please provide the horizontal analysis and the steps

provide the vertical analysis and the steps

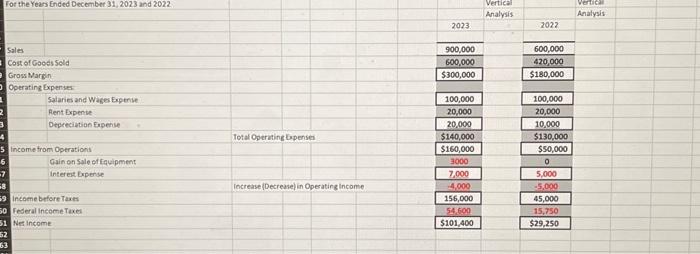

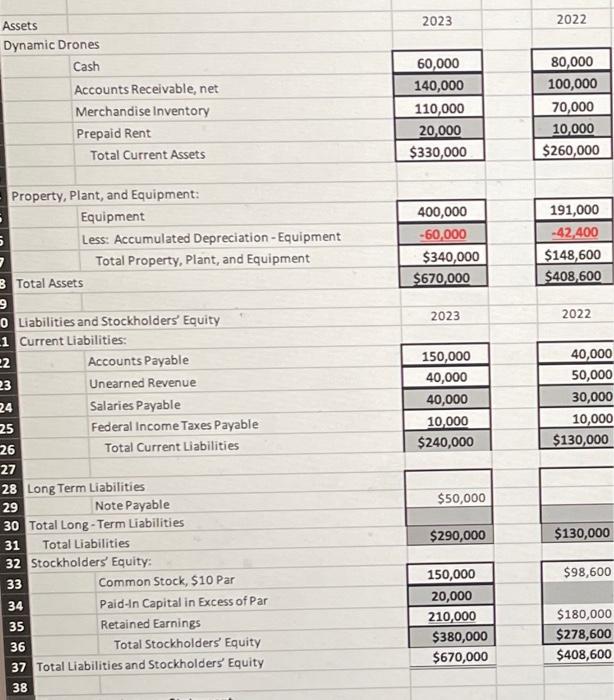

For the Years Ended December 31, 2023 and 2022 Sales Cost of Coods sold Grow Margin. Operating Expenses Salaries and Wakes Expense Rent Expenie Depreciation Expense income from Operations Gain on Sale of fquipment interest bxpense income before Taxes Total Operating bopensed \begin{tabular}{|c|} \hline 900,000 \\ \hline 600,000 \\ \hline 300,000 \\ \hline \end{tabular} \begin{tabular}{|c|} \hline 600,000 \\ \hline 420,000 \\ \hline$180,000 \\ \hline \end{tabular} Anatysis 2023. 2022 rederal income Taxes Nes income \begin{tabular}{|c|c|} \hline Total Operating Gopenses & $140,000 \\ \hline & $160,000 \\ \hline & 3000 \\ \hline & 7,000 \\ \hline Increase (Destease) in Opesating Income & 4,000 \\ \hline & 156,000 \\ \hline & 54,600 \\ \hline & $101,400 \\ \hline \end{tabular} \begin{tabular}{|c|} \hline 100,000 \\ \hline 20,000 \\ \hline 10,000 \\ \hline$130,000 \\ \hline$50,000 \\ \hline 0 \\ \hline 5,000 \\ \hline 5,000 \\ \hline 45,000 \\ \hline 15,750 \\ \hline$29,250 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Assets & & 2023 & 2022 \\ \hline \multicolumn{4}{|c|}{ Dynamic Drones } \\ \hline & Cash & 60,000 & 80,000 \\ \hline & Accounts Receivable, net & 140,000 & 100,000 \\ \hline & Merchandise Inventory & 110,000 & 70,000 \\ \hline & Prepaid Rent & 20,000 & 10,000 \\ \hline & Total Current Assets & $330,000 & $260,000 \\ \hline & & & \\ \hline \multicolumn{4}{|c|}{ Property, Plant, and Equipment: } \\ \hline & Equipment & 400,000 & 191,000 \\ \hline & Less: Accumulated Depreciation - Equipment & 60,000 & 42,400 \\ \hline 5 & Total Property, Plant, and Equipment & $340,000 & $148,600 \\ \hline \multicolumn{2}{|c|}{ Total Assets } & $670,000 & $408,600 \\ \hline 9 & & & \\ \hline \multicolumn{2}{|c|}{ Liabilities and Stockholders Equity } & 2023 & 2022 \\ \hline \multicolumn{4}{|c|}{ Current Liabilities: } \\ \hline 2 & Accounts Payable & 150,000 & 40,000 \\ \hline 3 & Unearned Revenue & 40,000 & 50,000 \\ \hline 24 & Salaries Payable & 40,000 & 30,000 \\ \hline 25 & Federal Income Taxes Payable & 10,000 & 10,000 \\ \hline 26 & Total Current Liabilities & $240,000 & $130,000 \\ \hline 27 & & & \\ \hline 28LO & \multicolumn{3}{|c|}{ Long Term Liabilities } \\ \hline 29 & Note Payable & $50,000 & \\ \hline \multicolumn{4}{|c|}{ Total Long - Term Liabilities } \\ \hline 31 & Liabilities & $290,000 & $130,000 \\ \hline 32St & \multicolumn{3}{|c|}{TotalLiabilitiesStockholdersEquity:} \\ \hline 33 & Common Stock, \$10 Par & 150,000 & $98,600 \\ \hline 34 & Paid-In Capital in Excess of Par & 20,000 & \\ \hline 35 & Retained Earnings & 210,000 & $180,000 \\ \hline 36 & Total Stockholders' Equity & $380,000 & $278,600 \\ \hline 37T & Total Liabilities and Stockholders' Equity & $670,000 & $408,600 \\ \hline 38 & & & \\ \hline \end{tabular}