please ignore previous question this is actually the question i wanted to post

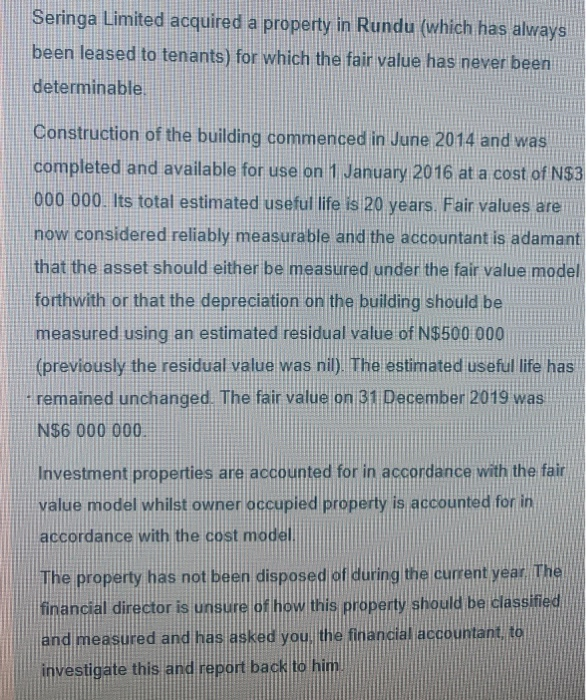

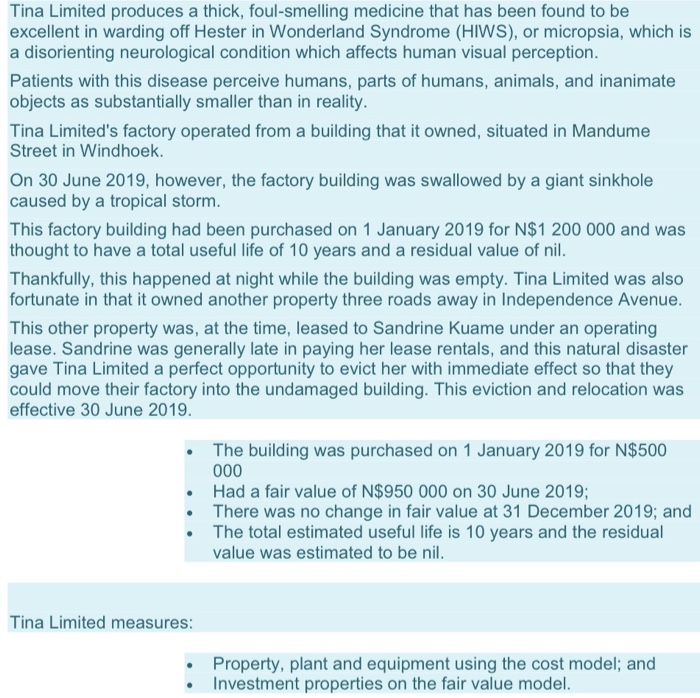

Seringa Limited acquired a property in Rundu (which has always been leased to tenants) for which the fair value has never been determinable Construction of the building commenced in June 2014 and was completed and available for use on 1 January 2016 at a cost of N$3 000 000. Its total estimated useful life is 20 years. Fair values are now considered reliably measurable and the accountant is adamant that the asset should either be measured under the fair value model forthwith or that the depreciation on the building should be measured using an estimated residual value of N$500 000 (previously the residual value was nil). The estimated useful life has 1 remained unchanged. The fair value on 31 December 2019 was N$6 000 000 Investment properties are accounted for in accordance with the fair value model whilst owner occupied property is accounted for in accordance with the cost model The property has not been disposed of during the current year. The financial director is unsure of how this property should be classified and measured and has asked you, the financial accountant, to investigate this and report back to him Tina Limited produces a thick, foul-smelling medicine that has been found to be excellent in warding off Hester in Wonderland Syndrome (HIWS), or micropsia, which is a disorienting neurological condition which affects human visual perception. Patients with this disease perceive humans, parts of humans, animals, and inanimate objects as substantially smaller than in reality. Tina Limited's factory operated from a building that it owned, situated in Mandume Street in Windhoek. On 30 June 2019, however, the factory building was swallowed by a giant sinkhole caused by a tropical storm. This factory building had been purchased on 1 January 2019 for N$1 200 000 and was thought to have a total useful life of 10 years and a residual value of nil. Thankfully, this happened at night while the building was empty. Tina Limited was also fortunate in that it owned another property three roads away in Independence Avenue. This other property was, at the time, leased to Sandrine Kuame under an operating lease. Sandrine was generally late in paying her lease rentals, and this natural disaster gave Tina Limited a perfect opportunity to evict her with immediate effect so that they could move their factory into the undamaged building. This eviction and relocation was effective 30 June 2019. The building was purchased on 1 January 2019 for N$500 000 Had a fair value of N$950 000 on 30 June 2019; There was no change in fair value at 31 December 2019; and The total estimated useful life is 10 years and the residual value was estimated to be nil. Tina Limited measures: Property, plant and equipment using the cost model; and Investment properties on the fair value model. a) Provide the journal entries to account for all of the above transactions in Tina Limited's financial statements for the year ended 31 December 2019. (18 marks) Seringa Limited acquired a property in Rundu (which has always been leased to tenants) for which the fair value has never been determinable Construction of the building commenced in June 2014 and was completed and available for use on 1 January 2016 at a cost of N$3 000 000. Its total estimated useful life is 20 years. Fair values are now considered reliably measurable and the accountant is adamant that the asset should either be measured under the fair value model forthwith or that the depreciation on the building should be measured using an estimated residual value of N$500 000 (previously the residual value was nil). The estimated useful life has 1 remained unchanged. The fair value on 31 December 2019 was N$6 000 000 Investment properties are accounted for in accordance with the fair value model whilst owner occupied property is accounted for in accordance with the cost model The property has not been disposed of during the current year. The financial director is unsure of how this property should be classified and measured and has asked you, the financial accountant, to investigate this and report back to him Tina Limited produces a thick, foul-smelling medicine that has been found to be excellent in warding off Hester in Wonderland Syndrome (HIWS), or micropsia, which is a disorienting neurological condition which affects human visual perception. Patients with this disease perceive humans, parts of humans, animals, and inanimate objects as substantially smaller than in reality. Tina Limited's factory operated from a building that it owned, situated in Mandume Street in Windhoek. On 30 June 2019, however, the factory building was swallowed by a giant sinkhole caused by a tropical storm. This factory building had been purchased on 1 January 2019 for N$1 200 000 and was thought to have a total useful life of 10 years and a residual value of nil. Thankfully, this happened at night while the building was empty. Tina Limited was also fortunate in that it owned another property three roads away in Independence Avenue. This other property was, at the time, leased to Sandrine Kuame under an operating lease. Sandrine was generally late in paying her lease rentals, and this natural disaster gave Tina Limited a perfect opportunity to evict her with immediate effect so that they could move their factory into the undamaged building. This eviction and relocation was effective 30 June 2019. The building was purchased on 1 January 2019 for N$500 000 Had a fair value of N$950 000 on 30 June 2019; There was no change in fair value at 31 December 2019; and The total estimated useful life is 10 years and the residual value was estimated to be nil. Tina Limited measures: Property, plant and equipment using the cost model; and Investment properties on the fair value model. a) Provide the journal entries to account for all of the above transactions in Tina Limited's financial statements for the year ended 31 December 2019. (18 marks)