Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please help with this accounting !I will give a thumbs up and a like to whoever does it first can you also make it clear

Please help with this accounting !I will give a thumbs up and a like to whoever does it first can you also make it clear to read. I need it in asap if possible that would be amazing Thank you!!!!

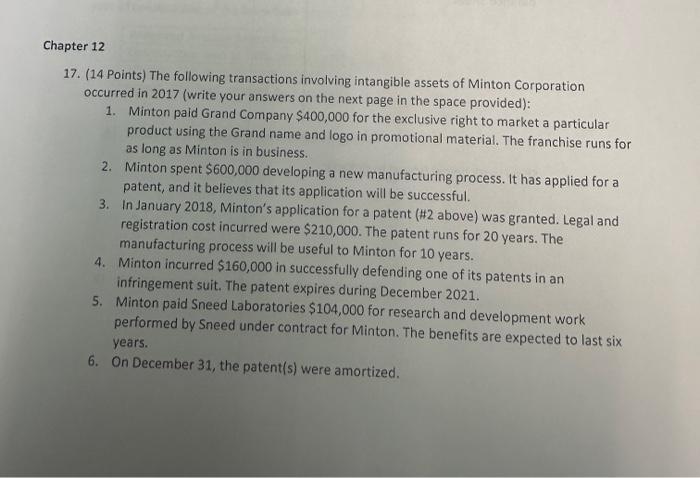

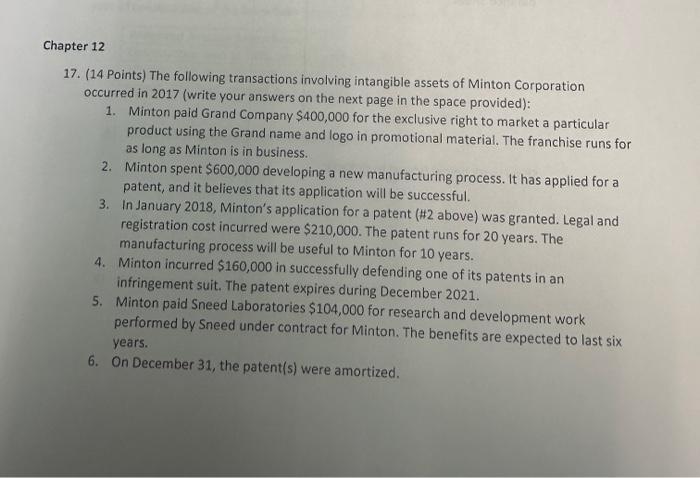

17. (14 Points) The following transactions involving intangible assets of Minton Corporation occurred in 2017 (write your answers on the next page in the space provided): 1. Minton paid Grand Company $400,000 for the exclusive right to market a particular product using the Grand name and logo in promotional material. The franchise runs for as long as Minton is in business. 2. Minton spent $600,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3. In January 2018, Minton's application for a patent ( #2 above) was granted. Legal and registration cost incurred were $210,000. The patent runs for 20 years. The manufacturing process will be useful to Minton for 10 years. 4. Minton incurred $160,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2021. 5. Minton paid Sneed Laboratories $104,000 for research and development work performed by Sneed under contract for Minton. The benefits are expected to last six years. 6. On December 31, the patent(s) were amortized

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started