Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please list functions You are considering two crowd-funding opportunities. Both are for prospective new personal computer manufacturers, Banana and Pear. Each requires that you to

Please list functions

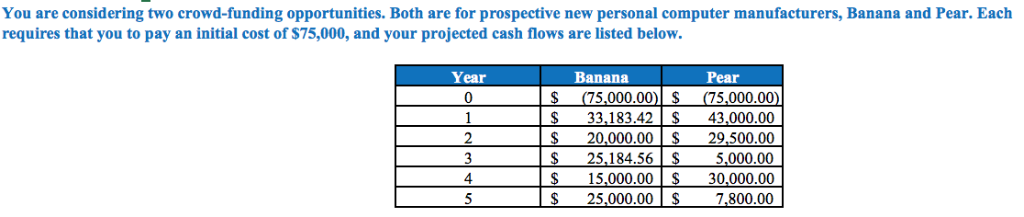

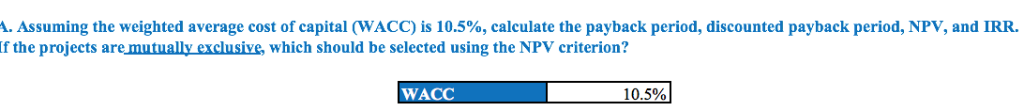

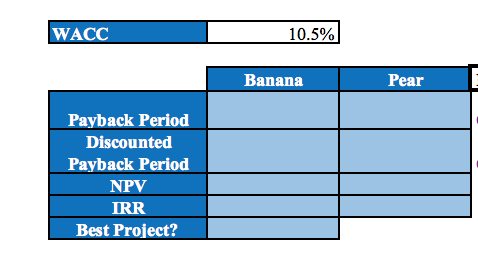

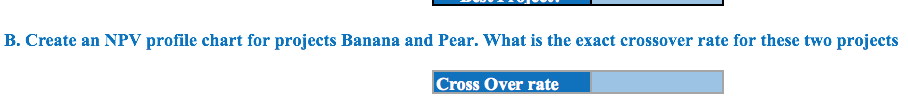

You are considering two crowd-funding opportunities. Both are for prospective new personal computer manufacturers, Banana and Pear. Each requires that you to pay an initial cost of $75,000, and your projected cash flows are listed below. Year Banana Pear (75,000.00)$ 33,183.42$ 20,000.00 $ 25,184.56 $ (75,000.00) 43,000.00 0 2 29,500.00 $ 3 5,000.00 $ 15,000.00 30,000.00 25,000.00 $ 5 7,800.00 A. Assuming the weighted average cost of capital (WACC) is 10.5%, calculate the payback period, discounted payback period, NPV, and IRR. f the projects are mutually exclusive, which should be selected using the NPV criterion? WACC 10.5% WACC 10.5% Banana Pear Payback Period Discounted Payback Period NPV IRR Best Project? B. Create an NPV profile chart for projects Banana and Pear. What is the exact crossover rate for these two projects Cross Over rate WACC NPV Banana NPV Pear 0.0% 1.5% 3.0% 4.5% 6.0% 7.5% 9.0% 10.5% 12.0% 13.5% 15.0% 16.5% 18.0% 19.5% 21.0% 22.5%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started