Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please help with this, the answer below is not correct i cant make a comment, i dont know why so i have to posted again

please help with this, the answer below is not correct

i cant make a comment, i dont know why so i have to posted again

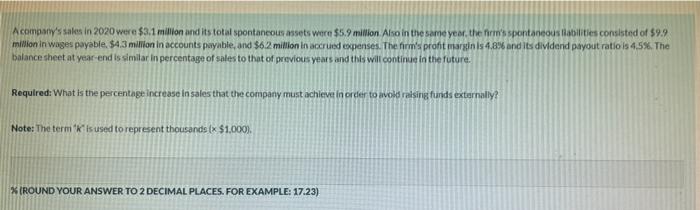

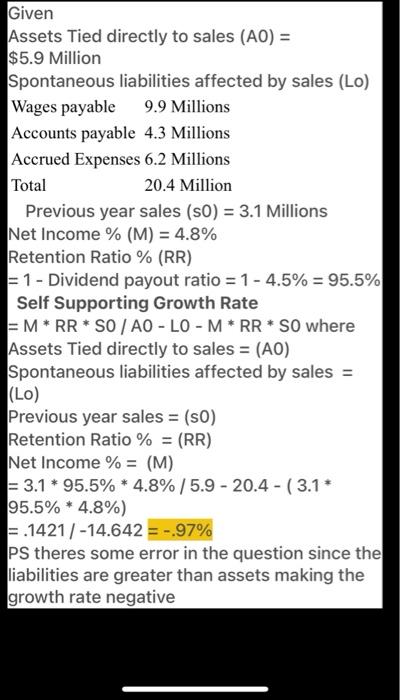

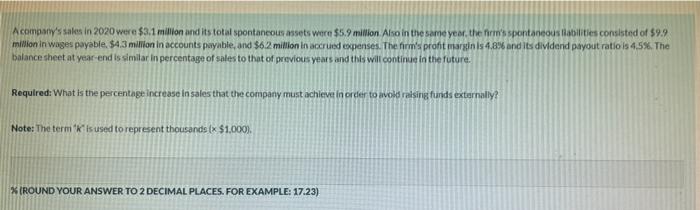

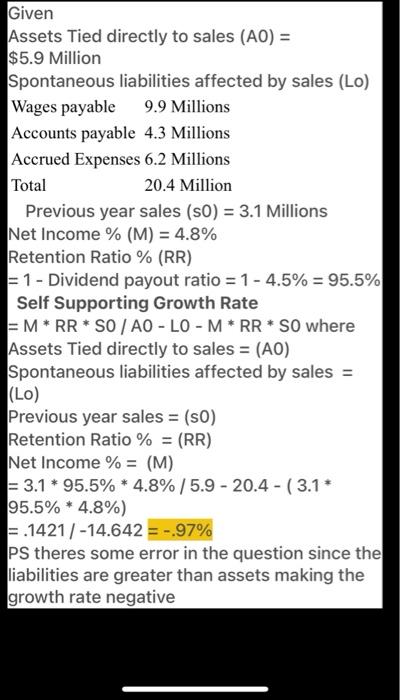

Acompany's sales in 2020 were $3.1 milion and its total spontaneous assets were $5.9 million. Also in the same year, the firm's spontaneous abilities consisted of 59.9 million in wages payable $4.3 million in accounts payable, and $6.2 million in accrued expenses. The firm's profit marginis 4,8% and its dividend payout ratio is 4.5%. The balance sheet at year end is similar in percentage of sales to that of previous years and this will continue in the future. Required: What is the percentage increase in sales that the company must achieve in order to hold raising funds externally? Note: The term is used to represent thousands ( $1.000). XIROUND YOUR ANSWER TO 2 DECIMAL PLACES. FOR EXAMPLE: 17.23) Given Assets Tied directly to sales (AO) = $5.9 Million Spontaneous liabilities affected by sales (LO) Wages payable 9.9 Millions Accounts payable 4.3 Millions Accrued Expenses 6.2 Millions Total 20.4 Million Previous year sales (s0) = 3.1 Millions Net Income % (M) = 4.8% Retention Ratio % (RR) = 1 - Dividend payout ratio = 1 - 4.5% = 95.5% Self Supporting Growth Rate = M* RR * SO AO - LO-M* RR* So where Assets Tied directly to sales = (AO) Spontaneous liabilities affected by sales = (LO) Previous year sales = (s0) Retention Ratio % = (RR) Net Income % = (M) = 3.1* 95.5% * 4.8% / 5.9 - 20.4 - (3.1* 95.5% * 4.8%) = .1421/-14.642 = -.97% PS theres some error in the question since the liabilities are greater than assets making the growth rate negative Acompany's sales in 2020 were $3.1 milion and its total spontaneous assets were $5.9 million. Also in the same year, the firm's spontaneous abilities consisted of 59.9 million in wages payable $4.3 million in accounts payable, and $6.2 million in accrued expenses. The firm's profit marginis 4,8% and its dividend payout ratio is 4.5%. The balance sheet at year end is similar in percentage of sales to that of previous years and this will continue in the future. Required: What is the percentage increase in sales that the company must achieve in order to hold raising funds externally? Note: The term is used to represent thousands ( $1.000). XIROUND YOUR ANSWER TO 2 DECIMAL PLACES. FOR EXAMPLE: 17.23) Given Assets Tied directly to sales (AO) = $5.9 Million Spontaneous liabilities affected by sales (LO) Wages payable 9.9 Millions Accounts payable 4.3 Millions Accrued Expenses 6.2 Millions Total 20.4 Million Previous year sales (s0) = 3.1 Millions Net Income % (M) = 4.8% Retention Ratio % (RR) = 1 - Dividend payout ratio = 1 - 4.5% = 95.5% Self Supporting Growth Rate = M* RR * SO AO - LO-M* RR* So where Assets Tied directly to sales = (AO) Spontaneous liabilities affected by sales = (LO) Previous year sales = (s0) Retention Ratio % = (RR) Net Income % = (M) = 3.1* 95.5% * 4.8% / 5.9 - 20.4 - (3.1* 95.5% * 4.8%) = .1421/-14.642 = -.97% PS theres some error in the question since the liabilities are greater than assets making the growth rate negative Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started