please help

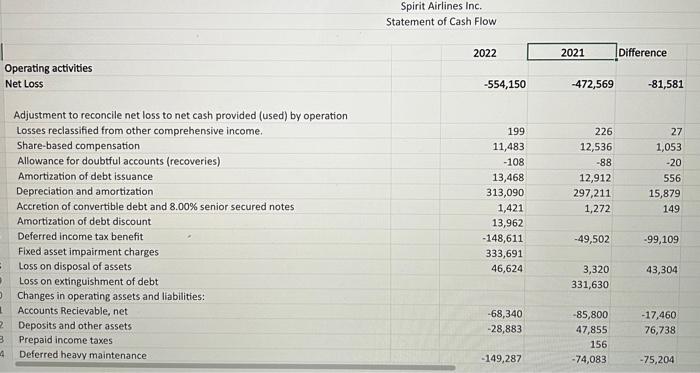

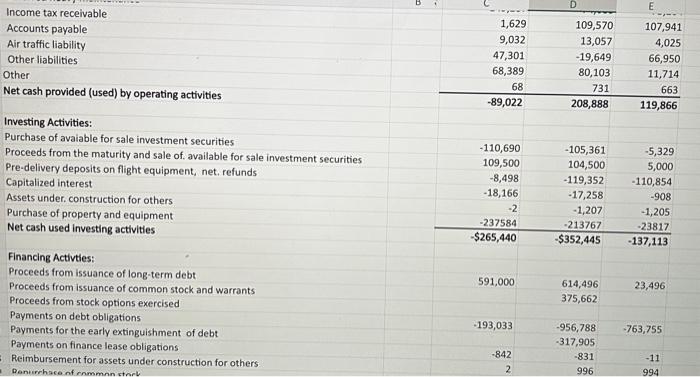

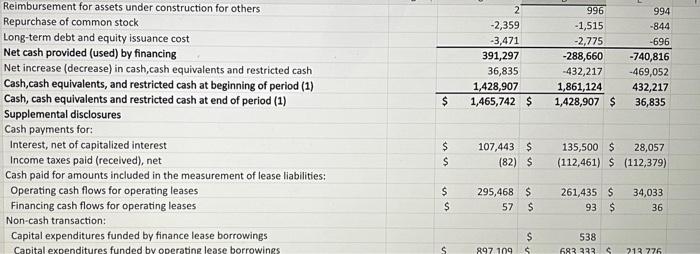

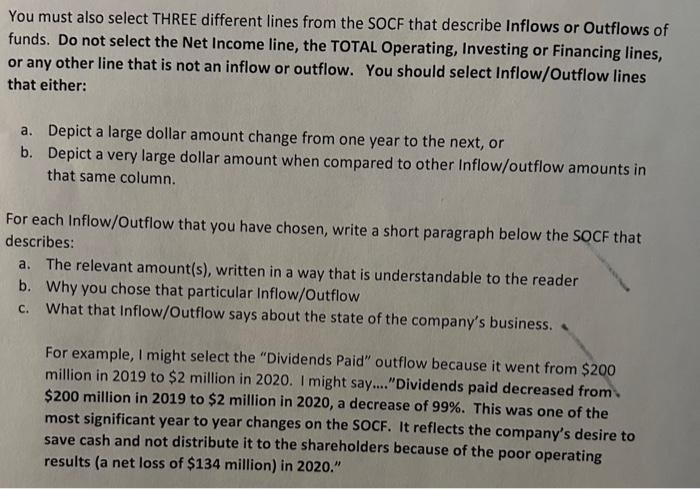

You must also select THREE different lines from the SOCF that describe Inflows or Outflows of funds. Do not select the Net Income line, the TOTAL Operating, Investing or Financing lines, or any other line that is not an inflow or outflow. You should select Inflow/Outflow lines that either: a. Depict a large dollar amount change from one year to the next, or b. Depict a very large dollar amount when compared to other Inflow/outflow amounts in that same column. For each Inflow/Outflow that you have chosen, write a short paragraph below the SOCF that describes: a. The relevant amount(s), written in a way that is understandable to the reader b. Why you chose that particular Inflow/Outflow c. What that Inflow/Outflow says about the state of the company's business. For example, I might select the "Dividends Paid" outflow because it went from $200 million in 2019 to \$2 million in 2020. I might say...."Dividends paid decreased from $200 million in 2019 to $2 million in 2020, a decrease of 99%. This was one of the most significant year to year changes on the SOCF. It reflects the company's desire to save cash and not distribute it to the shareholders because of the poor operating results (a net loss of $134 million) in 2020." Spirit Airlines Inc. Statement of Cash Flow You must also select THREE different lines from the SOCF that describe Inflows or Outflows of funds. Do not select the Net Income line, the TOTAL Operating, Investing or Financing lines, or any other line that is not an inflow or outflow. You should select Inflow/Outflow lines that either: a. Depict a large dollar amount change from one year to the next, or b. Depict a very large dollar amount when compared to other Inflow/outflow amounts in that same column. For each Inflow/Outflow that you have chosen, write a short paragraph below the SOCF that describes: a. The relevant amount(s), written in a way that is understandable to the reader b. Why you chose that particular Inflow/Outflow c. What that Inflow/Outflow says about the state of the company's business. For example, I might select the "Dividends Paid" outflow because it went from $200 million in 2019 to \$2 million in 2020. I might say...."Dividends paid decreased from $200 million in 2019 to $2 million in 2020, a decrease of 99%. This was one of the most significant year to year changes on the SOCF. It reflects the company's desire to save cash and not distribute it to the shareholders because of the poor operating results (a net loss of $134 million) in 2020." Spirit Airlines Inc. Statement of Cash Flow