Answered step by step

Verified Expert Solution

Question

1 Approved Answer

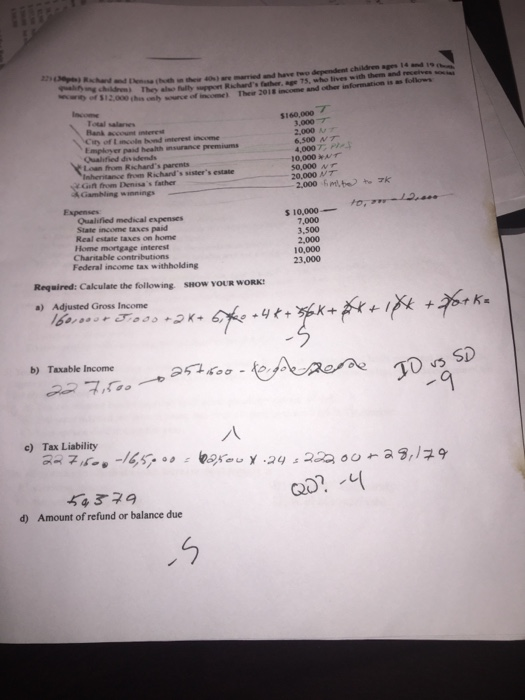

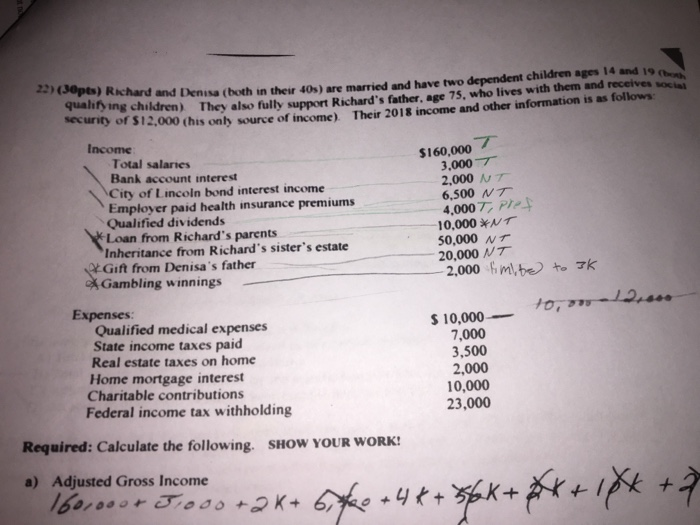

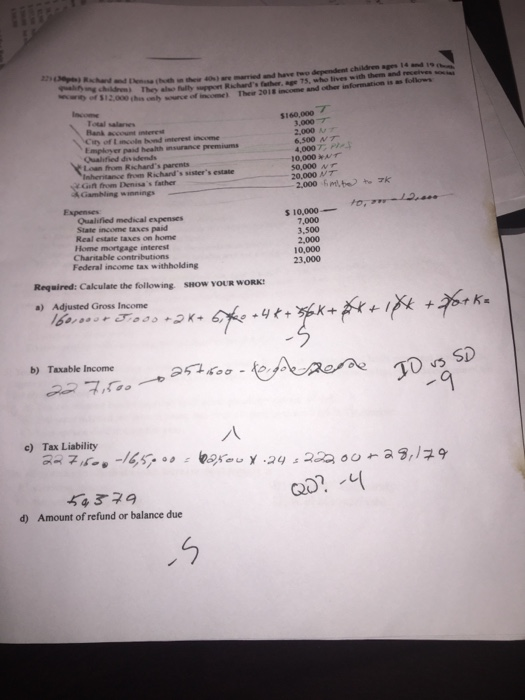

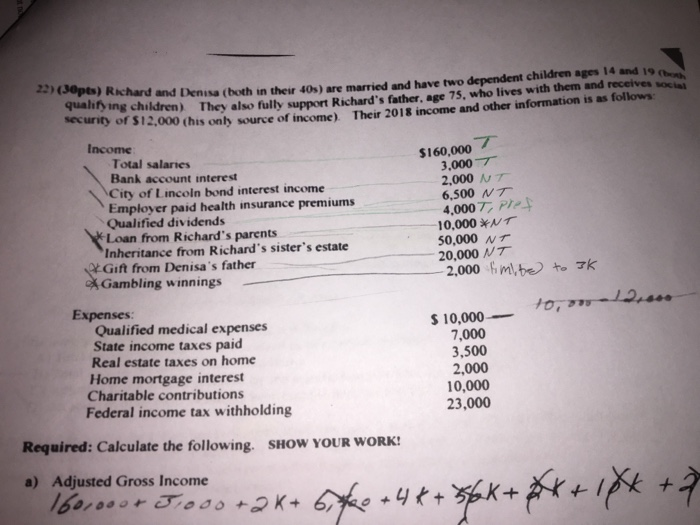

Please I need help with this Accounting taxation question, both pictures for the same question onb swuce of income Ther 2018 income and other information

Please I need help with this Accounting taxation question, both pictures for the same question

onb swuce of income Ther 2018 income and other information is as follows Total salanes City of tmcoln bond interest income Loan from Richard's parents 5160,000 7 3,000 7 2,000 6,500 N7 10,000 uT 50,000 wr 20,000 M7 Ishenitance from Richand's sister's estate Cft fhom Denisa's father s 10,000to State income taxes paid Real estate taxes on home Home mortgage interest Charitable contributions Federal income tax withholding 7,000 3,500 2,000 10,000 23,000 Required: Calculate the following a) Adjusted Gross Income SHow YOUR WORK ea 50 b) Taxable Income c) Tax Liability d) Amount of refund or balance due 22)30pts) )Richard and Denisa (both in their 40s) are married and have two dependent children ages 14 and 19 ualit ing children) They also fully support Richard's father, age 75, who lives with them and receives soct g or S12,000 (his only source of income) Their 2018 income and other information is as follows Income $160,000-T Total salaries Bank account interest 3,0007 2,000 6,500 City of Lincoln bond interest income Employer paid health insurance premiums Qualified dividends Loan from Richard's parents Inheritance from Richard's sister's estate Gift from Denisa's father Gambling winnings 10,000NT 50,000 NT 20,000 NT 2,000 iml b to Tk Expenses: 10,000112 Qualified medical expenses State income taxes paid Real estate taxes on home Home mortgage interest Charitable contributions 7,000 3,500 2,000 10,000 23,000 Federal income tax withholding Required: Calculate the following. SHOW YOUR WORK: a) Adjusted Gross Income onb swuce of income Ther 2018 income and other information is as follows Total salanes City of tmcoln bond interest income Loan from Richard's parents 5160,000 7 3,000 7 2,000 6,500 N7 10,000 uT 50,000 wr 20,000 M7 Ishenitance from Richand's sister's estate Cft fhom Denisa's father s 10,000to State income taxes paid Real estate taxes on home Home mortgage interest Charitable contributions Federal income tax withholding 7,000 3,500 2,000 10,000 23,000 Required: Calculate the following a) Adjusted Gross Income SHow YOUR WORK ea 50 b) Taxable Income c) Tax Liability d) Amount of refund or balance due 22)30pts) )Richard and Denisa (both in their 40s) are married and have two dependent children ages 14 and 19 ualit ing children) They also fully support Richard's father, age 75, who lives with them and receives soct g or S12,000 (his only source of income) Their 2018 income and other information is as follows Income $160,000-T Total salaries Bank account interest 3,0007 2,000 6,500 City of Lincoln bond interest income Employer paid health insurance premiums Qualified dividends Loan from Richard's parents Inheritance from Richard's sister's estate Gift from Denisa's father Gambling winnings 10,000NT 50,000 NT 20,000 NT 2,000 iml b to Tk Expenses: 10,000112 Qualified medical expenses State income taxes paid Real estate taxes on home Home mortgage interest Charitable contributions 7,000 3,500 2,000 10,000 23,000 Federal income tax withholding Required: Calculate the following. SHOW YOUR WORK: a) Adjusted Gross Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started