Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with questions 1 - 5 utilizing the attached tables. If the tables are not correct please assist. Please see project 4 answers attached

Please help with questions 1 - 5 utilizing the attached tables. If the tables are not correct please assist.

Please see project 4 answers attached below Thank You.

Yes. questions 1-5 at the top. question 1 talks about depreciation for the year. the questions at the bottom was in regards to the last project and those are answered. Thanks for your help.

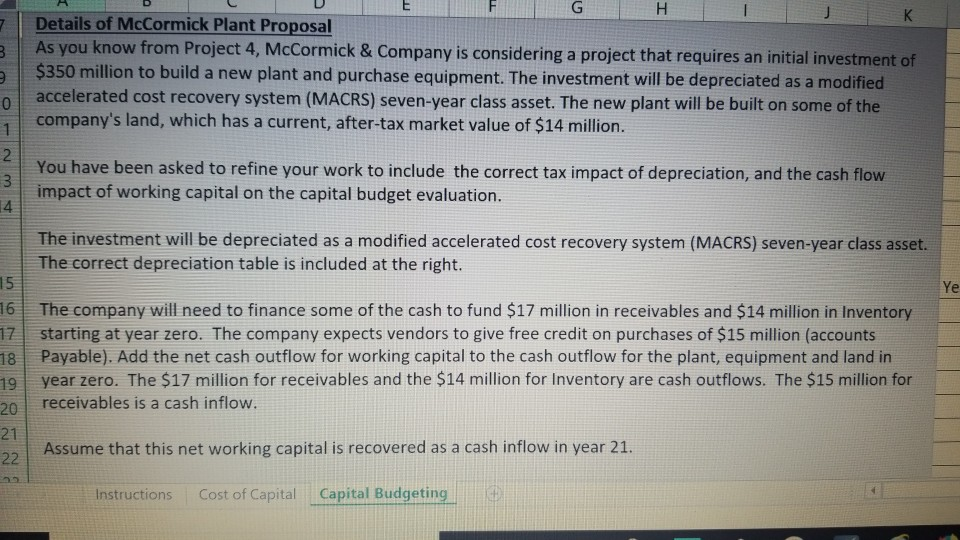

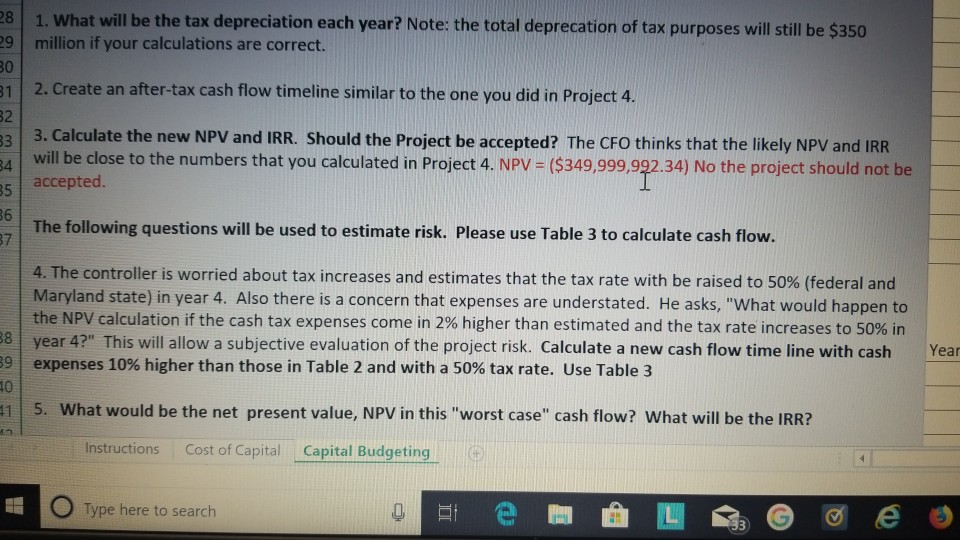

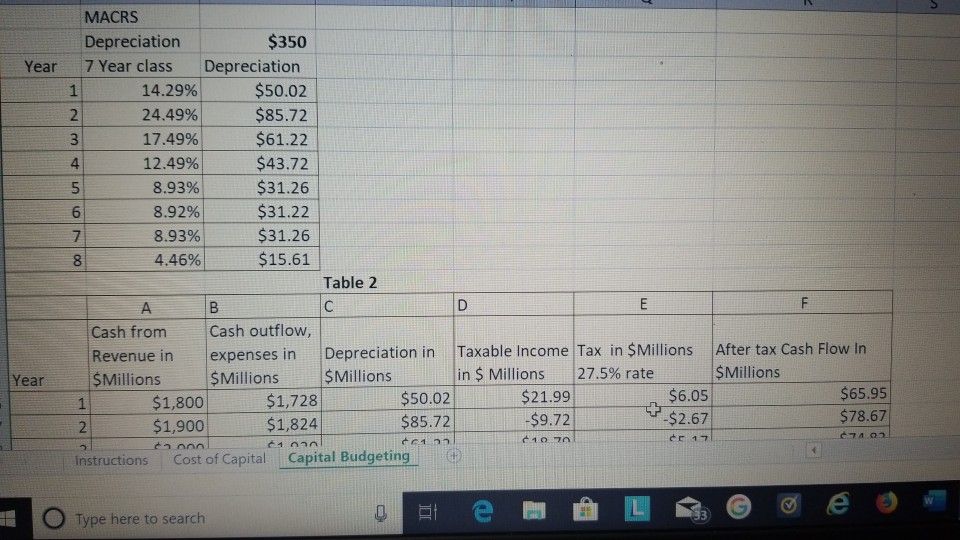

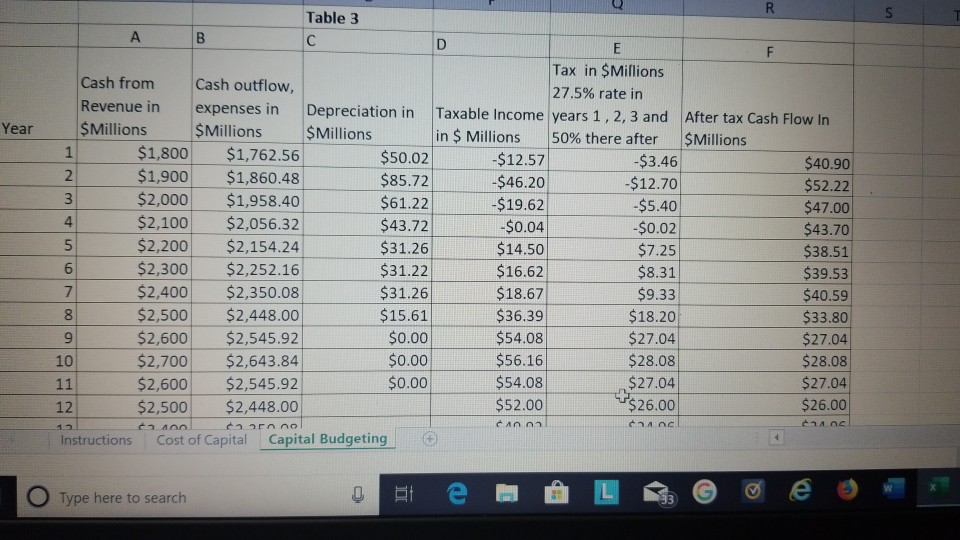

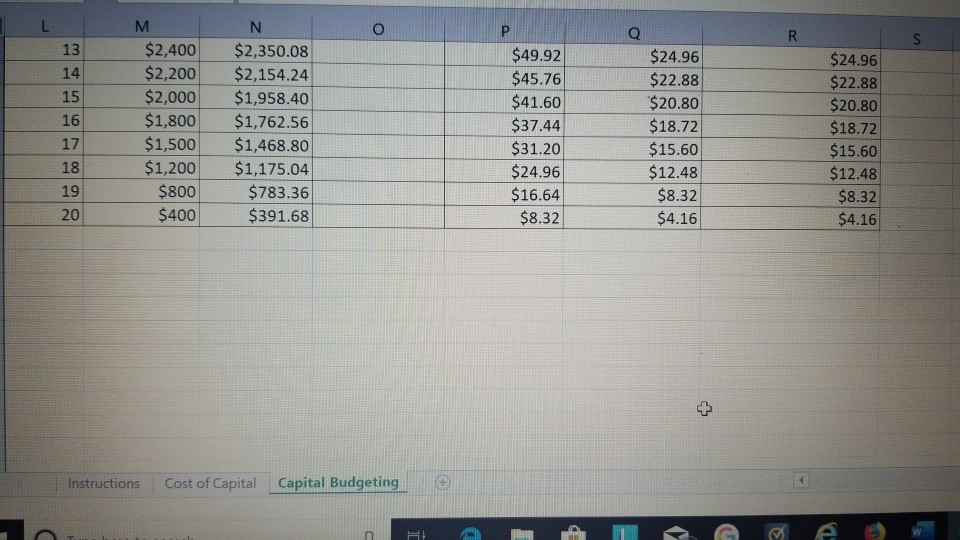

1 Details of McCormick Plant Proposal As you know from Project 4, McCormick & Company is considering a project that requires an initial investment of $350 million to build a new plant and purchase equipment. The investment will be depreciated as a modified accelerated cost recovery system (MACRS) seven-year class asset. The new plant will be built on some of the company's land, which has a current, after-tax market value of $14 million. You have been asked to refine your work to include the correct tax impact of depreciation, and the cash flow impact of working capital on the capital budget evaluation. The investment will be depreciated as a modified accelerated cost recovery system (MACRS) seven-year class asset. The correct depreciation table is included at the right. 15 16 18 The company will need to finance some of the cash to fund $17 million in receivables and $14 million in Inventory starting at year zero. The company expects vendors to give free credit on purchases of $15 million (accounts Payable). Add the net cash outflow for working capital to the cash outflow for the plant, equipment and land in year zero. The $17 million for receivables and the $14 million for Inventory are cash outflows. The $15 million for receivables is a cash inflow. Assume that this net working capital is recovered as a cash inflow in year 21. Instructions Cost of Capital Capital Budgeting 8 9 1. What will be the tax depreciation each year? Note: the total deprecation of tax purposes will still be $350 million if your calculations are correct. 31 2. Create an after-tax cash flow timeline similar to the one you did in Project 4. 3. Calculate the new NPV and IRR. Should the Project be accepted? The CFO thinks that the likely NPV and IRR will be close to the numbers that you calculated in Project 4. NPV = ($349,999,992.34) No the project should not be accepted. The following questions will be used to estimate risk. Please use Table 3 to calculate cash flow. 4. The controller is worried about tax increases and estimates that the tax rate with be raised to 50% (federal and Maryland state) in year 4. Also there is a concern that expenses are understated. He asks, "What would happen to the NPV calculation if the cash tax expenses come in 2% higher than estimated and the tax rate increases to 50% in year 4?" This will allow a subjective evaluation of the project risk. Calculate a new cash flow time line with cash expenses 10% higher than those in Table 2 and with a 50% tax rate. Use Table 3 8 Year O 115. What would be the net present value, NPV in this "worst case" cash flow? What will be the IRR? Instructions Cost of Capital Capital Budgeting O Type here to search Year 00 NOU AWN MACRS Depreciation $350 7 Year class Depreciation 1 14.29% $50.02 2 24.49% $85.72 3 17.49% $61.22 12.49% $43.72 8.93% $31.26 8.92% $31.22 8.93% $31.26 4.46% $15.61 Table 2 Cash from Cash outflow, Revenue in expenses in Depreciation in Taxable income Tax in $Millions After tax Cash Flow In $Millions SMillions $ Millions in $ Millions 27.5% rate $Millions $1,800 $1,728 $50.02 $21.99 $6.05 $65.95 $1,900 $1,824 $85.72 -$9.72 +-$2.67 $78.67 doon 1070 e 17 Instructions Cost of Capital Capital Budgeting 61 O Type here to search o e L e o o 5 N $2,000 $1,920 $61.22 $2,100 $2,016 $43.72 $2,200 $2,112 $31.26 $2,300 $2,208 $31.22 $2,400 $2,304 $31.26 $2,500 $2,400 $15.61 $2,600 $2,496 $2,700 $2,592 $2,600 $2,496 $2,500 $2,400 $2,400 $2,304 $2,200 $2,112 $2,000 $1,920 $1,800 $1,728 $1,500 $1,440 $1,200 $1,152 $800 $768 20 $400 $384 Talla? Instructions Cost of Capital Capital Budgeting $18.79 $40.29 $56.75 $60.78 $64.75 $84.39 $104.00 $108.00 $104.00 $100.00 $96.00 $88.00 $80.00 $72.00 $60.00 $48.00 $32.00 $16.00 $5.17 $11.08 $15.60 $16.71 $17.80 $23.21 $28.60 $29.70 $28.60 $27.50 $26.40 $24.20 $22.00 $19.80 $16.50 $13.20 $8.80 Rs $74.83 $72.92 $72.40 $75.29 $78.20 $76.79 $75.40 $78.30 $75.40 $72.50 $69.60 $63.80 $58.00 $52.20 $43.50 $34.80 $23.20 $27.60 N-UU 18 19 + $4.40 in Type here to search Table 3 A B Year Tax in Millions Cash from Cash outflow, 27.5% rate in Revenue in expenses in Depreciation in Taxable income years 1, 2, 3 and Millions $Millions $ Millions in $ Millions 50% there after 1 $1,800 $1,762.56 $50.02 -$12.57 -$3.46 2 $1,900 $1,860.48 $85.72 -$46.20 -$12.70 3 $2,000 $1,958.40 $61.22 -$19.62 -$5.40 $2,100 $2,056.32 $43.72 -$0.04 -$0.02 $2,200 $2,154.24 $31.26 $14.50 $7.25 $2,300 $2,252.16 $31.22 $16.62 $8.31 $2,400 $2,350.08 $31.26 $18.67 $9.33 $2,500 $2,448.00 $15.61 $36.39 $18.20 9 $2,600 $2,545.92 $0.00 $54.08 $27.04 $2,700 $2,643.84 $0.00 $56.16 $28.08 $2,600 $2,545.92 $0.00 $54.08 $27.04 $2,500 $2,448.00 $52.00 $26.00 100 Anno C C 4.0c Instructions Cost of Capital Capital Budgeting After tax Cash Flow In Millions $40.90 $52.22 $47.00 $43.70 $38.51 $39.53 $40.59 $33.80 $27.04 $28.08 $27.04 $26.00 20 11 O Type here to search M N 15 $2,400 $2,200 $2,000 $1,800 $1,500 $1,200 $800 $400 $2,350.08 $2,154.24 $1,958.40 $1,762.56 $1,468.80 $1,175.04 $783.36 $391.68 $49.92 $45.76 $41.60 $37.44 $31.20 $24.96 $16.64 $8.32 $24.96 $22.88 $20.80 $18.72 $15.60 $12.48 $8.32 $4.16 $24.96 $22.88 $20.80 $18.72 $15.60 $12.48 $8.32 $4.16 17 20 Instructions Cost of Capital Capital Budgeting 2 3 GH M McCormick & Company is considering building a new factory in Largo, Maryland. James Francis, a landowner, is selling a 4.35-acre parcel of industrial zoned land with a listed sale price of $3,000,000.00 for the land. McCormick & Company is interested in the land and so is another manufacturing company. The competing manufacturing company has made a full offer of $3,000,000.00 for the land. McCormick & Company knows it can make an offer to outbid the competitor to obtain the land. So, McCormick & Company decided to offer $4,424,000.00 5 6 co Now, the landowner must make a decision between the two competing offers. To make this decision, James should first identify the Future Value (FV) of each offer. James's bank is offering a 12 percent interest rate when invested through the bank-managed growth stock portfolios. Let's help James make his decision by answering the following questions using the template to the right. 12 1. What is the Future Value (FV) of each offer? FV=13,740,272 What is the two competing offers? Unknown manufacturing company makes an for $3,000,000.00 and McCormick & Company makes an offer $4,424,000.00. comp 13 14 15 2. Based on your future Value calculations, which offer should James accept? James should accept the offer from McCormick and Company. McCormick & Company has decided in order for the company to have a minimal impact on current cash flows, the company will need to borrow 70 percent Loan to Value (LTV) of the $4,424,000.00 offer in the form of a commercial acquisition and development loan to purchase the land. This means McCormick & Company will need to make a 30 percent down payment to secure the commercial acquisition and development loan. McCormick & Company is considering three different loan options: EZ Loan A: 20-year loan with a fixed annual interest rate of 6 percent Loan B: 10-year loan with a fixed annual interest rate of 4,5 percent Loan C: 15-year loan with a fixed annual interest rate of 5 percent 22 23 24 25 3. How much of the total $4,424,000.00 offer will be financed? 3,096,800 Intructions financing and Investing Corporate Valuation Annuities NUR E IN VERTREU 3,090,00 4. Which loan will have the lowest monthly payment? Loan A 5. Which loan will have the lowest total payback amount? Loan B $3,913,699.35 6. Would you recommend McCormick & Company select the loan with lowest monthly payment or lowest total payment and why? I recommend McCormick select the loan with the lowest total payback amount should be accepted as overall, it will have the lowest Instructions Financing and Investing Corporate Valuation Annuities O Type here to search PMT PV $4,424.000 12% FV ($13,740,272.47) N INY PMT PV 12% $ 4,424,000.00 ($13,740,272.47) Principal Percent Down Amount Financed 30% $ 3,096,800.00 INY 20 Loan Loan A Loan B Loan C 6% $ 3,096,800.00 4.5% $ 3,096,800.00 5% $ 3,096,800.00 PMT ($269,993.14) ($391,369.94) ($298,352.80) 10 15 5 DUAL 5 PV Loan Loan A Loan B Loan C 6% 4.5% 5% $3,096,800 $3,096,800 $3,096,800 PMT $269,993.14 $391,369.94 $298,352.80 Total Paid $5,400,000.00 $3,913,699.35 $4,475,291.94 6 Loan B Instructions Financing and Investing Corporate Valuation Annuities McCormick & Company uses the 10-Year Treasury Constant Maturity Rate as the risk-free rate. As of 7/1/2019, this was 2.03 according to the US Treasury. McCormick & Company has disclosed the company's levered Beta is 0.60 (MarketWatch, 7/1/2019). McCormick & Company has disclosed the company's expected return on the market is 8.03% To answer the following questions, use the template to the right. 1. What is McCormick & Company's expected return on the issuance of stock using CAPM? In the CAPM, we examined the expected return on the market as a whole. In an effort to estimate the expected return of McCormick & Company's stock, we will use the Dividend Discount Model (DDM). We can help McCormick & Company with this by answering the following questions using the provided information below: McCormick & Company's expected dividend per share next year is $2.28 McCormick & Company's expected dividend per share constant growth rate is 8.70% (as of May 2019) McCormick & Company's stock price per share was $155.70 on 7/1/2019 Div P = 2. Using the Dividend Discount Model (DDM), what is the cost of equity? To find the cost of equity using DDM, we take the original equation and rearrange the equation: = +g P- Rs-g cuation Du Instructions Financing and Investing Corporate Valuation Annuities 1 Details of McCormick Plant Proposal As you know from Project 4, McCormick & Company is considering a project that requires an initial investment of $350 million to build a new plant and purchase equipment. The investment will be depreciated as a modified accelerated cost recovery system (MACRS) seven-year class asset. The new plant will be built on some of the company's land, which has a current, after-tax market value of $14 million. You have been asked to refine your work to include the correct tax impact of depreciation, and the cash flow impact of working capital on the capital budget evaluation. The investment will be depreciated as a modified accelerated cost recovery system (MACRS) seven-year class asset. The correct depreciation table is included at the right. 15 16 18 The company will need to finance some of the cash to fund $17 million in receivables and $14 million in Inventory starting at year zero. The company expects vendors to give free credit on purchases of $15 million (accounts Payable). Add the net cash outflow for working capital to the cash outflow for the plant, equipment and land in year zero. The $17 million for receivables and the $14 million for Inventory are cash outflows. The $15 million for receivables is a cash inflow. Assume that this net working capital is recovered as a cash inflow in year 21. Instructions Cost of Capital Capital Budgeting 8 9 1. What will be the tax depreciation each year? Note: the total deprecation of tax purposes will still be $350 million if your calculations are correct. 31 2. Create an after-tax cash flow timeline similar to the one you did in Project 4. 3. Calculate the new NPV and IRR. Should the Project be accepted? The CFO thinks that the likely NPV and IRR will be close to the numbers that you calculated in Project 4. NPV = ($349,999,992.34) No the project should not be accepted. The following questions will be used to estimate risk. Please use Table 3 to calculate cash flow. 4. The controller is worried about tax increases and estimates that the tax rate with be raised to 50% (federal and Maryland state) in year 4. Also there is a concern that expenses are understated. He asks, "What would happen to the NPV calculation if the cash tax expenses come in 2% higher than estimated and the tax rate increases to 50% in year 4?" This will allow a subjective evaluation of the project risk. Calculate a new cash flow time line with cash expenses 10% higher than those in Table 2 and with a 50% tax rate. Use Table 3 8 Year O 115. What would be the net present value, NPV in this "worst case" cash flow? What will be the IRR? Instructions Cost of Capital Capital Budgeting O Type here to search Year 00 NOU AWN MACRS Depreciation $350 7 Year class Depreciation 1 14.29% $50.02 2 24.49% $85.72 3 17.49% $61.22 12.49% $43.72 8.93% $31.26 8.92% $31.22 8.93% $31.26 4.46% $15.61 Table 2 Cash from Cash outflow, Revenue in expenses in Depreciation in Taxable income Tax in $Millions After tax Cash Flow In $Millions SMillions $ Millions in $ Millions 27.5% rate $Millions $1,800 $1,728 $50.02 $21.99 $6.05 $65.95 $1,900 $1,824 $85.72 -$9.72 +-$2.67 $78.67 doon 1070 e 17 Instructions Cost of Capital Capital Budgeting 61 O Type here to search o e L e o o 5 N $2,000 $1,920 $61.22 $2,100 $2,016 $43.72 $2,200 $2,112 $31.26 $2,300 $2,208 $31.22 $2,400 $2,304 $31.26 $2,500 $2,400 $15.61 $2,600 $2,496 $2,700 $2,592 $2,600 $2,496 $2,500 $2,400 $2,400 $2,304 $2,200 $2,112 $2,000 $1,920 $1,800 $1,728 $1,500 $1,440 $1,200 $1,152 $800 $768 20 $400 $384 Talla? Instructions Cost of Capital Capital Budgeting $18.79 $40.29 $56.75 $60.78 $64.75 $84.39 $104.00 $108.00 $104.00 $100.00 $96.00 $88.00 $80.00 $72.00 $60.00 $48.00 $32.00 $16.00 $5.17 $11.08 $15.60 $16.71 $17.80 $23.21 $28.60 $29.70 $28.60 $27.50 $26.40 $24.20 $22.00 $19.80 $16.50 $13.20 $8.80 Rs $74.83 $72.92 $72.40 $75.29 $78.20 $76.79 $75.40 $78.30 $75.40 $72.50 $69.60 $63.80 $58.00 $52.20 $43.50 $34.80 $23.20 $27.60 N-UU 18 19 + $4.40 in Type here to search Table 3 A B Year Tax in Millions Cash from Cash outflow, 27.5% rate in Revenue in expenses in Depreciation in Taxable income years 1, 2, 3 and Millions $Millions $ Millions in $ Millions 50% there after 1 $1,800 $1,762.56 $50.02 -$12.57 -$3.46 2 $1,900 $1,860.48 $85.72 -$46.20 -$12.70 3 $2,000 $1,958.40 $61.22 -$19.62 -$5.40 $2,100 $2,056.32 $43.72 -$0.04 -$0.02 $2,200 $2,154.24 $31.26 $14.50 $7.25 $2,300 $2,252.16 $31.22 $16.62 $8.31 $2,400 $2,350.08 $31.26 $18.67 $9.33 $2,500 $2,448.00 $15.61 $36.39 $18.20 9 $2,600 $2,545.92 $0.00 $54.08 $27.04 $2,700 $2,643.84 $0.00 $56.16 $28.08 $2,600 $2,545.92 $0.00 $54.08 $27.04 $2,500 $2,448.00 $52.00 $26.00 100 Anno C C 4.0c Instructions Cost of Capital Capital Budgeting After tax Cash Flow In Millions $40.90 $52.22 $47.00 $43.70 $38.51 $39.53 $40.59 $33.80 $27.04 $28.08 $27.04 $26.00 20 11 O Type here to search M N 15 $2,400 $2,200 $2,000 $1,800 $1,500 $1,200 $800 $400 $2,350.08 $2,154.24 $1,958.40 $1,762.56 $1,468.80 $1,175.04 $783.36 $391.68 $49.92 $45.76 $41.60 $37.44 $31.20 $24.96 $16.64 $8.32 $24.96 $22.88 $20.80 $18.72 $15.60 $12.48 $8.32 $4.16 $24.96 $22.88 $20.80 $18.72 $15.60 $12.48 $8.32 $4.16 17 20 Instructions Cost of Capital Capital Budgeting 2 3 GH M McCormick & Company is considering building a new factory in Largo, Maryland. James Francis, a landowner, is selling a 4.35-acre parcel of industrial zoned land with a listed sale price of $3,000,000.00 for the land. McCormick & Company is interested in the land and so is another manufacturing company. The competing manufacturing company has made a full offer of $3,000,000.00 for the land. McCormick & Company knows it can make an offer to outbid the competitor to obtain the land. So, McCormick & Company decided to offer $4,424,000.00 5 6 co Now, the landowner must make a decision between the two competing offers. To make this decision, James should first identify the Future Value (FV) of each offer. James's bank is offering a 12 percent interest rate when invested through the bank-managed growth stock portfolios. Let's help James make his decision by answering the following questions using the template to the right. 12 1. What is the Future Value (FV) of each offer? FV=13,740,272 What is the two competing offers? Unknown manufacturing company makes an for $3,000,000.00 and McCormick & Company makes an offer $4,424,000.00. comp 13 14 15 2. Based on your future Value calculations, which offer should James accept? James should accept the offer from McCormick and Company. McCormick & Company has decided in order for the company to have a minimal impact on current cash flows, the company will need to borrow 70 percent Loan to Value (LTV) of the $4,424,000.00 offer in the form of a commercial acquisition and development loan to purchase the land. This means McCormick & Company will need to make a 30 percent down payment to secure the commercial acquisition and development loan. McCormick & Company is considering three different loan options: EZ Loan A: 20-year loan with a fixed annual interest rate of 6 percent Loan B: 10-year loan with a fixed annual interest rate of 4,5 percent Loan C: 15-year loan with a fixed annual interest rate of 5 percent 22 23 24 25 3. How much of the total $4,424,000.00 offer will be financed? 3,096,800 Intructions financing and Investing Corporate Valuation Annuities NUR E IN VERTREU 3,090,00 4. Which loan will have the lowest monthly payment? Loan A 5. Which loan will have the lowest total payback amount? Loan B $3,913,699.35 6. Would you recommend McCormick & Company select the loan with lowest monthly payment or lowest total payment and why? I recommend McCormick select the loan with the lowest total payback amount should be accepted as overall, it will have the lowest Instructions Financing and Investing Corporate Valuation Annuities O Type here to search PMT PV $4,424.000 12% FV ($13,740,272.47) N INY PMT PV 12% $ 4,424,000.00 ($13,740,272.47) Principal Percent Down Amount Financed 30% $ 3,096,800.00 INY 20 Loan Loan A Loan B Loan C 6% $ 3,096,800.00 4.5% $ 3,096,800.00 5% $ 3,096,800.00 PMT ($269,993.14) ($391,369.94) ($298,352.80) 10 15 5 DUAL 5 PV Loan Loan A Loan B Loan C 6% 4.5% 5% $3,096,800 $3,096,800 $3,096,800 PMT $269,993.14 $391,369.94 $298,352.80 Total Paid $5,400,000.00 $3,913,699.35 $4,475,291.94 6 Loan B Instructions Financing and Investing Corporate Valuation Annuities McCormick & Company uses the 10-Year Treasury Constant Maturity Rate as the risk-free rate. As of 7/1/2019, this was 2.03 according to the US Treasury. McCormick & Company has disclosed the company's levered Beta is 0.60 (MarketWatch, 7/1/2019). McCormick & Company has disclosed the company's expected return on the market is 8.03% To answer the following questions, use the template to the right. 1. What is McCormick & Company's expected return on the issuance of stock using CAPM? In the CAPM, we examined the expected return on the market as a whole. In an effort to estimate the expected return of McCormick & Company's stock, we will use the Dividend Discount Model (DDM). We can help McCormick & Company with this by answering the following questions using the provided information below: McCormick & Company's expected dividend per share next year is $2.28 McCormick & Company's expected dividend per share constant growth rate is 8.70% (as of May 2019) McCormick & Company's stock price per share was $155.70 on 7/1/2019 Div P = 2. Using the Dividend Discount Model (DDM), what is the cost of equity? To find the cost of equity using DDM, we take the original equation and rearrange the equation: = +g P- Rs-g cuation Du Instructions Financing and Investing Corporate Valuation AnnuitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

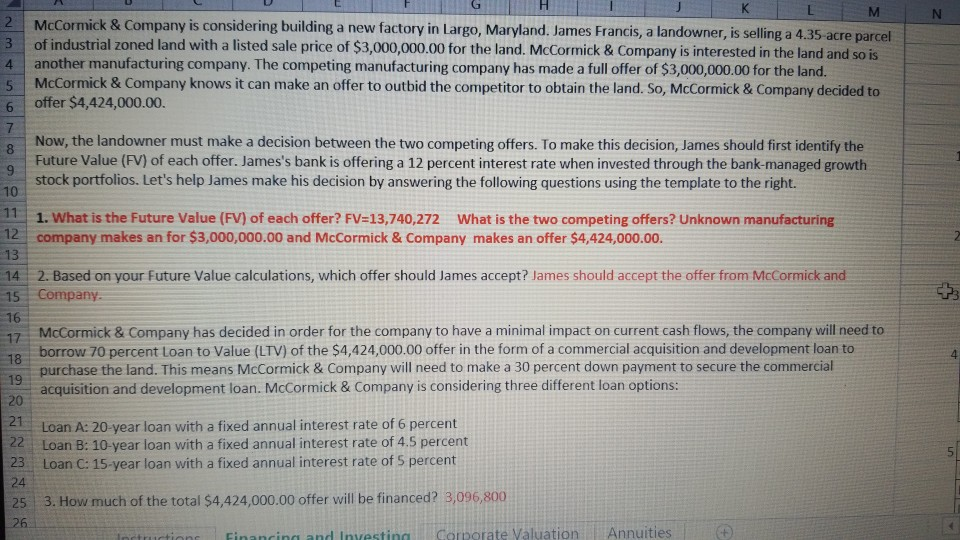

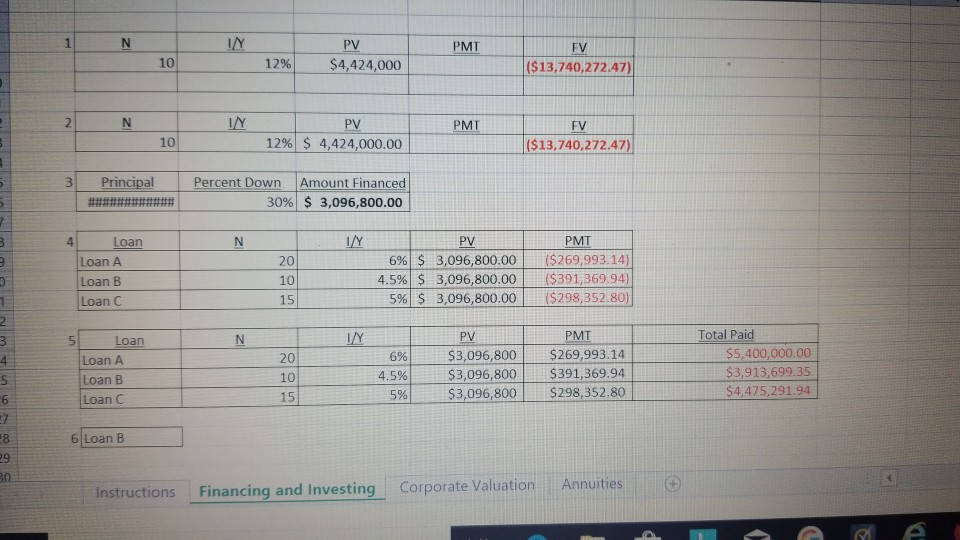

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

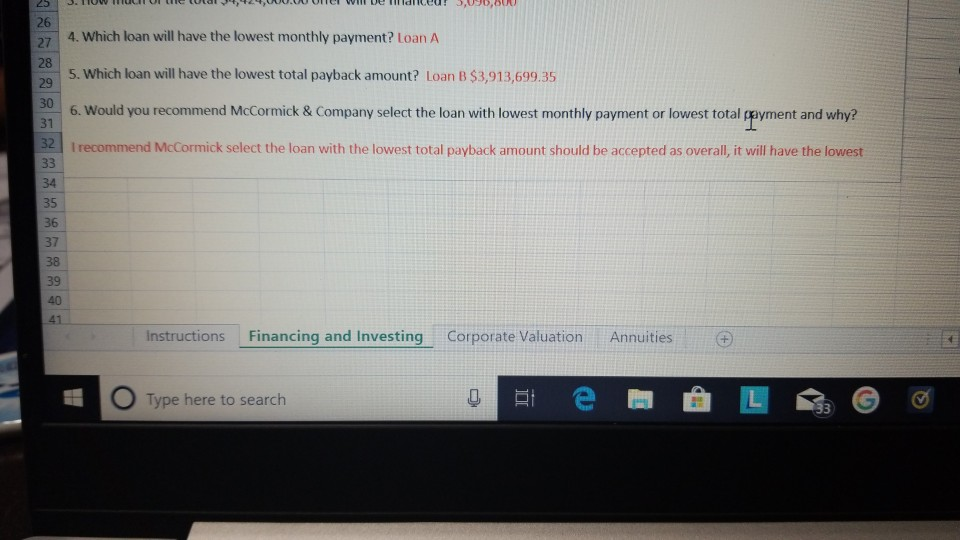

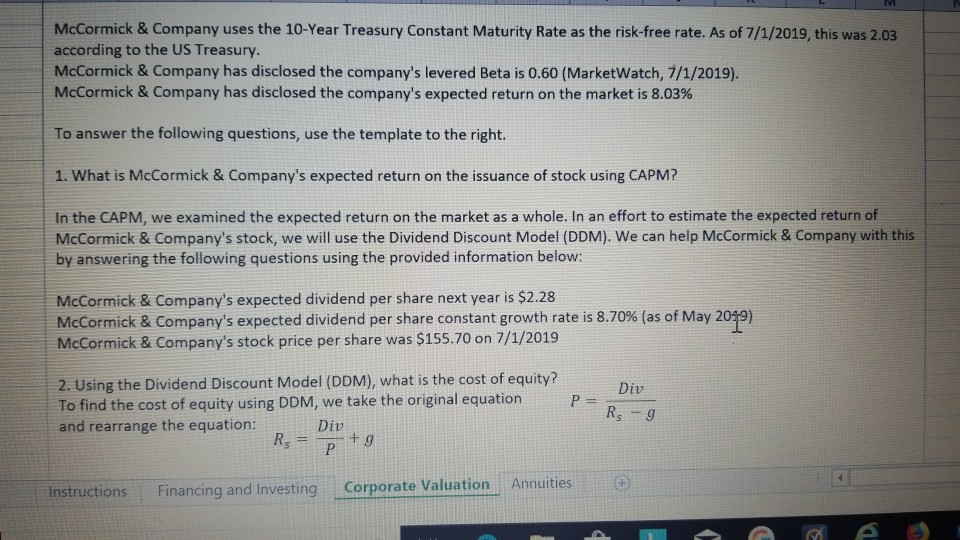

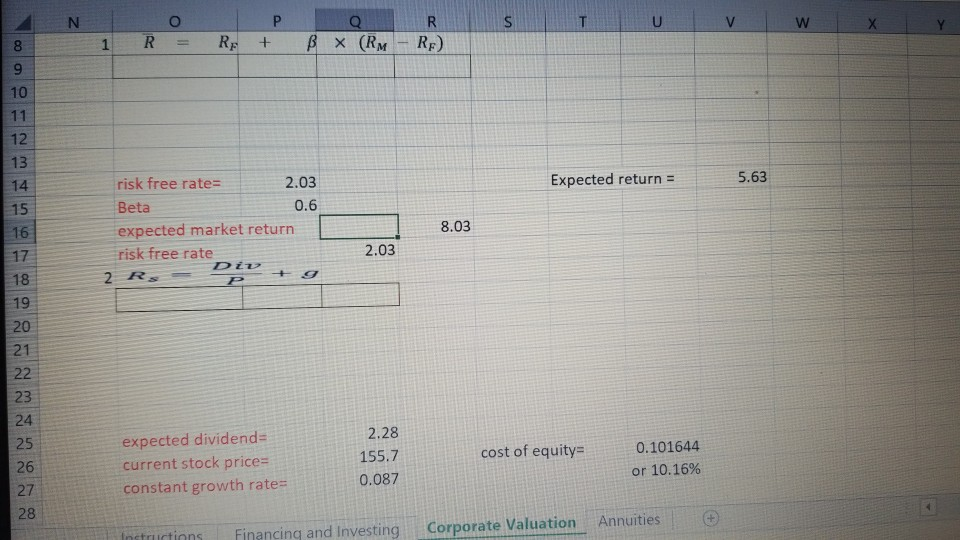

Get Started