Answered step by step

Verified Expert Solution

Question

1 Approved Answer

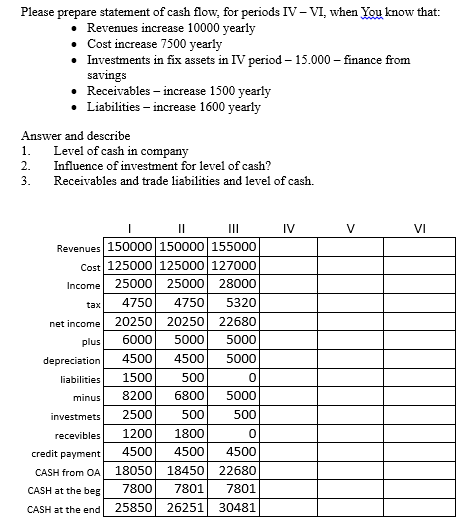

Please prepare statement of cash flow, for periods IV-VI, when You know that: Revenues increase 10000 yearly Cost increase 7500 yearly Investments in fix

Please prepare statement of cash flow, for periods IV-VI, when You know that: Revenues increase 10000 yearly Cost increase 7500 yearly Investments in fix assets in IV period - 15.000 - finance from savings Receivables - increase 1500 yearly Liabilities - increase 1600 yearly Answer and describe 1. 2. 3. Level of cash in company Influence of investment for level of cash? Receivables and trade liabilities and level of cash. || Revenues 150000 150000 155000 Cost 125000 125000| 127000 Income 25000 25000 28000 5320 4750 4750 20250 20250 22680 6000 5000 5000 depreciation 4500 4500 5000 0 5000 500 0 4500 18050 18450 22680 7800 7801 7801 25850 26251 30481 tax net income plus liabilities 1500 500 minus 8200 6800 2500 500 1200 1800 4500 4500 investmets recevibles credit payment CASH from OA CASH at the beg CASH at the end IV V VI

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

606ad56865ca7_49408.pdf

180 KBs PDF File

606ad56865ca7_49408.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started