Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with questions 8,9 and 10. I confused myself with question 8 and am now stumped. M= 8. market rate is 1.9% If the

Please help with questions 8,9 and 10. I confused myself with question 8 and am now stumped. M= 8.

market rate is 1.9%

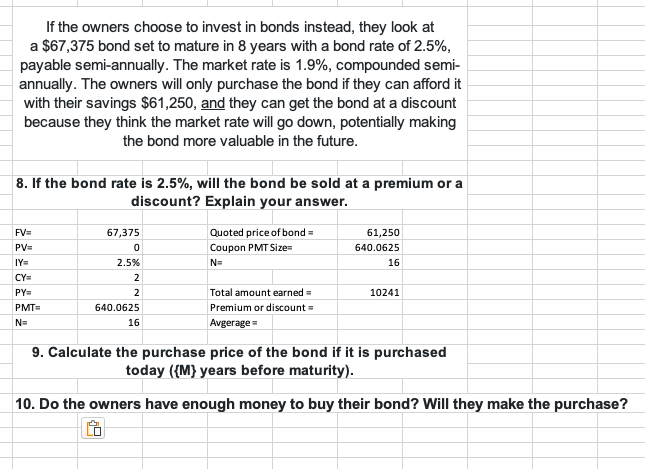

If the owners choose to invest in bonds instead, they look at a $67,375 bond set to mature in 8 years with a bond rate of 2.5%, payable semi-annually. The market rate is 1.9%, compounded semi- annually. The owners will only purchase the bond if they can afford it with their savings $61,250, and they can get the bond at a discount because they think the market rate will go down, potentially making the bond more valuable in the future. 8. If the bond rate is 2.5%, will the bond be sold at a premium or a discount? Explain your answer. Quoted price of bond Coupon PMT Size N= 61,250 640.0625 16 FV= PV= IY CY= PY PMT= N= 67,375 0 2.5% 2 2 640.0625 16 10241 Total amount earned = Premium or discount = Avgerage = 9. Calculate the purchase price of the bond if it is purchased today ({M} years before maturity). 10. Do the owners have enough money to buy their bond? Will they make the purchase? If the owners choose to invest in bonds instead, they look at a $67,375 bond set to mature in 8 years with a bond rate of 2.5%, payable semi-annually. The market rate is 1.9%, compounded semi- annually. The owners will only purchase the bond if they can afford it with their savings $61,250, and they can get the bond at a discount because they think the market rate will go down, potentially making the bond more valuable in the future. 8. If the bond rate is 2.5%, will the bond be sold at a premium or a discount? Explain your answer. Quoted price of bond Coupon PMT Size N= 61,250 640.0625 16 FV= PV= IY CY= PY PMT= N= 67,375 0 2.5% 2 2 640.0625 16 10241 Total amount earned = Premium or discount = Avgerage = 9. Calculate the purchase price of the bond if it is purchased today ({M} years before maturity). 10. Do the owners have enough money to buy their bond? Will they make the purchase Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started