Answered step by step

Verified Expert Solution

Question

1 Approved Answer

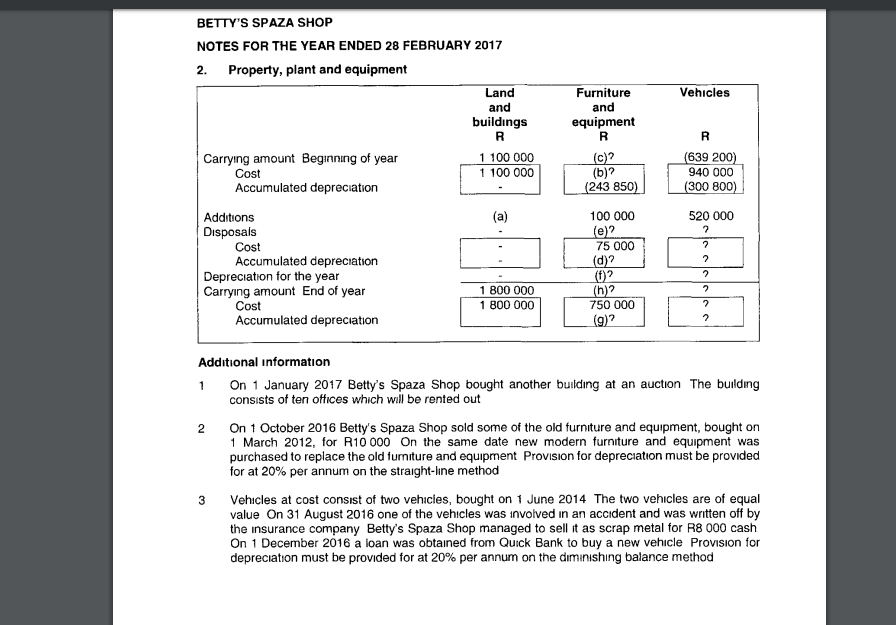

please show and explain how you got your answers please BETTY'S SPAZA SHOP NOTES FOR THE YEAR ENDED 28 FEBRUARY 2017 2. Property, plant and

please show and explain how you got your answers please

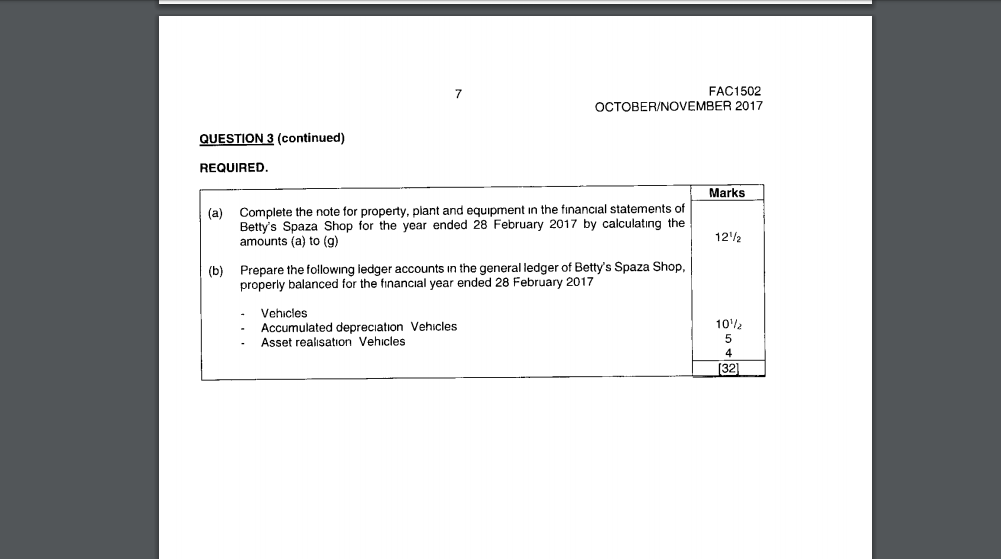

BETTY'S SPAZA SHOP NOTES FOR THE YEAR ENDED 28 FEBRUARY 2017 2. Property, plant and equipment Vehicles Land and buildings Furniture and equipment Carrying amount Beginning of year Cost Accumulated depreciation 1 100 000 1 100 000 c)? (b)? (639 200) 940 000 (300 800) (243 850) 520 000 100 000 le) 75 000 (d)? Additions Disposals Cost Accumulated depreciation Depreciation for the year Carrying amount End of year Cost Accumulated depreciation (t)? 1 800 000 1 800 000 (b)? 750 000 (9)? Additional information On 1 January 2017 Betty's Spaza Shop bought another building at an auction The building consists of ten offices which will be rented out On 1 October 2016 Betty's Spaza Shop sold some of the old furniture and equipment, bought on 1 March 2012, for R10 000 On the same date new modern furniture and equipment was purchased to replace the old furniture and equipment Provision for depreciation must be provided for at 20% per annum on the straight-line method Vehicles at cost consist of two vehicles, bought on 1 June 2014 The two vehicles are of equal value On 31 August 2016 one of the vehicles was involved in an accident and was written off by the insurance company Betty's Spaza Shop managed to sell it as scrap metal for R8 000 cash On 1 December 2016 a loan was obtained from Quick Bank to buy a new vehicle Provision for depreciation must be provided for at 20% per annum on the diminishing balance method FAC1502 OCTOBER/NOVEMBER 2017 QUESTION 3 (continued) REQUIRED Marks (a) Complete the note for property, plant and equipment in the financial statements of Betty's Spaza Shop for the year ended 28 February 2017 by calculating the amounts (a) to (9) 12/2 (b) Prepare the following ledger accounts in the general ledger of Betty's Spaza Shop, properly balanced for the financial year ended 28 February 2017 - . . Vehicles Accumulated depreciation Vehicles Asset realisation Vehicles 1012 (32)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started