Answered step by step

Verified Expert Solution

Question

1 Approved Answer

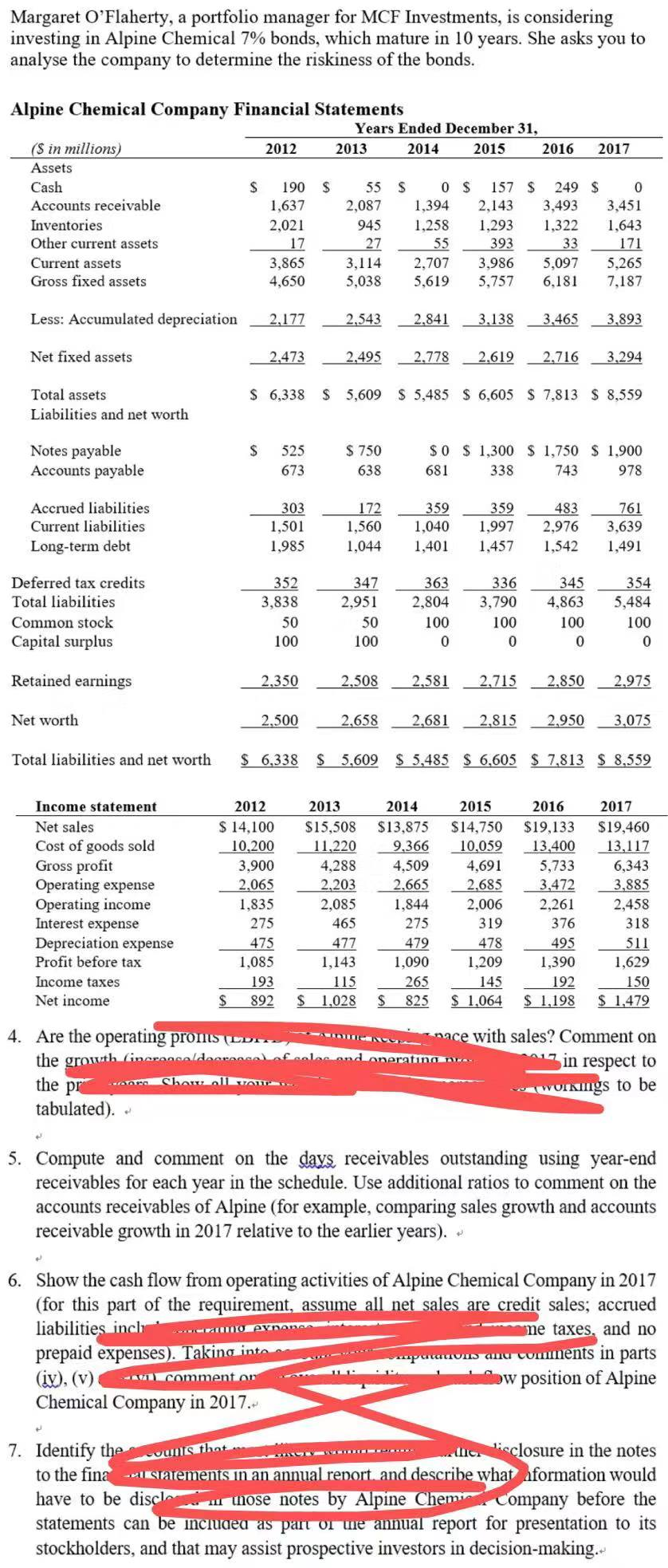

please ONLY anwser question 5 please ONLY anwser question 5 Margaret O'Flaherty, a portfolio manager for MCF Investments, is considering investing in Alpine Chemical 7%

please ONLY anwser question 5

please ONLY anwser question 5

Margaret O'Flaherty, a portfolio manager for MCF Investments, is considering investing in Alpine Chemical 7% bonds, which mature in 10 years. She asks you to analyse the company to determine the riskiness of the bonds. Alpine Chemical Company Financial Statements Years Ended December 31, (S in millions) 2012 2013 2014 2015 2016 2017 Assets Cash $ 190 $ 55 $ 0 $ 157 $ 249 $ 0 Accounts receivable 1,637 2,087 1,394 2,143 3,493 3,451 Inventories 2,021 945 1,258 1,293 1,322 1,643 Other current assets 17 27 55 393 33 171 Current assets 3,865 3,114 2.707 3.986 5,097 5.265 Gross fixed assets 4,650 5,038 5,619 5,757 6,181 7,187 Less: Accumulated depreciation 2,177 2.543 2.841 3,138 3,465 3,893 Net fixed assets 2,473 2,495 2,778 2.619 2,716 3,294 $ 6,338 $ 5,609 $ 5,485 $ 6,605 $ 7,813 $ 8,559 Total assets Liabilities and net worth $ Notes payable Accounts payable 525 673 $ 750 638 $0 $ 1,300 $ 1,750 $ 1,900 681 338 743 978 Accrued liabilities Current liabilities Long-term debt 303172359359483761 1,501 1.560 1.0401.997 2.976 3,639 1,985 1,044 1,401 1,457 1,542 1,491 Deferred tax credits Total liabilities Common stock Capital surplus 352 3,838 50 100 347 363 2,951 2,804 50 100 1000 336 3,790 100 0 0 345 4,863 100 0 354 5,484 100 Retained earnings 2.350 2,500 2,508 2,658 2,581 2,681 2,715 2,815 2,850 2,950 2.975 3,075 Net worth Total liabilities and net worth $ 6,338 $ 5,609 $ 5,485 $ 6,605 $ 7,813 $ 8,559 Income statement Net sales Cost of goods sold Gross profit Operating expense Operating income Interest expense Depreciation expense Profit before tax Income taxes Net income 2012 $ 14,100 10,200 3,900 2,065 1,835 275 475 1,085 2013 $15,508 11,220 4,288 2.203 2,085 465 2014 2015 $13,875 $14,750 9,366 10,059 4.5094,691 2.665 2.685 1,844 2,006 275 319 479 478 1,090 1,209 265 145 $ 825 $ 1,064 2016 $19,133 13,400 5,733 3,472 2,261 376 2017 $19,460 13,117 6,343 - 3,885 2,458 318 511 1,629 150 $ 1,479 477 495 1,143 193 115 1,390 192 $ 1,198 $ 892 $ 1,028 nerating 4. Are the operating pronts DE the growth Cinaranan daarna the pro chawoll Tam tabulated). nace with sales? Comment on 17 in respect to Workings to be 5. Compute and comment on the days, receivables outstanding using year-end receivables for each year in the schedule. Use additional ratios to comment on the accounts receivables of Alpine (for example, comparing sales growth and accounts receivable growth in 2017 relative to the earlier years). 6. Show the cash flow from operating activities of Alpine Chemical Company in 2017 (for this part of the requirement, assume all net sales are credit sales, accrued liabilities incl ... MO YANA e taxes, and no prepaid expenses). Taking into ons and comments in parts (iv), (v) comment on low position of Alpine Chemical Company in 2017. 7. Identify the counts that Melisclosure in the notes to the final statements in an annual report and describe what formation would have to be disclou mose notes by Alpine Chemi Company before the statements can be included as part on me annual report for presentation to its stockholders, and that may assist prospective investors in decision-makingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started