Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please i need the answee please i need the answer Learning Outcomes: Develop a personal budget Introduction: Bungo and Esmerelda Baggins and their 13 year

please i need the answee

please i need the answer

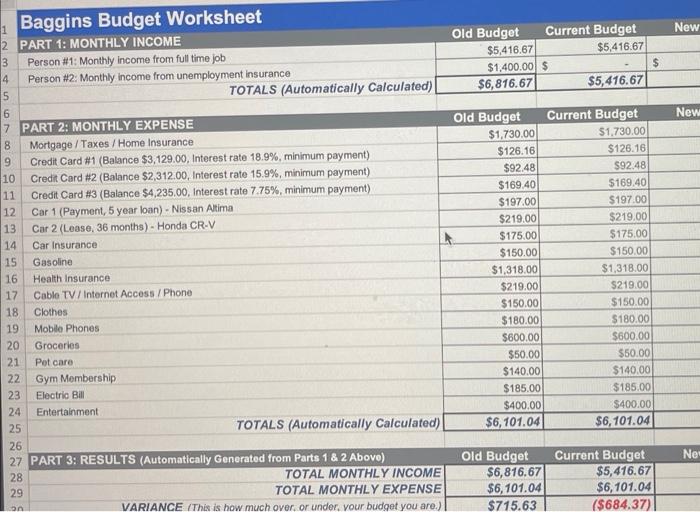

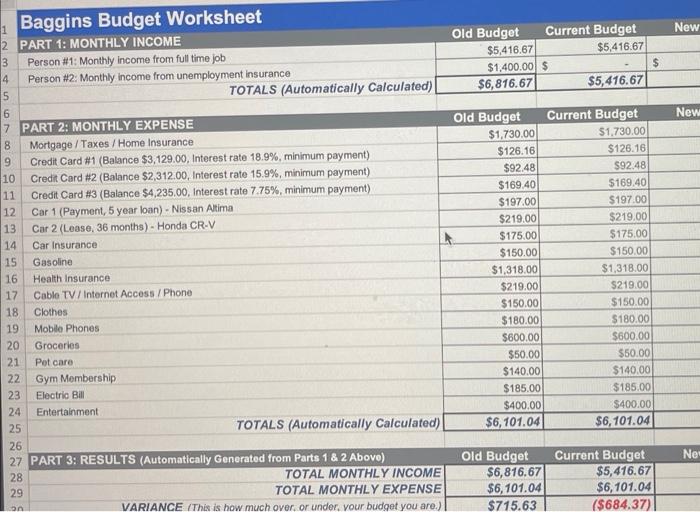

Learning Outcomes: Develop a personal budget Introduction: Bungo and Esmerelda Baggins and their 13 year old son, Fosco, five in a beautiful house in Cary, North Carolina. Their house has 4 bedrooms, 4 baths and is 3.475ft2. In 2016 , shortly after the family purchased their home and a new Nissan Altima, Bungo lost his job. Since then he has been unable to find employment. Living on Bungo's unemployment insurance rather than his salary left the family with less money than they were used to spending, so they used credit cards to pay for some of their expenditures. In December of 2017, believing that he was about to be offered a prestigious new job, Bungo leased a 2018 Honda CR-V (36 month lease). That job fell through and his unemployment benefits have recently run out. The family can no longer meet their monthly expenses and have come to your group for heip. 1. Look at the Baggins family expenses found on the attached Excel sheet, research ways in which the famlly can cut its monthly expenses and balance its budget. Your recommendations must be realistic (for example the Baggins family can't stop eating or wearing clothes) and well researched. If you recommend saving money on housing. insurance, car payments, utilities, etc. you must research that budget item and find a less expensive alternative for them. If you recommend debt consolidation, you must find them a lower cost loan. 2. Fill out the New Budget column on the Baggins_Budget. Worksheet with your recommended changes. Be sure that their new budget covers all of their monthly expenses. Docurnent your recommendations and cite your research in the text box on the worksheet. Baggins Budget Worksheet Learning Outcomes: Develop a personal budget Introduction: Bungo and Esmerelda Baggins and their 13 year old son, Fosco, five in a beautiful house in Cary, North Carolina. Their house has 4 bedrooms, 4 baths and is 3.475ft2. In 2016 , shortly after the family purchased their home and a new Nissan Altima, Bungo lost his job. Since then he has been unable to find employment. Living on Bungo's unemployment insurance rather than his salary left the family with less money than they were used to spending, so they used credit cards to pay for some of their expenditures. In December of 2017, believing that he was about to be offered a prestigious new job, Bungo leased a 2018 Honda CR-V (36 month lease). That job fell through and his unemployment benefits have recently run out. The family can no longer meet their monthly expenses and have come to your group for heip. 1. Look at the Baggins family expenses found on the attached Excel sheet, research ways in which the famlly can cut its monthly expenses and balance its budget. Your recommendations must be realistic (for example the Baggins family can't stop eating or wearing clothes) and well researched. If you recommend saving money on housing. insurance, car payments, utilities, etc. you must research that budget item and find a less expensive alternative for them. If you recommend debt consolidation, you must find them a lower cost loan. 2. Fill out the New Budget column on the Baggins_Budget. Worksheet with your recommended changes. Be sure that their new budget covers all of their monthly expenses. Docurnent your recommendations and cite your research in the text box on the worksheet. Baggins Budget Worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started