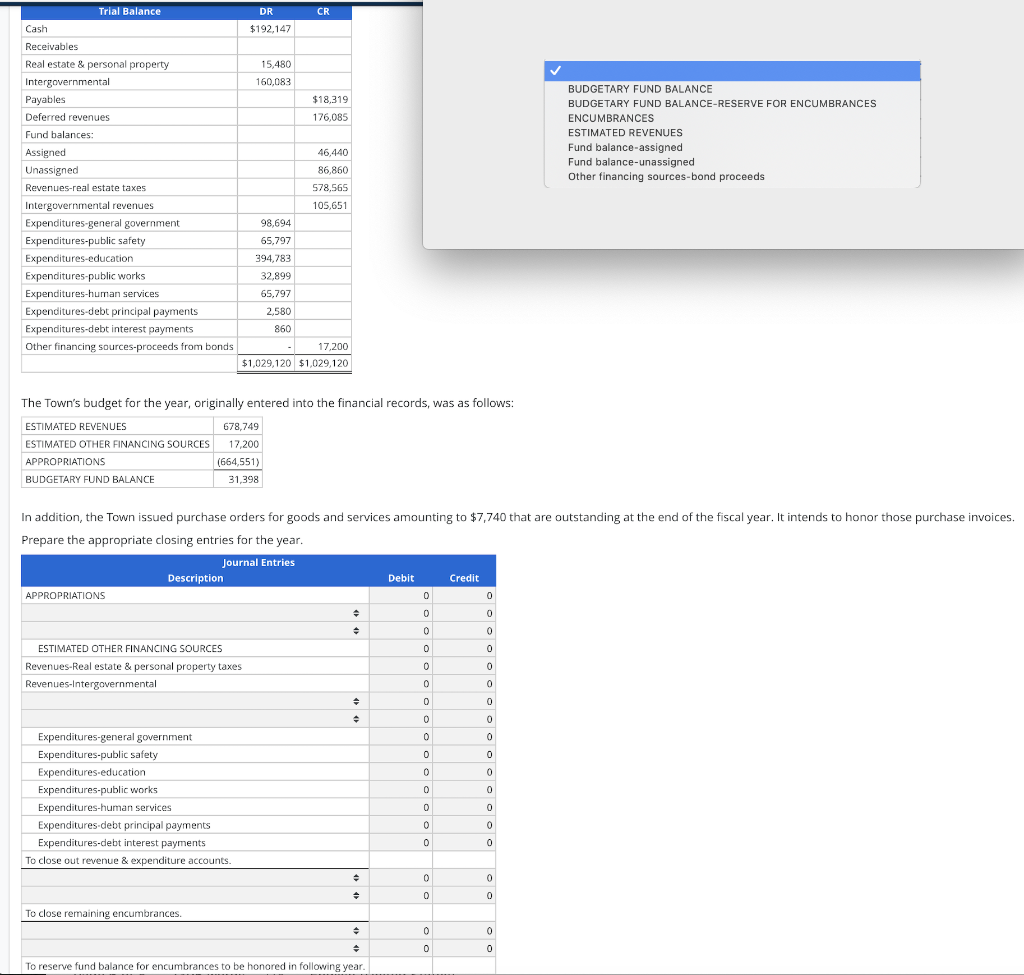

Please Help Trial Balance DR CR Cash $192.147 Receivables Real estate & personal property 15,480 160.083 Intergovernmental BUDGETARY FUND BALANCE Payables $18,319 BUDGETARY FUND BALANCE-RESERVE

Please Help

Trial Balance DR CR Cash $192.147 Receivables Real estate & personal property 15,480 160.083 Intergovernmental BUDGETARY FUND BALANCE Payables $18,319 BUDGETARY FUND BALANCE-RESERVE FOR ENCUMBRANCES Deferred revenues 176,085 ENCUMBRANCES ESTIMATED REVENUES Fund balances: Fund balance-assigned 46.440 Assigned Fund balance-unassigned Other financing sources-bond proceeds Unassigned 86.860 Revenues-real estate taxes 578.565 Intergovernmental revenues 105.651 Expenditures-general government 98.694 Expenditures-public safety 65,797 Expenditures-education 394.783 Expenditures-public works 32,899 Expenditures-human services 65,797 Expenditures-debt principal payments 2,580 860 Expenditures-debt interest payments Other financing sources-proceeds from bonds 17.200 $1,029,120 $1,029,120 The Town's budget for the year, originally entered into the financial records, was as follows: ESTIMATED REVENUES 678,749 ESTIMATED OTHER FINANCING SOURCES 17.200 (664.551) APPROPRIATIONS BUDGETARY FUND BALANCE 31,398 In addition, the Town issued purchase orders for goods and services amounting to $7,740 that are outstanding at the end of the fiscal year. It intends to honor those purchase invoices. Prepare the appropriate closing entries for the year. Journal Entries Description Debit Credit APPROPRIATIONS 0 0 ESTIMATED OTHER FINANCING SOURCES 0 Revenues-Real estate & personal property taxes 0 Revenues-Intergovernmental . C Expenditures-general government 0 0 Expenditures-public safety Expenditures-education 0 0 Expenditures-public works 0 0 Expenditures-human services 0 Expenditures-debt principal payments Expenditures-debt interest payments 0 To close out revenue & expenditure accounts. C To close remaining encumbrances To reserve fund balance for encumbrances to be honored in following year. Trial Balance DR CR Cash $192.147 Receivables Real estate & personal property 15,480 160.083 Intergovernmental BUDGETARY FUND BALANCE Payables $18,319 BUDGETARY FUND BALANCE-RESERVE FOR ENCUMBRANCES Deferred revenues 176,085 ENCUMBRANCES ESTIMATED REVENUES Fund balances: Fund balance-assigned 46.440 Assigned Fund balance-unassigned Other financing sources-bond proceeds Unassigned 86.860 Revenues-real estate taxes 578.565 Intergovernmental revenues 105.651 Expenditures-general government 98.694 Expenditures-public safety 65,797 Expenditures-education 394.783 Expenditures-public works 32,899 Expenditures-human services 65,797 Expenditures-debt principal payments 2,580 860 Expenditures-debt interest payments Other financing sources-proceeds from bonds 17.200 $1,029,120 $1,029,120 The Town's budget for the year, originally entered into the financial records, was as follows: ESTIMATED REVENUES 678,749 ESTIMATED OTHER FINANCING SOURCES 17.200 (664.551) APPROPRIATIONS BUDGETARY FUND BALANCE 31,398 In addition, the Town issued purchase orders for goods and services amounting to $7,740 that are outstanding at the end of the fiscal year. It intends to honor those purchase invoices. Prepare the appropriate closing entries for the year. Journal Entries Description Debit Credit APPROPRIATIONS 0 0 ESTIMATED OTHER FINANCING SOURCES 0 Revenues-Real estate & personal property taxes 0 Revenues-Intergovernmental . C Expenditures-general government 0 0 Expenditures-public safety Expenditures-education 0 0 Expenditures-public works 0 0 Expenditures-human services 0 Expenditures-debt principal payments Expenditures-debt interest payments 0 To close out revenue & expenditure accounts. C To close remaining encumbrances To reserve fund balance for encumbrances to be honored in following yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started