Please short simple format

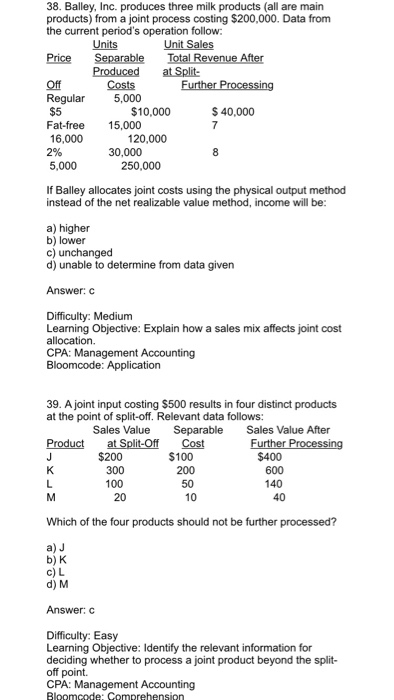

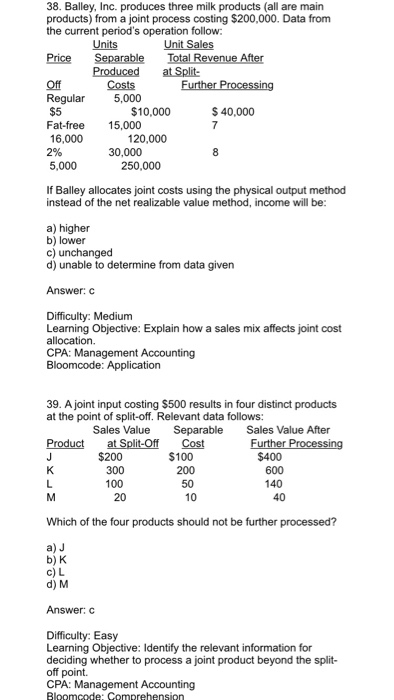

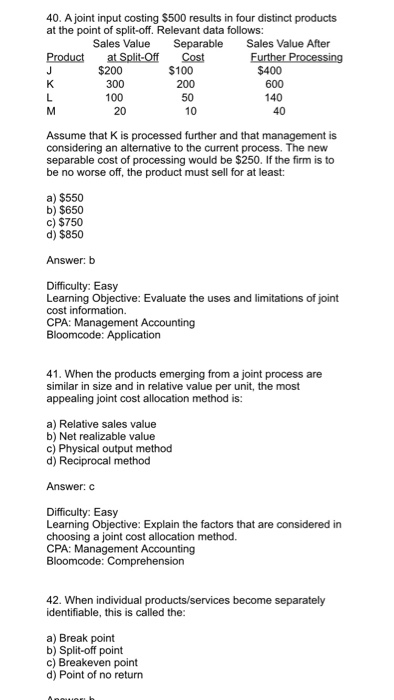

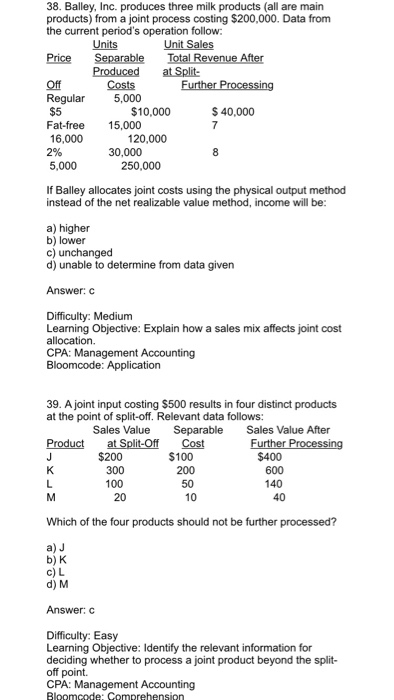

38. Balley, Inc. produces three milk products (all are main products) from a joint process costing $200,000. Data from the current period's operation follow: Produced at Split- Regular 5,000 $5 Fat-free 15,000 16,000 $10,000 $ 40,000 120,000 30,000 5,000 250,000 If Balley allocates joint costs using the physical output method instead of the net realizable value method, income will be: a) higher b) lower d) unable to determine from data given Answer:c Difficulty: Medium Learning Objective: Explain how a sales mix affects joint cost allocation. CPA: Management Accounting 39. A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows: Sales Value Separable Sales Value After Product at Split-Off Cost $200 300 100 20 $100 200 50 $400 600 140 Which of the four products should not be further processed? a) J b) K c) L d) M Answer: Difficulty: Easy Learning Objective: lIdentify the relevant information for deciding whether to process a joint product beyond the split- off point. 40. A joint input costing $500 results in four distinct products at the point of split-off. Relevant data follows: Sales Value Separable Sales Value After Product at Split-Off Cost $200 300 100 20 $100 200 50 10 400 600 140 40 Assume that K is processed further and that management is considering an alternative to the current process. The new separable cost of processing would be $250. If the firm is to be no worse off, the product must sell for at least: a) $550 b) $650 c) $750 d) $850 Answer: b Difficulty: Easy Learning Objective: Evaluate the uses and limitations of joint cost information. 41. When the products emerging from a joint process are similar in size and in relative value per unit, the most appealing joint cost allocation method is: a) Relative sales value b) Net realizable value c) Physical output method d) Reciprocal methood Answer: C Difficulty: Easy Learning Objective: Explain the factors that are considered in choosing a joint cost allocation method. CPA: Management Accounting 42. When individual products/services become separately identifiable, this is called the: a) Break point b) Split-off point c) Breakeven point d) Point of no return