Answered step by step

Verified Expert Solution

Question

1 Approved Answer

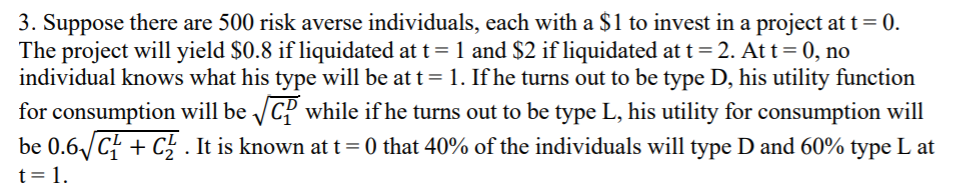

Please show all working out and reasonings thank you. 3. Suppose there are 500 risk averse individuals, each with a $1 to invest in a

Please show all working out and reasonings thank you.

3. Suppose there are 500 risk averse individuals, each with a $1 to invest in a project at t= 0. The project will yield $0.8 if liquidated at t= 1 and $2 if liquidated at t= 2. At t=0, no individual knows what his type will be at t= 1. If he turns out to be type D, his utility function for consumption will be C while if he turns out to be type L, his utility for consumption will be 0.61C1 + CZ. It is known at t=0 that 40% of the individuals will type D and 60% type L at t=1. (i) (iii) (10 marks) Consider a case with no banks. Each individual invests in his own project. Find the expected utility of an individual in this case. (10 marks) Now, suppose a bank is introduced who offers deposit contracts to consumers. A bank promises to pay $1 for withdrawals at t=1, and $X for withdrawals at t=2. How many projects will the bank have to be liquidate to satisfy t= 1 withdrawals? (10 marks) Assume the banking market is competitive so that the bank makes zero profits. What is the value of X the bank can promise to pay to depositors who withdraw at t=2? (10) What is the expected utility of consumers if they choose to invest their funds in the bank? Compare what you found with the value of the expected utility you found in (i); explain. (iv) 3. Suppose there are 500 risk averse individuals, each with a $1 to invest in a project at t= 0. The project will yield $0.8 if liquidated at t= 1 and $2 if liquidated at t= 2. At t=0, no individual knows what his type will be at t= 1. If he turns out to be type D, his utility function for consumption will be C while if he turns out to be type L, his utility for consumption will be 0.61C1 + CZ. It is known at t=0 that 40% of the individuals will type D and 60% type L at t=1. (i) (iii) (10 marks) Consider a case with no banks. Each individual invests in his own project. Find the expected utility of an individual in this case. (10 marks) Now, suppose a bank is introduced who offers deposit contracts to consumers. A bank promises to pay $1 for withdrawals at t=1, and $X for withdrawals at t=2. How many projects will the bank have to be liquidate to satisfy t= 1 withdrawals? (10 marks) Assume the banking market is competitive so that the bank makes zero profits. What is the value of X the bank can promise to pay to depositors who withdraw at t=2? (10) What is the expected utility of consumers if they choose to invest their funds in the bank? Compare what you found with the value of the expected utility you found in (i); explain. (iv)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started