Question: please please please help I'm about to drop the class. last picture of table is for question1 Please help as much as you can, I

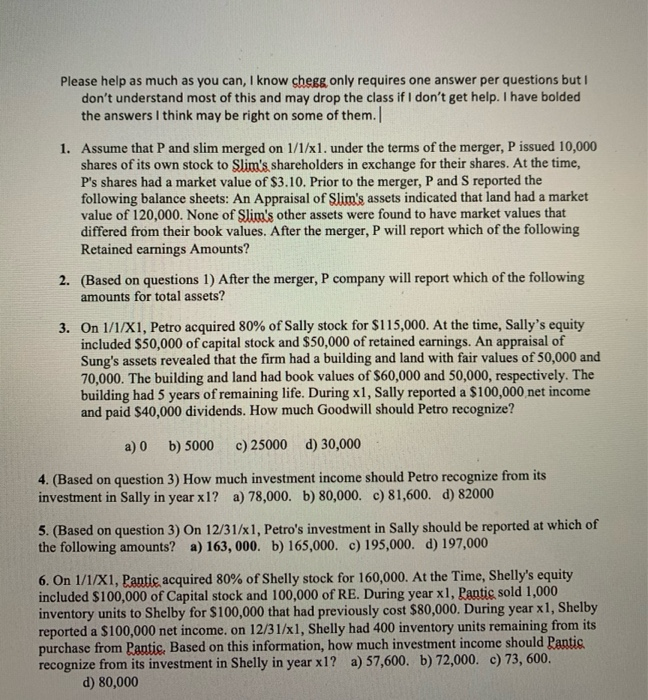

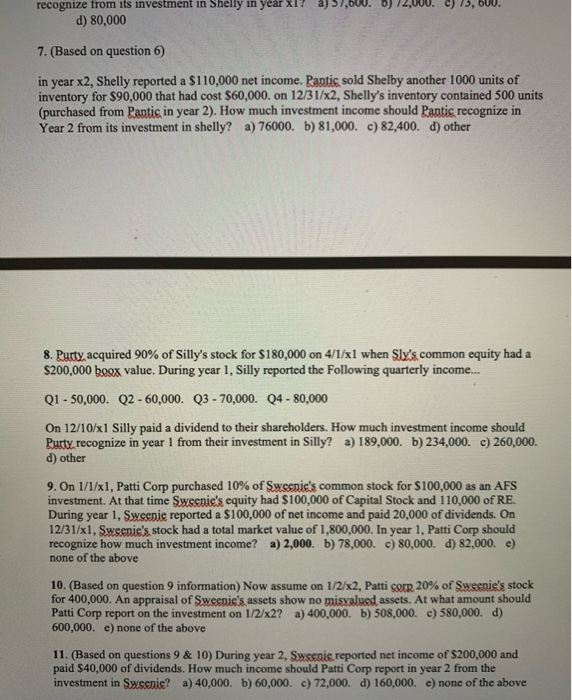

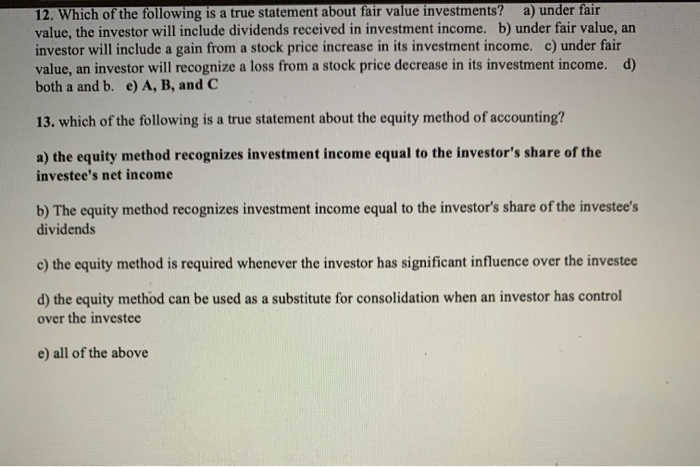

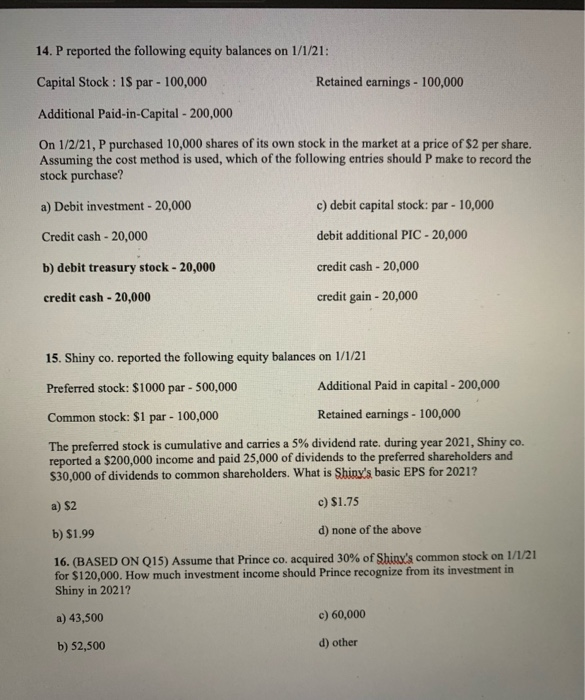

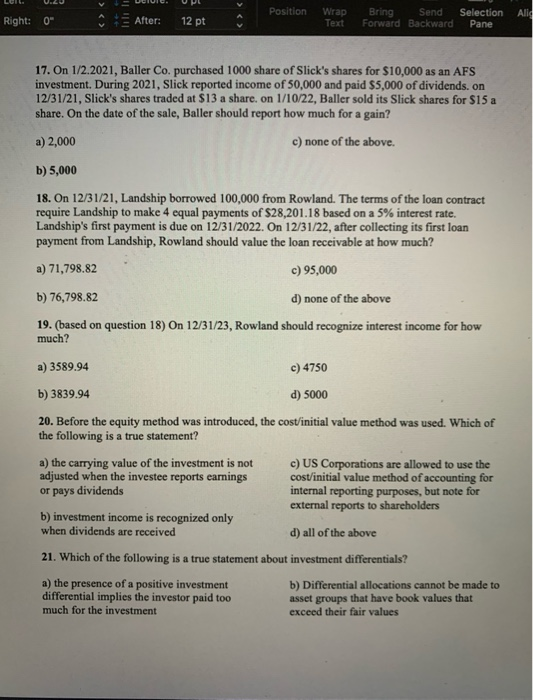

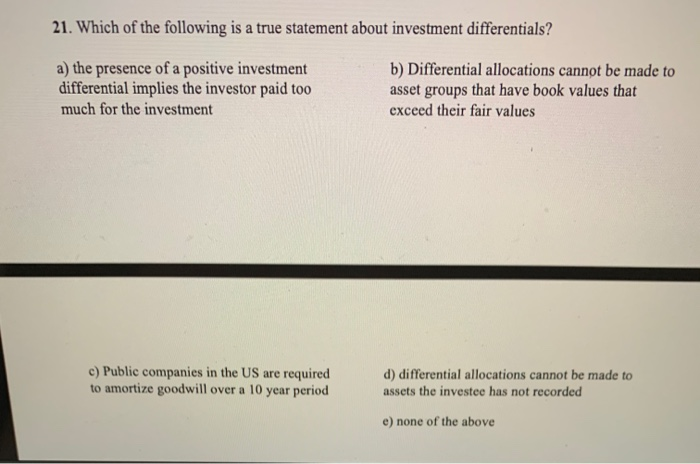

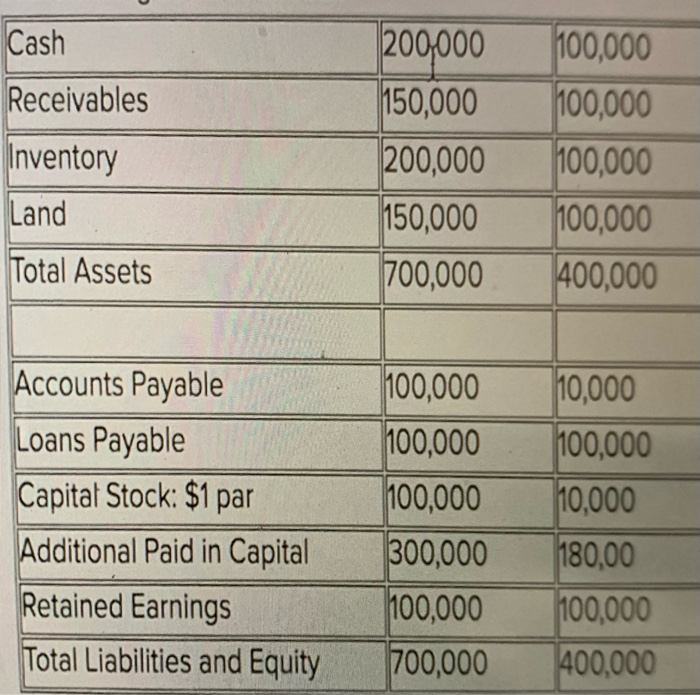

Please help as much as you can, I know chegg only requires one answer per questions but I don't understand most of this and may drop the class if I don't get help. I have bolded the answers I think may be right on some of them.| 1. Assume that P and slim merged on 1/1/x1. under the terms of the merger, P issued 10,000 shares of its own stock to Slim's shareholders in exchange for their shares. At the time, P's shares had a market value of $3.10. Prior to the merger, P and S reported the following balance sheets: An Appraisal of Slim's assets indicated that land had a market value of 120,000. None of Slim's other assets were found to have market values that differed from their book values. After the merger, P will report which of the following Retained earnings Amounts? 2. (Based on questions 1) After the merger, P company will report which of the following amounts for total assets? 3. On 1/1/X1, Petro acquired 80% of Sally stock for $115,000. At the time, Sally's equity included $50,000 of capital stock and $50,000 of retained earnings. An appraisal of Sung's assets revealed that the firm had a building and land with fair values of 50,000 and 70,000. The building and land had book values of $60,000 and 50,000, respectively. The building had 5 years of remaining life. During x1, Sally reported a $100,000 net income and paid $40,000 dividends. How much Goodwill should Petro recognize? a) 0 b) 5000 c) 25000 d) 30,000 4. (Based on question 3) How much investment income should Petro recognize from its investment in Sally in year xl? a) 78,000. b) 80,000. c) 81,600. d) 82000 5. (Based on question 3) On 12/31/x1, Petro's investment in Sally should be reported at which of the following amounts? a) 163, 000. b) 165,000. c) 195,000. d) 197,000 6. On 1/1/X1, Pantic acquired 80% of Shelly stock for 160,000. At the Time, Shelly's equity included $100,000 of Capital stock and 100,000 of RE. During year xl, Pantic sold 1,000 inventory units to Shelby for $100,000 that had previously cost $80,000. During year x1, Shelby reported a $100,000 net income, on 12/31/x1, Shelly had 400 inventory units remaining from its purchase from Pantis. Based on this information, how much investment income should Pantis recognize from its investment in Shelly in year x1? a) 57,600. b) 72,000. c) 73,600. d) 80,000 c) 3, recognize from its investment in Shelly in year d) 80,000 7. (Based on question ) in year x2, Shelly reported a $110,000 net income. Pantic sold Shelby another 1000 units of inventory for $90,000 that had cost $60,000. on 12/31/x2, Shelly's inventory contained 500 units (purchased from Pantic in year 2). How much investment income should Pantic recognize in Year 2 from its investment in shelly? a) 76000. b) 81,000. c) 82,400. d) other 8. Putty acquired 90% of Silly's stock for $180,000 on 4/1/xl when Sly's common equity had a $200,000 boox value. During year 1, Silly reported the following quarterly income... Q1 - 50,000. Q2 - 60,000. Q3 - 70,000. 04 - 80,000 On 12/10/x1 Silly paid a dividend to their shareholders. How much investment income should Purty, recognize in year 1 from their investment in Silly? a) 189,000. b) 234,000. c) 260,000. d) other 9. On 1/1/x1, Patti Corp purchased 10% of Sweenie's common stock for $100,000 as an AFS investment. At that time Sweenie's equity had $100,000 of Capital Stock and 110,000 of RE. During year 1, Sweenie reported a $100,000 of net income and paid 20,000 of dividends. On 12/31/x1, Sweenie's, stock had a total market value of 1,800,000. In year 1, Patti Corp should recognize how much investment income? a) 2,000. b) 78,000. c) 80,000. d) 82,000. e) none of the above 10. (Based on question 9 information) Now assume on 1/2/x2, Patti corr. 20% of Sweenie's stock for 400,000. An appraisal of Sweenie's assets show no misvalued assets. At what amount should Patti Corp report on the investment on 1/2/x2? a) 400,000. b) 508,000. c) 580,000. d) 600,000. e) none of the above 11. (Based on questions 9 & 10) During year 2, Swsenis reported net income of $200,000 and paid $40,000 of dividends. How much income should Patti Corp report in year 2 from the investment in Swsenie? a) 40,000. b) 60,000. c) 72,000. d) 160,000. e) none of the above 12. Which of the following is a true statement about fair value investments? a) under fair value, the investor will include dividends received in investment income. b) under fair value, an investor will include a gain from a stock price increase in its investment income. c) under fair value, an investor will recognize a loss from a stock price decrease in its investment income. d) both a and b. e) A, B, and C 13. which of the following is a true statement about the equity method of accounting? a) the equity method recognizes investment income equal to the investor's share of the investee's net income b) The equity method recognizes investment income equal to the investor's share of the investee's dividends c) the equity method is required whenever the investor has significant influence over the investee d) the equity method can be used as a substitute for consolidation when an investor has control over the investee e) all of the above 14. P reported the following equity balances on 1/1/21: Capital Stock : 18 par - 100,000 Retained earnings - 100,000 Additional Paid-in-Capital - 200,000 On 1/2/21, P purchased 10,000 shares of its own stock in the market at a price of $2 per share. Assuming the cost method is used, which of the following entries should P make to record the stock purchase? a) Debit investment - 20,000 c) debit capital stock: par - 10,000 Credit cash - 20,000 debit additional PIC - 20,000 b) debit treasury stock - 20,000 credit cash - 20,000 credit cash - 20,000 credit gain - 20,000 15. Shiny co. reported the following equity balances on 1/1/21 Preferred stock: $1000 par - 500,000 Additional Paid in capital - 200,000 Common stock: $1 par - 100,000 Retained earnings - 100,000 The preferred stock is cumulative and carries a 5% dividend rate. during year 2021, Shiny co. reported a $200,000 income and paid 25,000 of dividends to the preferred shareholders and $30,000 of dividends to common shareholders. What is Shiny's basic EPS for 2021? a) $2 c) $1.75 b) $1.99 d) none of the above 16. (BASED ON Q15) Assume that Prince co acquired 30% of Shinx's common stock on 1/1/21 for $120,000. How much investment income should Prince recognize from its investment in Shiny in 2021? a) 43,500 c) 60,000 b) 52,500 d) other Position Hili li Right: Alld 0" After: 12 pt Wrap Text Bring Send Forward Backward Selection Pane 17. On 1/2.2021, Baller Co. purchased 1000 share of Slick's shares for $10,000 as an AFS investment. During 2021, Slick reported income of 50,000 and paid $5,000 of dividends. on 12/31/21, Slick's shares traded at $13 a share on 1/10/22, Baller sold its Slick shares for $15 a share. On the date of the sale, Baller should report how much for a gain? a) 2,000 c) none of the above b) 5,000 18. On 12/31/21, Landship borrowed 100,000 from Rowland. The terms of the loan contract require Landship to make 4 equal payments of $28,201.18 based on a 5% interest rate. Landship's first payment is due on 12/31/2022. On 12/31/22, after collecting its first loan payment from Landship, Rowland should value the loan receivable at how much? a) 71,798.82 c) 95,000 b) 76,798.82 d) none of the above 19. (based on question 18) On 12/31/23, Rowland should recognize interest income for how much? a) 3589.94 c) 4750 b) 3839.94 d) 5000 20. Before the equity method was introduced, the cost/initial value method was used. Which of the following is a true statement? a) the carrying value of the investment is not c) US Corporations are allowed to use the adjusted when the investee reports earnings cost/initial value method of accounting for or pays dividends internal reporting purposes, but note for external reports to shareholders b) investment income is recognized only when dividends are received d) all of the above 21. Which of the following is a true statement about investment differentials? a) the presence of a positive investment b) Differential allocations cannot be made to differential implies the investor paid too asset groups that have book values that much for the investment exceed their fair values 21. Which of the following is a true statement about investment differentials? a) the presence of a positive investment b) Differential allocations cannot be made to differential implies the investor paid too asset groups that have book values that much for the investment exceed their fair values c) Public companies in the US are required to amortize goodwill over a 10 year period d) differential allocations cannot be made to assets the investee has not recorded e) none of the above Cash 100,000 Receivables Inventory Land 200,000 ||150,000 200,000 150,000 700,000 100,000 100,000 100,000 400,000 Total Assets 10,000 100,000 Accounts Payable Loans Payable Capital Stock: $1 par Additional Paid in Capital Retained Earnings Total Liabilities and Equity 100,000 100,000 100,000 300,000 100,000 700,000 10,000 180,00 100,000 400,000 Please help as much as you can, I know chegg only requires one answer per questions but I don't understand most of this and may drop the class if I don't get help. I have bolded the answers I think may be right on some of them.| 1. Assume that P and slim merged on 1/1/x1. under the terms of the merger, P issued 10,000 shares of its own stock to Slim's shareholders in exchange for their shares. At the time, P's shares had a market value of $3.10. Prior to the merger, P and S reported the following balance sheets: An Appraisal of Slim's assets indicated that land had a market value of 120,000. None of Slim's other assets were found to have market values that differed from their book values. After the merger, P will report which of the following Retained earnings Amounts? 2. (Based on questions 1) After the merger, P company will report which of the following amounts for total assets? 3. On 1/1/X1, Petro acquired 80% of Sally stock for $115,000. At the time, Sally's equity included $50,000 of capital stock and $50,000 of retained earnings. An appraisal of Sung's assets revealed that the firm had a building and land with fair values of 50,000 and 70,000. The building and land had book values of $60,000 and 50,000, respectively. The building had 5 years of remaining life. During x1, Sally reported a $100,000 net income and paid $40,000 dividends. How much Goodwill should Petro recognize? a) 0 b) 5000 c) 25000 d) 30,000 4. (Based on question 3) How much investment income should Petro recognize from its investment in Sally in year xl? a) 78,000. b) 80,000. c) 81,600. d) 82000 5. (Based on question 3) On 12/31/x1, Petro's investment in Sally should be reported at which of the following amounts? a) 163, 000. b) 165,000. c) 195,000. d) 197,000 6. On 1/1/X1, Pantic acquired 80% of Shelly stock for 160,000. At the Time, Shelly's equity included $100,000 of Capital stock and 100,000 of RE. During year xl, Pantic sold 1,000 inventory units to Shelby for $100,000 that had previously cost $80,000. During year x1, Shelby reported a $100,000 net income, on 12/31/x1, Shelly had 400 inventory units remaining from its purchase from Pantis. Based on this information, how much investment income should Pantis recognize from its investment in Shelly in year x1? a) 57,600. b) 72,000. c) 73,600. d) 80,000 c) 3, recognize from its investment in Shelly in year d) 80,000 7. (Based on question ) in year x2, Shelly reported a $110,000 net income. Pantic sold Shelby another 1000 units of inventory for $90,000 that had cost $60,000. on 12/31/x2, Shelly's inventory contained 500 units (purchased from Pantic in year 2). How much investment income should Pantic recognize in Year 2 from its investment in shelly? a) 76000. b) 81,000. c) 82,400. d) other 8. Putty acquired 90% of Silly's stock for $180,000 on 4/1/xl when Sly's common equity had a $200,000 boox value. During year 1, Silly reported the following quarterly income... Q1 - 50,000. Q2 - 60,000. Q3 - 70,000. 04 - 80,000 On 12/10/x1 Silly paid a dividend to their shareholders. How much investment income should Purty, recognize in year 1 from their investment in Silly? a) 189,000. b) 234,000. c) 260,000. d) other 9. On 1/1/x1, Patti Corp purchased 10% of Sweenie's common stock for $100,000 as an AFS investment. At that time Sweenie's equity had $100,000 of Capital Stock and 110,000 of RE. During year 1, Sweenie reported a $100,000 of net income and paid 20,000 of dividends. On 12/31/x1, Sweenie's, stock had a total market value of 1,800,000. In year 1, Patti Corp should recognize how much investment income? a) 2,000. b) 78,000. c) 80,000. d) 82,000. e) none of the above 10. (Based on question 9 information) Now assume on 1/2/x2, Patti corr. 20% of Sweenie's stock for 400,000. An appraisal of Sweenie's assets show no misvalued assets. At what amount should Patti Corp report on the investment on 1/2/x2? a) 400,000. b) 508,000. c) 580,000. d) 600,000. e) none of the above 11. (Based on questions 9 & 10) During year 2, Swsenis reported net income of $200,000 and paid $40,000 of dividends. How much income should Patti Corp report in year 2 from the investment in Swsenie? a) 40,000. b) 60,000. c) 72,000. d) 160,000. e) none of the above 12. Which of the following is a true statement about fair value investments? a) under fair value, the investor will include dividends received in investment income. b) under fair value, an investor will include a gain from a stock price increase in its investment income. c) under fair value, an investor will recognize a loss from a stock price decrease in its investment income. d) both a and b. e) A, B, and C 13. which of the following is a true statement about the equity method of accounting? a) the equity method recognizes investment income equal to the investor's share of the investee's net income b) The equity method recognizes investment income equal to the investor's share of the investee's dividends c) the equity method is required whenever the investor has significant influence over the investee d) the equity method can be used as a substitute for consolidation when an investor has control over the investee e) all of the above 14. P reported the following equity balances on 1/1/21: Capital Stock : 18 par - 100,000 Retained earnings - 100,000 Additional Paid-in-Capital - 200,000 On 1/2/21, P purchased 10,000 shares of its own stock in the market at a price of $2 per share. Assuming the cost method is used, which of the following entries should P make to record the stock purchase? a) Debit investment - 20,000 c) debit capital stock: par - 10,000 Credit cash - 20,000 debit additional PIC - 20,000 b) debit treasury stock - 20,000 credit cash - 20,000 credit cash - 20,000 credit gain - 20,000 15. Shiny co. reported the following equity balances on 1/1/21 Preferred stock: $1000 par - 500,000 Additional Paid in capital - 200,000 Common stock: $1 par - 100,000 Retained earnings - 100,000 The preferred stock is cumulative and carries a 5% dividend rate. during year 2021, Shiny co. reported a $200,000 income and paid 25,000 of dividends to the preferred shareholders and $30,000 of dividends to common shareholders. What is Shiny's basic EPS for 2021? a) $2 c) $1.75 b) $1.99 d) none of the above 16. (BASED ON Q15) Assume that Prince co acquired 30% of Shinx's common stock on 1/1/21 for $120,000. How much investment income should Prince recognize from its investment in Shiny in 2021? a) 43,500 c) 60,000 b) 52,500 d) other Position Hili li Right: Alld 0" After: 12 pt Wrap Text Bring Send Forward Backward Selection Pane 17. On 1/2.2021, Baller Co. purchased 1000 share of Slick's shares for $10,000 as an AFS investment. During 2021, Slick reported income of 50,000 and paid $5,000 of dividends. on 12/31/21, Slick's shares traded at $13 a share on 1/10/22, Baller sold its Slick shares for $15 a share. On the date of the sale, Baller should report how much for a gain? a) 2,000 c) none of the above b) 5,000 18. On 12/31/21, Landship borrowed 100,000 from Rowland. The terms of the loan contract require Landship to make 4 equal payments of $28,201.18 based on a 5% interest rate. Landship's first payment is due on 12/31/2022. On 12/31/22, after collecting its first loan payment from Landship, Rowland should value the loan receivable at how much? a) 71,798.82 c) 95,000 b) 76,798.82 d) none of the above 19. (based on question 18) On 12/31/23, Rowland should recognize interest income for how much? a) 3589.94 c) 4750 b) 3839.94 d) 5000 20. Before the equity method was introduced, the cost/initial value method was used. Which of the following is a true statement? a) the carrying value of the investment is not c) US Corporations are allowed to use the adjusted when the investee reports earnings cost/initial value method of accounting for or pays dividends internal reporting purposes, but note for external reports to shareholders b) investment income is recognized only when dividends are received d) all of the above 21. Which of the following is a true statement about investment differentials? a) the presence of a positive investment b) Differential allocations cannot be made to differential implies the investor paid too asset groups that have book values that much for the investment exceed their fair values 21. Which of the following is a true statement about investment differentials? a) the presence of a positive investment b) Differential allocations cannot be made to differential implies the investor paid too asset groups that have book values that much for the investment exceed their fair values c) Public companies in the US are required to amortize goodwill over a 10 year period d) differential allocations cannot be made to assets the investee has not recorded e) none of the above Cash 100,000 Receivables Inventory Land 200,000 ||150,000 200,000 150,000 700,000 100,000 100,000 100,000 400,000 Total Assets 10,000 100,000 Accounts Payable Loans Payable Capital Stock: $1 par Additional Paid in Capital Retained Earnings Total Liabilities and Equity 100,000 100,000 100,000 300,000 100,000 700,000 10,000 180,00 100,000 400,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts