Answered step by step

Verified Expert Solution

Question

1 Approved Answer

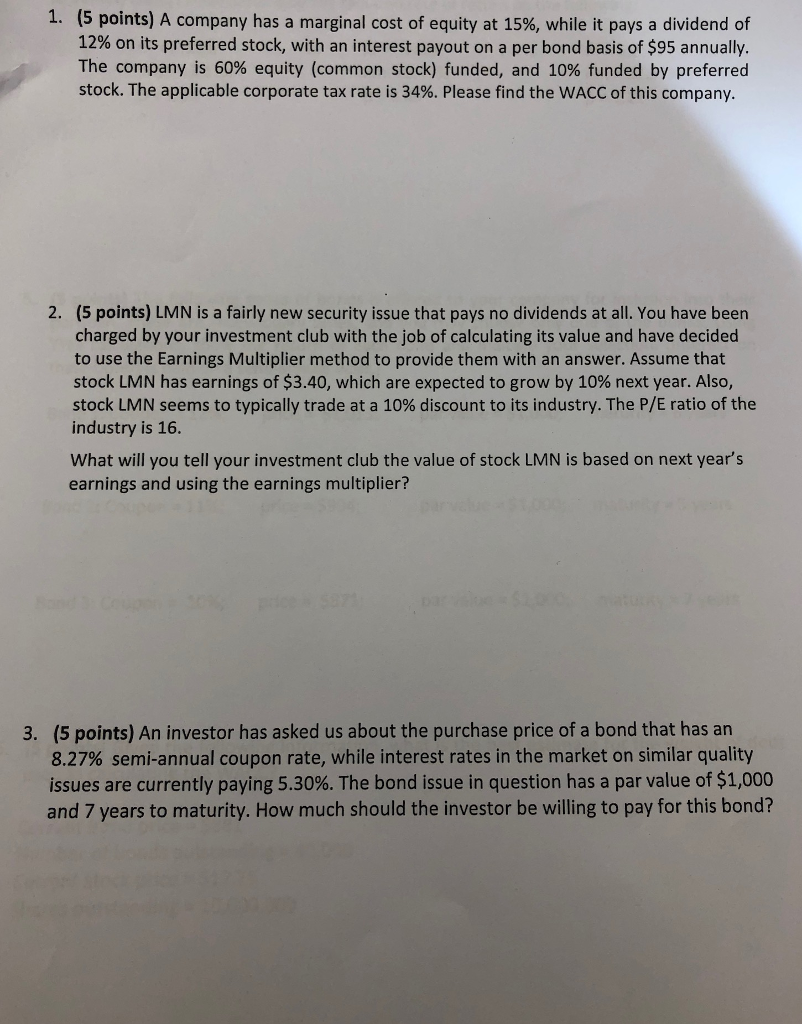

Please provide full answers of all the 3 questions with, financial calculator instructions, and used formulas 1. (5 points) A company has a marginal cost

Please provide full answers of all the 3 questions with, financial calculator instructions, and used formulas

1. (5 points) A company has a marginal cost of equity at 15%, while it pays a dividend of 12% on its preferred stock, with an interest payout on a per bond basis of $95 annually. The company is 60% equity (common stock) funded, and 10% funded by preferred stock. The applicable corporate tax rate is 34%. Please find the WACC of this company. (5 points) LMN is a fairly new security issue that pays no dividends at all. You have been charged by your investment club with the job of calculating its value and have decided to use the Earnings Multiplier method to provide them with an answer. Assume that stock LMN has earnings of $3.40, which are expected to grow by 10% next year. Also, stock LMN seems to typically trade at a 10% discount to its industry. The P/E ratio of the industry is 16. What will you tell your investment club the value of stock LMN is based on next year's earnings and using the earnings multiplier? 2. (5 points) An investor has asked us about the purchase price of a bond that has an 8.27% semi-annual coupon rate, while interest rates in the market on similar quality issues are currently paying 5.30%. The bond issue in question has a par value of $1,000 and 7 years to maturity. How much should the investor be willing to pay for this bond? 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started