Answered step by step

Verified Expert Solution

Question

1 Approved Answer

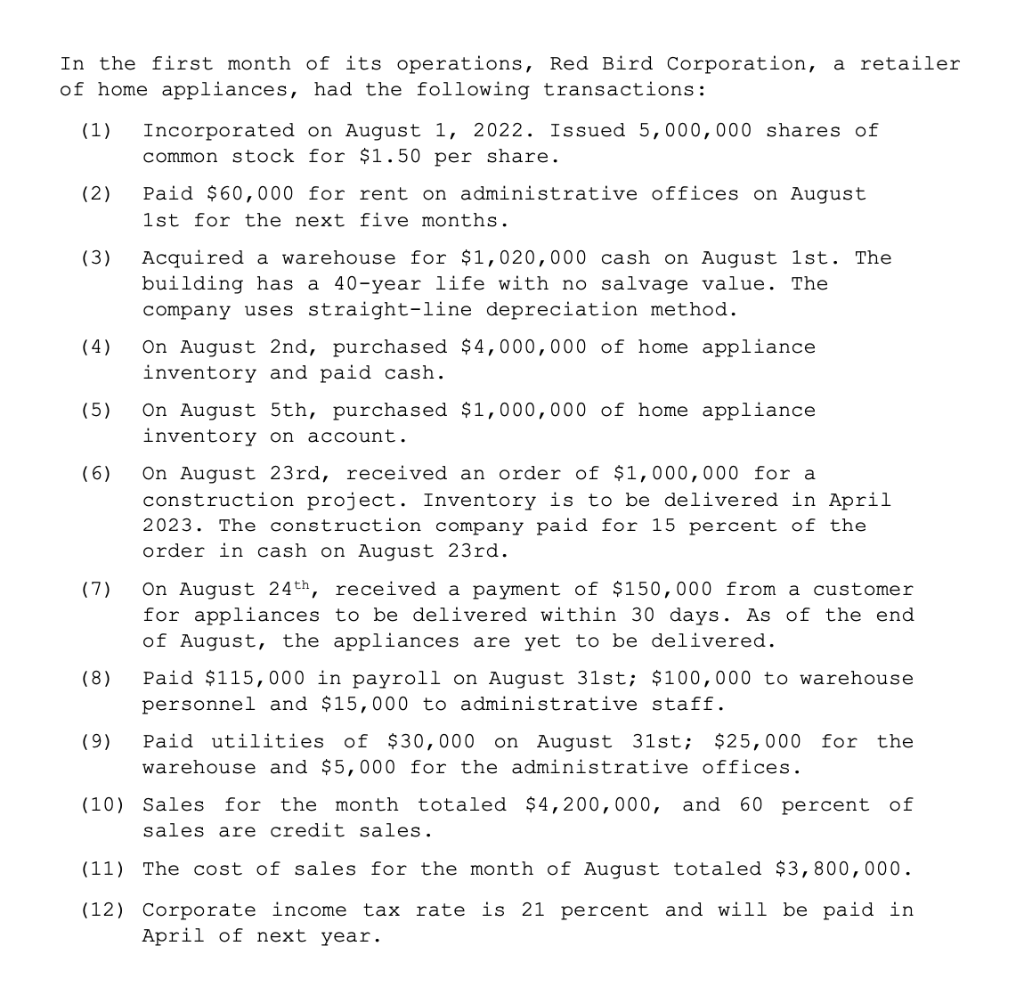

Please respond to 1.2.3.4.5.6 or as many as you can using the 2nd photo 1. Analyze and record the transactions for the first month of

Please respond to 1.2.3.4.5.6 or as many as you can using the 2nd photo

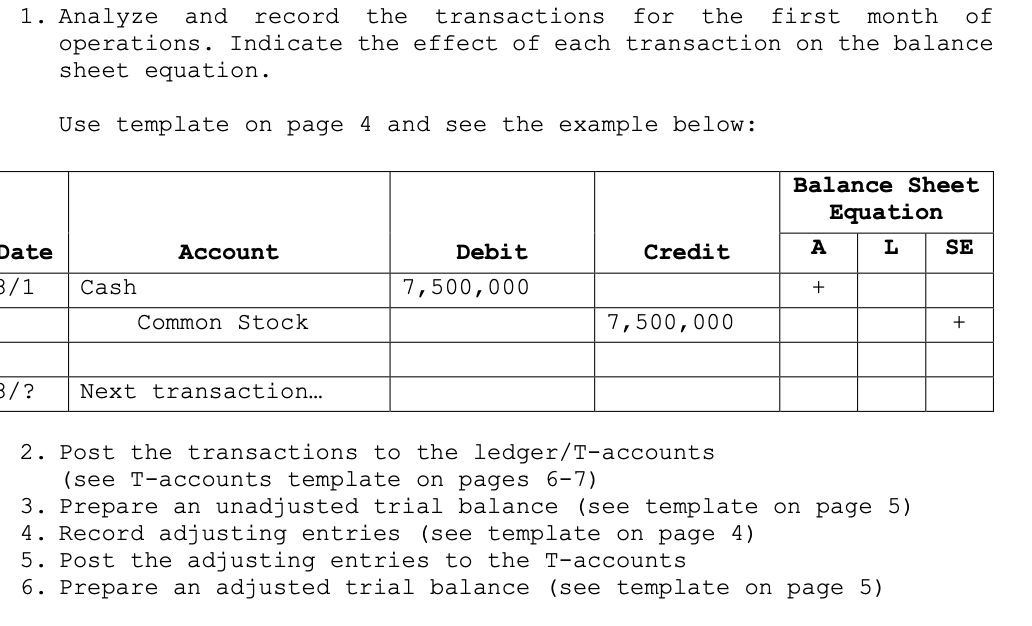

1. Analyze and record the transactions for the first month of operations. Indicate the effect of each transaction on the balance sheet equation. Use template on page 4 and see the example below: 2. Post the transactions to the ledger/T-accounts (see T-accounts template on pages 6-7) 3. Prepare an unadjusted trial balance (see template on page 5) 4. Record adjusting entries (see template on page 4) 5. Post the adjusting entries to the Taccounts 6. Prepare an adjusted trial balance (see template on page 5) In the first month of its operations, Red Bird Corporation, a retaile of home appliances, had the following transactions: (1) Incorporated on August 1, 2022. Issued 5,000,000 shares of common stock for $1.50 per share. (2) Paid $60,000 for rent on administrative offices on August 1st for the next five months. (3) Acquired a warehouse for $1,020,000 cash on August 1st. The building has a 40-year life with no salvage value. The company uses straight-line depreciation method. (4) On August 2nd, purchased $4,000,000 of home appliance inventory and paid cash. (5) On August 5th, purchased $1,000,000 of home appliance inventory on account. (6) On August 23rd, received an order of $1,000,000 for a construction project. Inventory is to be delivered in April 2023. The construction company paid for 15 percent of the order in cash on August 23rd. (7) On August 24th, received a payment of $150,000 from a customer for appliances to be delivered within 30 days. As of the end of August, the appliances are yet to be delivered. (8) Paid $115,000 in payroll on August 31st; $100,000 to warehouse personnel and $15,000 to administrative staff. (9) Paid utilities of $30,000 on August 31 st; $25,000 for the warehouse and $5,000 for the administrative offices. (10) Sales for the month totaled $4,200,000, and 60 percent of sales are credit sales. (11) The cost of sales for the month of August totaled $3,800,000. (12) Corporate income tax rate is 21 percent and will be paid in April of next yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started