please show formulas and work . please put in excel format

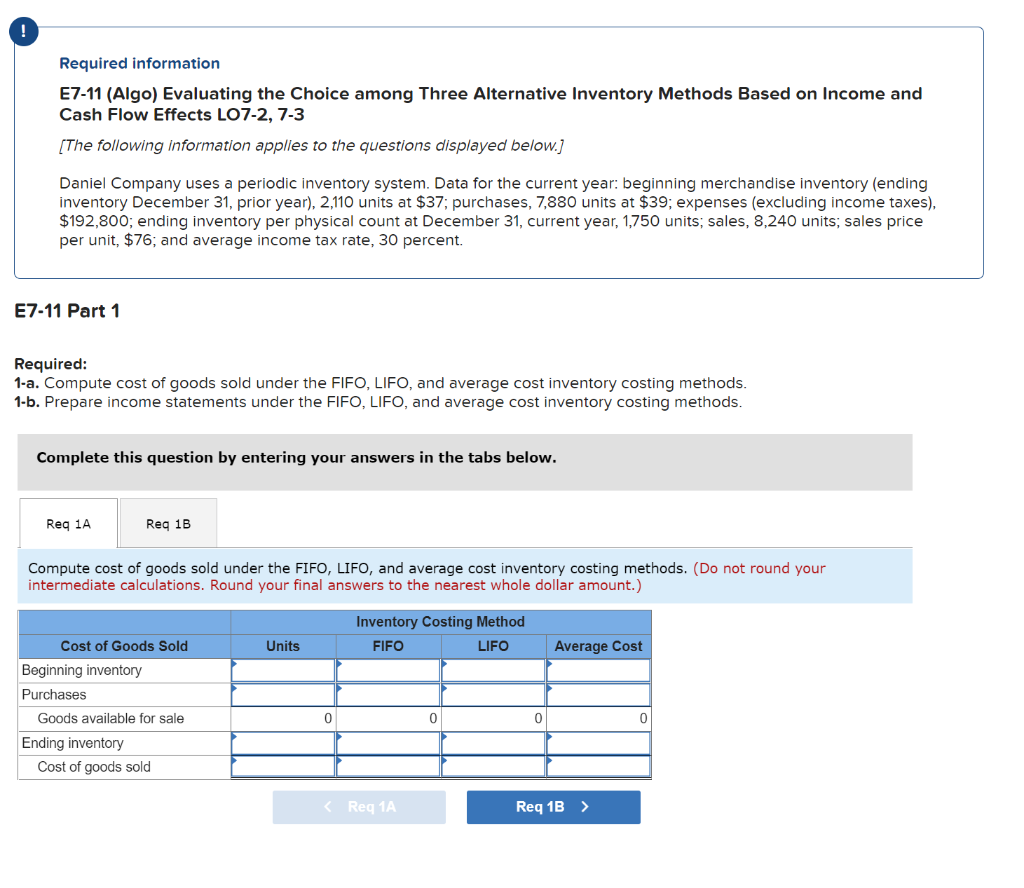

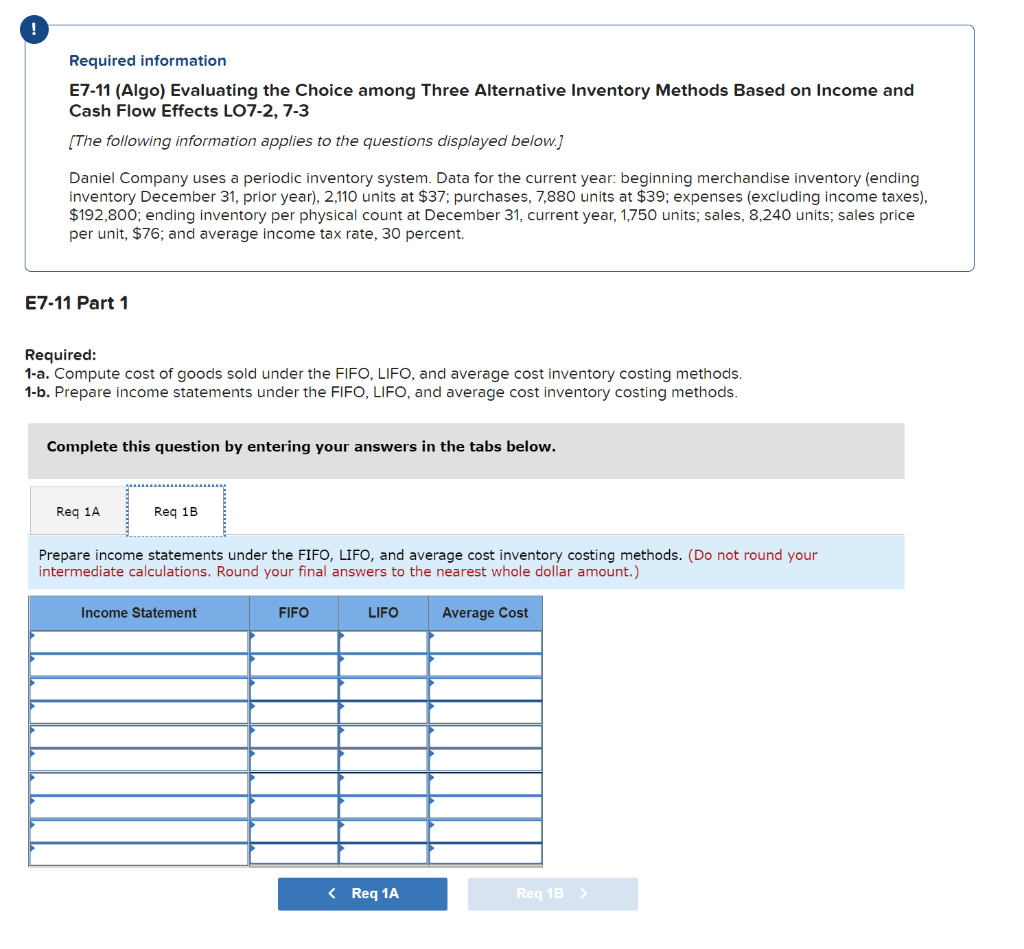

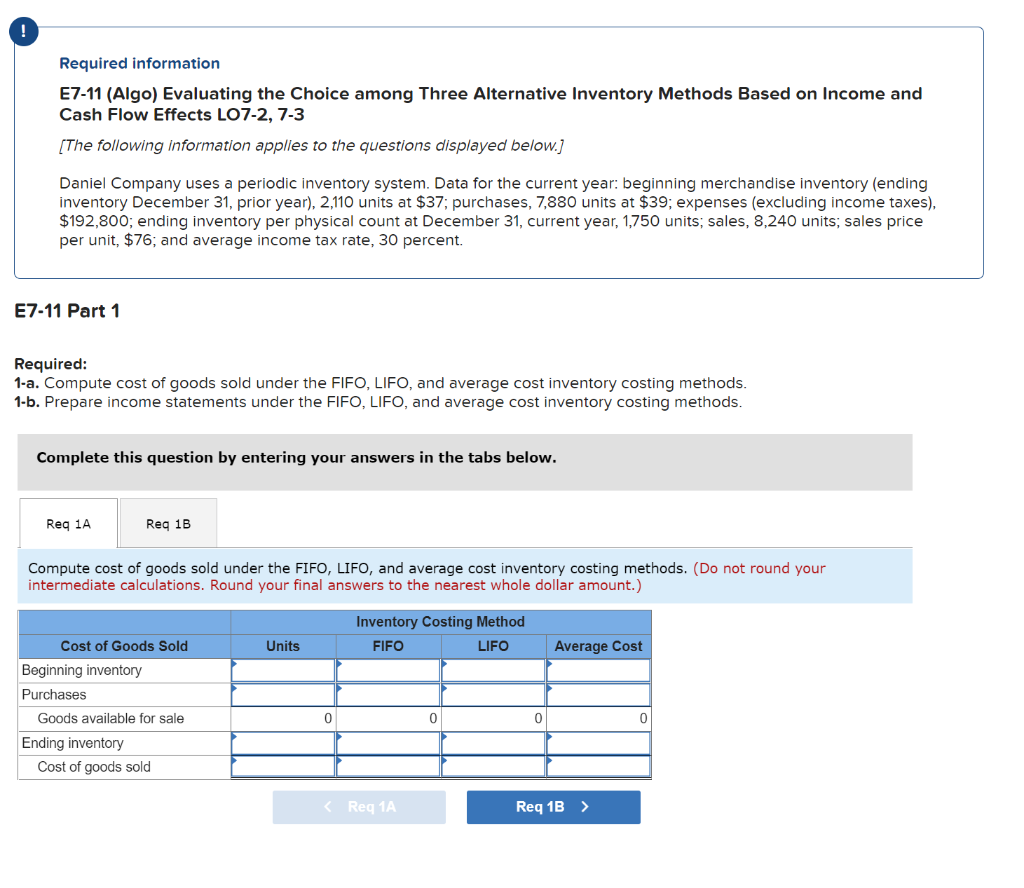

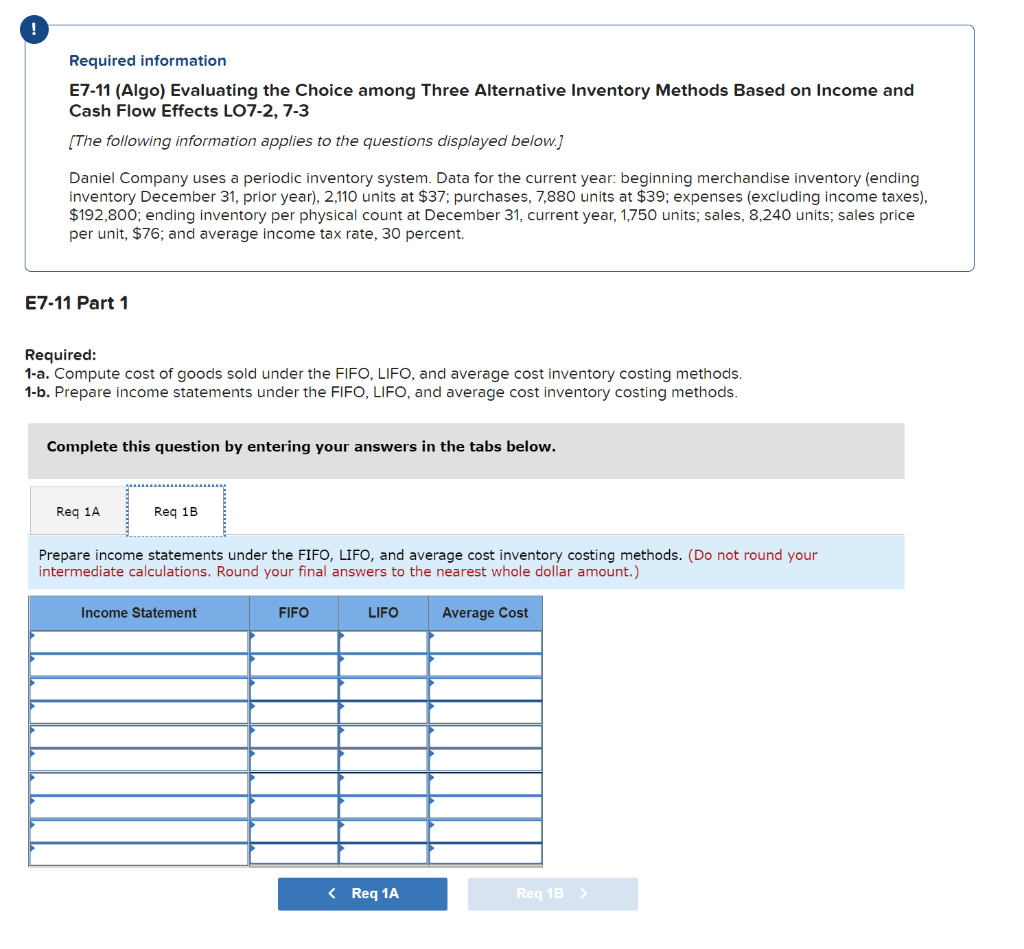

Required information E7-11 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Income and Cash Flow Effects LO7-2, 7-3 [The following information applies to the questions displayed below. Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending inventory December 31, prior year), 2,110 units at $37; purchases, 7,880 units at $39; expenses (excluding income taxes), $192,800; ending inventory per physical count at December 31, current year, 1,750 units, sales, 8,240 units, sales price per unit, $76, and average income tax rate, 30 percent. E7-11 Part 1 Required: 1-a. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. 1-b. Prepare income statements under the FIFO, LIFO, and average cost inventory costing methods. Complete this question by entering your answers in the tabs below. Req 1A Reg 1B Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. (Do not round your intermediate calculations. Round your final answers to the nearest whole dollar amount.) Inventory Costing Method FIFO LIFO Cost of Goods Sold Units Average Cost Beginning inventory Purchases Goods available for sale Ending inventory Cost of goods sold 0 0 0 0 Reg 1A Req 1B > ! Required information E7-11 (Algo) Evaluating the Choice among Three Alternative Inventory Methods Based on Income and Cash Flow Effects LO7-2, 7-3 (The following information applies to the questions displayed below.] Daniel Company uses a periodic inventory system. Data for the current year: beginning merchandise inventory (ending inventory December 31, prior year), 2,110 units at $37; purchases, 7,880 units at $39; expenses (excluding income taxes), $192,800; ending inventory per physical count at December 31, current year, 1,750 units, sales, 8,240 units; sales price per unit, $76; and average income tax rate, 30 percent. E7-11 Part 1 Required: 1-a. Compute cost of goods sold under the FIFO, LIFO, and average cost inventory costing methods. 1-b. Prepare income statements under the FIFO, LIFO, and average cost inventory costing methods. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Prepare income statements under the FIFO, LIFO, and average cost inventory costing methods. (Do not round your intermediate calculations. Round your final answers to the nearest whole dollar amount.) Income Statement FIFO LIFO Average Cost