Answered step by step

Verified Expert Solution

Question

1 Approved Answer

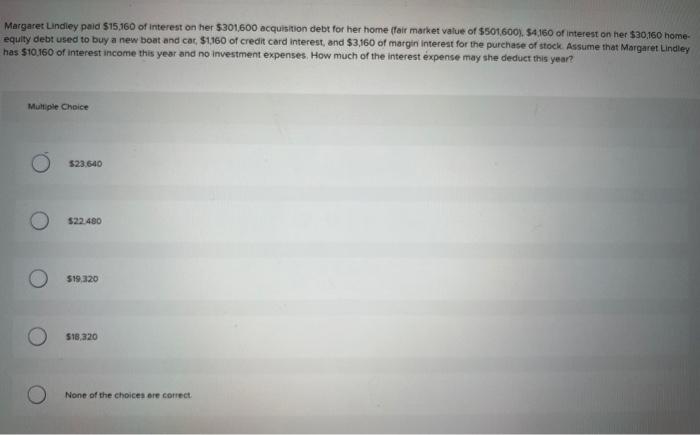

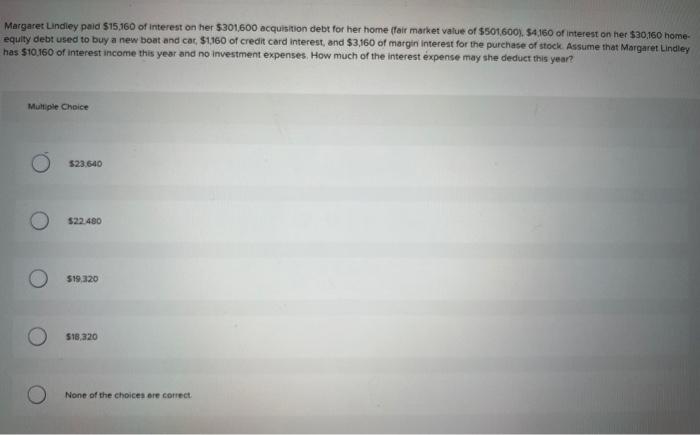

please respond to these 3 questions! Margaret Lindley paid $15,160 of interest on her $301,600 acquisition debt for her home ffair market value of $501,600).

please respond to these 3 questions!

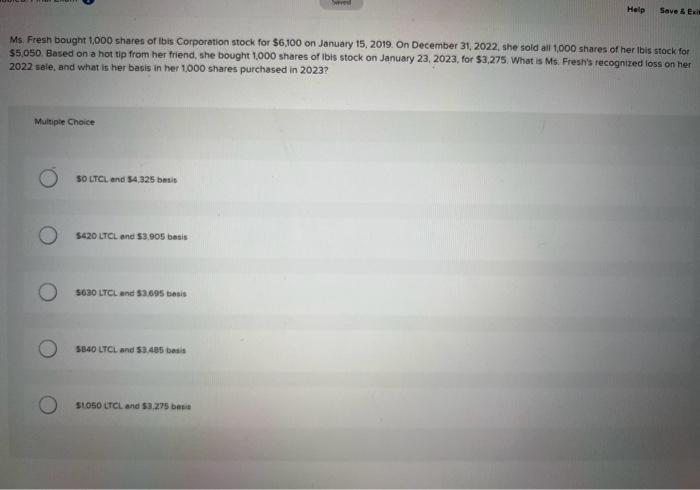

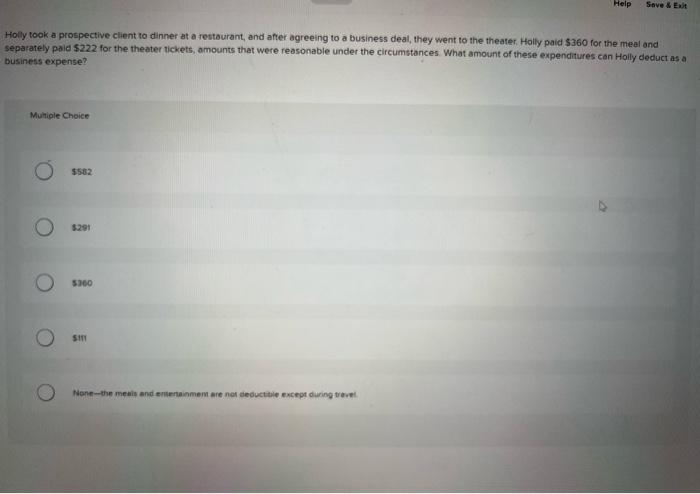

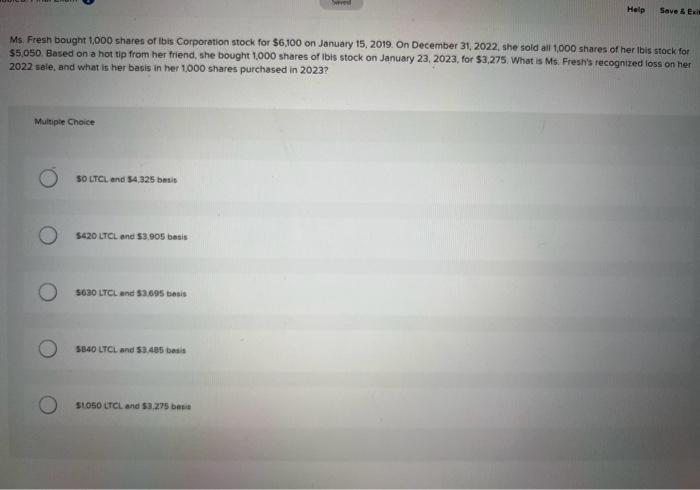

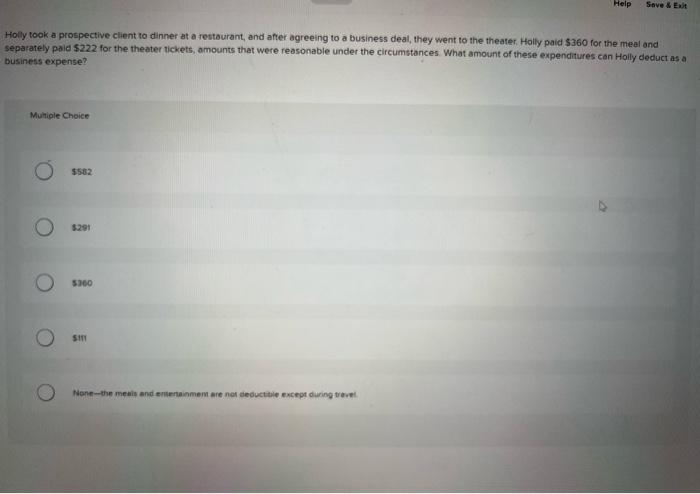

Margaret Lindley paid $15,160 of interest on her $301,600 acquisition debt for her home ffair market value of $501,600). 54,160 of interest on her $30,160 homeequily debt used to buy a new boat and cat, $1,160 of credit card interest, and $3,160 of margin interest for the purehase of stock. Assume that Margaret Lindley has $10.160 of interest income this year and no investment expenses. How much of the interest expense may she deduct this year? Multipie Choice $23.640 522.480 519.320 518,320 None of the choices ere collect. Ms. Fresh bought 1,000 shares of ibis Corporation stock for $6,100 on January 15,2019 . On December 31, 2022, she sold all 1,000 shares of her lbis stock for \$5,050. Based on a hot tip from her friend, she bought 1,000 shares of lbis stock on January 23, 2023, for $3,275. What is M5. Fresh's recognized loss on her 2022 sale, and what is her basis in her 1.000 shares purchased in 2023 ? Multupie Choice 50 LTCL and $4,325 besis \$420 LTCL and $3.905 besis 5630 LTCL and 53695 besis SB4OLTCL and S: 485 besis sto50 LtCL and 53,235 bee: Holly took a prospective client to dinner at a restourant, and after agreeing to a business deal, they went to the theater. Holly paid 3360 for the meal and separately paid $222 for the theater tickets, amounts that were reasonable under the circumstances What amount of these expenditures can Holly deduct as a business expense? Mutripie Choice 5562 1201 5360 5111 None-the meiis andi ertienainmem mre not deductite except during trerel Margaret Lindley paid $15,160 of interest on her $301,600 acquisition debt for her home ffair market value of $501,600). 54,160 of interest on her $30,160 homeequily debt used to buy a new boat and cat, $1,160 of credit card interest, and $3,160 of margin interest for the purehase of stock. Assume that Margaret Lindley has $10.160 of interest income this year and no investment expenses. How much of the interest expense may she deduct this year? Multipie Choice $23.640 522.480 519.320 518,320 None of the choices ere collect. Ms. Fresh bought 1,000 shares of ibis Corporation stock for $6,100 on January 15,2019 . On December 31, 2022, she sold all 1,000 shares of her lbis stock for \$5,050. Based on a hot tip from her friend, she bought 1,000 shares of lbis stock on January 23, 2023, for $3,275. What is M5. Fresh's recognized loss on her 2022 sale, and what is her basis in her 1.000 shares purchased in 2023 ? Multupie Choice 50 LTCL and $4,325 besis \$420 LTCL and $3.905 besis 5630 LTCL and 53695 besis SB4OLTCL and S: 485 besis sto50 LtCL and 53,235 bee: Holly took a prospective client to dinner at a restourant, and after agreeing to a business deal, they went to the theater. Holly paid 3360 for the meal and separately paid $222 for the theater tickets, amounts that were reasonable under the circumstances What amount of these expenditures can Holly deduct as a business expense? Mutripie Choice 5562 1201 5360 5111 None-the meiis andi ertienainmem mre not deductite except during trerel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started