Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show calculation work as well! Thankyou!!! Leander Office Products Inc. produces and sells small storage and organizational products for office use. During the first

Please show calculation work as well! Thankyou!!!

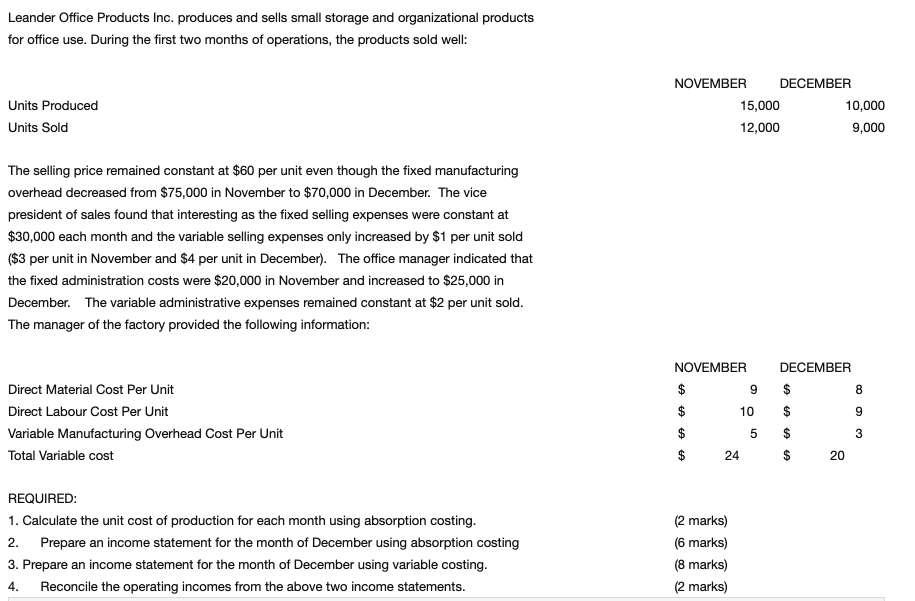

Leander Office Products Inc. produces and sells small storage and organizational products for office use. During the first two months of operations, the products sold well: NOVEMBER DECEMBER Units Produced 15,000 10,000 Units Sold 12,000 9,000 The selling price remained constant at $60 per unit even though the fixed manufacturing overhead decreased from $75,000 in November to $70,000 in December. The vice president of sales found that interesting as the fixed selling expenses were constant at $30,000 each month and the variable selling expenses only increased by $1 per unit sold ($3 per unit in November and $4 per unit in December). The office manager indicated that the fixed administration costs were $20,000 in November and increased to $25,000 in December. The variable administrative expenses remained constant at $2 per unit sold. The manager of the factory provided the following information: NOVEMBER DECEMBER Direct Material Cost Per Unit $ 9 $ $ 8 Direct Labour Cost Per Unit 10 $ 9 A A A A Variable Manufacturing Overhead Cost Per Unit 5 3 Total Variable cost 24 20 REQUIRED: 1. Calculate the unit cost of production for each month using absorption costing. 2. Prepare an income statement for the month of December using absorption costing 3. Prepare an income statement for the month of December using variable costing. 4. Reconcile the operating incomes from the above two income statements. (2 marks) (6 marks) (8 marks) (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started