Answered step by step

Verified Expert Solution

Question

1 Approved Answer

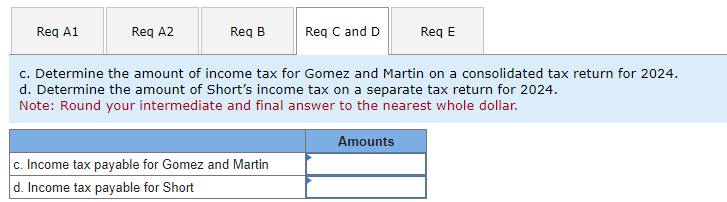

Please help with required C,D and E? Thank you!! c. Determine the amount of income tax for Gomez and Martin on a consolidated tax return

Please help with required C,D and E? Thank you!!

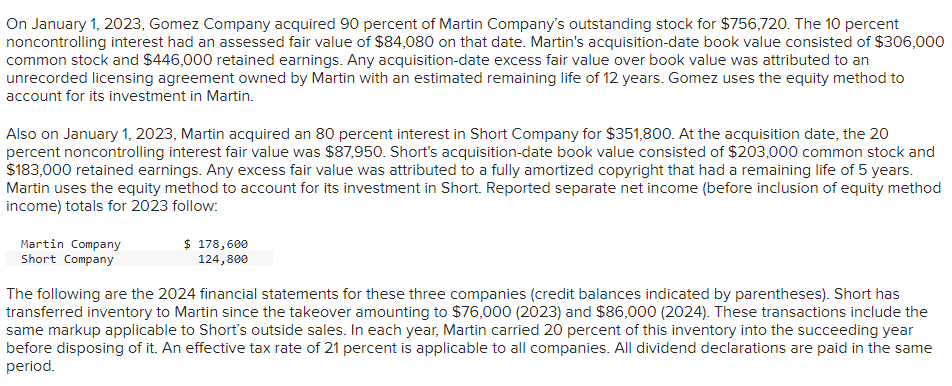

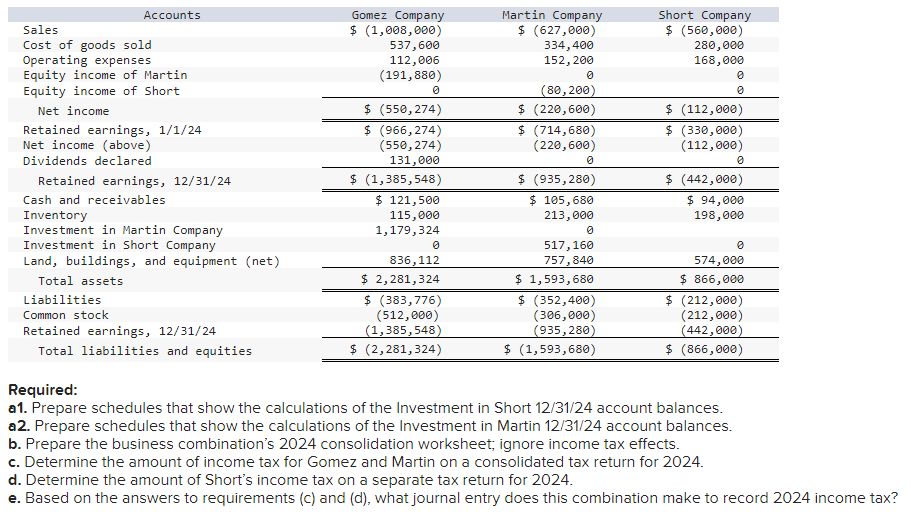

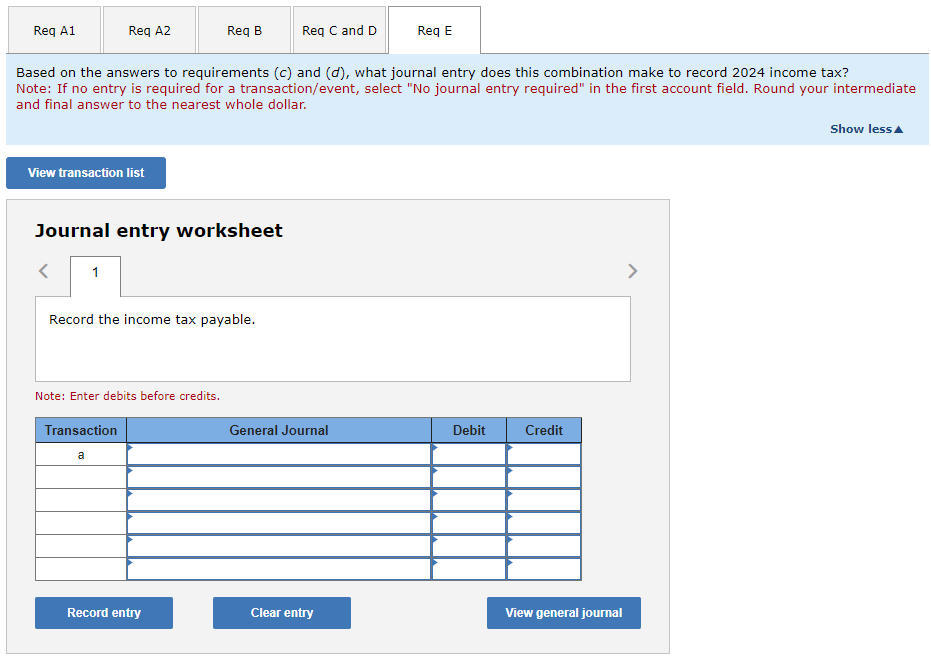

c. Determine the amount of income tax for Gomez and Martin on a consolidated tax return for 2024. d. Determine the amount of Short's income tax on a separate tax return for 2024. Note: Round your intermediate and final answer to the nearest whole dollar. Based on the answers to requirements (c) and (d), what journal entry does this combination make to record 2024 income tax? Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answer to the nearest whole dollar. Show less Journal entry worksheet Note: Enter debits before credits. On January 1, 2023, Gomez Company acquired 90 percent of Martin Company's outstanding stock for $756,720. The 10 percent noncontrolling interest had an assessed fair value of $84,080 on that date. Martin's acquisition-date book value consisted of $306,000 common stock and $446,000 retained earnings. Any acquisition-date excess fair value over book value was attributed to an unrecorded licensing agreement owned by Martin with an estimated remaining life of 12 years. Gomez uses the equity method to account for its investment in Martin. Also on January 1, 2023, Martin acquired an 80 percent interest in Short Company for $351,800. At the acquisition date, the 20 percent noncontrolling interest fair value was $87,950. Short's acquisition-date book value consisted of $203,000 common stock and $183,000 retained earnings. Any excess fair value was attributed to a fully amortized copyright that had a remaining life of 5 years. Martin uses the equity method to account for its investment in Short. Reported separate net income (before inclusion of equity method income) totals for 2023 follow: The following are the 2024 financial statements for these three companies (credit balances indicated by parentheses). Short has transferred inventory to Martin since the takeover amounting to $76,000 (2023) and $86,000 (2024). These transactions include the same markup applicable to Short's outside sales. In each year, Martin carried 20 percent of this inventory into the succeeding year before disposing of it. An effective tax rate of 21 percent is applicable to all companies. All dividend declarations are paid in the same period. Required: a1. Prepare schedules that show the calculations of the Investment in Short 12/31/24 account balances. a2. Prepare schedules that show the calculations of the Investment in Martin 12/31/24 account balances. b. Prepare the business combination's 2024 consolidation worksheet; ignore income tax effects. c. Determine the amount of income tax for Gomez and Martin on a consolidated tax return for 2024. d. Determine the amount of Short's income tax on a separate tax return for 2024. e. Based on the answers to requirements (c) and (d), what journal entry does this combination make to record 2024 income tax

c. Determine the amount of income tax for Gomez and Martin on a consolidated tax return for 2024. d. Determine the amount of Short's income tax on a separate tax return for 2024. Note: Round your intermediate and final answer to the nearest whole dollar. Based on the answers to requirements (c) and (d), what journal entry does this combination make to record 2024 income tax? Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your intermediate and final answer to the nearest whole dollar. Show less Journal entry worksheet Note: Enter debits before credits. On January 1, 2023, Gomez Company acquired 90 percent of Martin Company's outstanding stock for $756,720. The 10 percent noncontrolling interest had an assessed fair value of $84,080 on that date. Martin's acquisition-date book value consisted of $306,000 common stock and $446,000 retained earnings. Any acquisition-date excess fair value over book value was attributed to an unrecorded licensing agreement owned by Martin with an estimated remaining life of 12 years. Gomez uses the equity method to account for its investment in Martin. Also on January 1, 2023, Martin acquired an 80 percent interest in Short Company for $351,800. At the acquisition date, the 20 percent noncontrolling interest fair value was $87,950. Short's acquisition-date book value consisted of $203,000 common stock and $183,000 retained earnings. Any excess fair value was attributed to a fully amortized copyright that had a remaining life of 5 years. Martin uses the equity method to account for its investment in Short. Reported separate net income (before inclusion of equity method income) totals for 2023 follow: The following are the 2024 financial statements for these three companies (credit balances indicated by parentheses). Short has transferred inventory to Martin since the takeover amounting to $76,000 (2023) and $86,000 (2024). These transactions include the same markup applicable to Short's outside sales. In each year, Martin carried 20 percent of this inventory into the succeeding year before disposing of it. An effective tax rate of 21 percent is applicable to all companies. All dividend declarations are paid in the same period. Required: a1. Prepare schedules that show the calculations of the Investment in Short 12/31/24 account balances. a2. Prepare schedules that show the calculations of the Investment in Martin 12/31/24 account balances. b. Prepare the business combination's 2024 consolidation worksheet; ignore income tax effects. c. Determine the amount of income tax for Gomez and Martin on a consolidated tax return for 2024. d. Determine the amount of Short's income tax on a separate tax return for 2024. e. Based on the answers to requirements (c) and (d), what journal entry does this combination make to record 2024 income tax Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started