Answered step by step

Verified Expert Solution

Question

1 Approved Answer

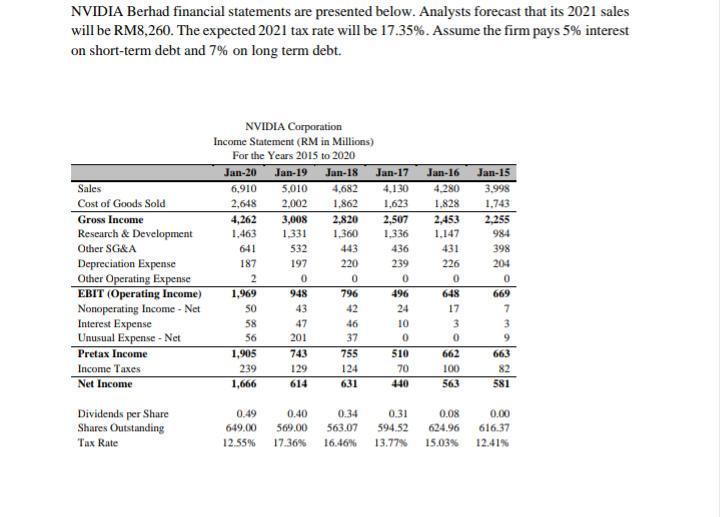

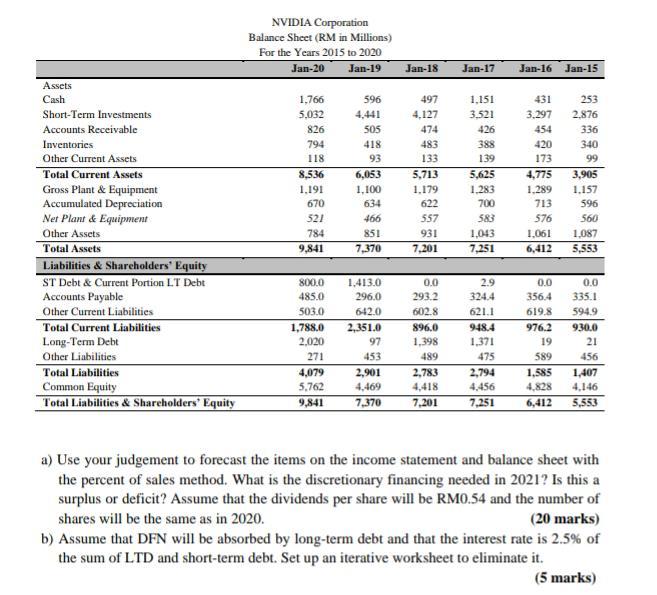

please show how to do in excel and show the formula one by one NVIDIA Berhad financial statements are presented below. Analysts forecast that its

please show how to do in excel and show the formula one by one

NVIDIA Berhad financial statements are presented below. Analysts forecast that its 2021 sales will be RM8,260. The expected 2021 tax rate will be 17.35%. Assume the firm pays 5% interest on short-term debt and 7% on long term debt. Jan-15 3.998 1,743 Sales Cost of Goods Sold Gross Income Research & Development Other SG&A Depreciation Expense Other Operating Expense EBIT (Operating Income) Nonoperating Income - Net Interest Expense Unusual Expense - Net Pretax Income Income Taxes Net Income NVIDIA Corporation Income Statement (RM in Millions) For the Years 2015 to 2020 Jan-20 Jan-19 Jan-18 Jan-17 6,910 5,010 4.682 4,130 2,648 2,002 1.862 1.623 4,262 3,008 2,820 2,507 1.463 1.331 1,360 1.336 641 532 443 436 187 197 220 239 2 0 0 0 1.969 948 796 496 50 43 42 24 58 47 46 10 56 201 37 0 1,905 743 755 510 239 129 124 70 1,666 614 631 440 Jan-16 4.280 1.828 2,453 1.147 431 226 0 648 17 3 0 662 100 563 2,255 984 398 204 0 669 7 3 9 663 82 581 Dividends per Share Shares Outstanding Tax Rate 0.49 649.00 0.40 569.00 0.34 563.07 0.31 594.52 0.08 624.96 0.00 616.37 12.41% 12.55% 17.36% 16.46% 13.77% 15.03% NVIDIA Corporation Balance Sheet (RM in Millions) For the Years 2015 to 2020 Jan-20 Jan-19 Jan-18 Jan-17 Jan-16 Jan-13 596 Assets Cash Short-Term Investments Accounts Receivable Inventories Other Current Assets Total Current Assets Gross Plant & Equipment Accumulated Depreciation Net Plant & Equipment Other Assets Total Assets Liabilities & Shareholders' Equity ST Debt & Current Portion LT Debt Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Other Liabilities Total Liabilities Common Equity Total Liabilities & Shareholders' Equity 1,766 5,032 826 794 118 8,536 1.191 670 521 784 9,841 50S 418 93 6,053 1.100 634 466 851 497 4,127 474 483 133 5,713 1.179 622 557 931 7,201 1.151 3,521 426 388 139 5,625 1.283 700 583 1,043 7,251 431 3.297 454 420 173 4.775 1.289 713 576 1.061 6,412 253 2.876 336 340 99 3,905 1.157 596 560 1,087 5,553 7,370 0.0 0.0 800.0 485.0 503.0 1,788.0 2,020 271 4,079 5,762 9,841 1.413.0 296.0 642.0 2,351.0 97 453 2,901 4.469 7,370 293.2 602.8 896.0 1.398 489 2.9 324.4 621.1 9-48.4 1,371 475 2,794 4,456 356.4 619.8 976.2 19 589 1,585 4.828 6,412 0.0 335.1 594.9 9.30.0 21 456 1,407 4,146 5,553 2,783 4,418 7,201 7,251 a) Use your judgement to forecast the items on the income statement and balance sheet with the percent of sales method. What is the discretionary financing needed in 2021? Is this a surplus or deficit? Assume that the dividends per share will be RM0.54 and the number of shares will be the same as in 2020. (20 marks) b) Assume that DFN will be absorbed by long-term debt and that the interest rate is 2.5% of the sum of LTD and short-term debt. Set up an iterative worksheet to eliminate it. (5 marks) NVIDIA Berhad financial statements are presented below. Analysts forecast that its 2021 sales will be RM8,260. The expected 2021 tax rate will be 17.35%. Assume the firm pays 5% interest on short-term debt and 7% on long term debt. Jan-15 3.998 1,743 Sales Cost of Goods Sold Gross Income Research & Development Other SG&A Depreciation Expense Other Operating Expense EBIT (Operating Income) Nonoperating Income - Net Interest Expense Unusual Expense - Net Pretax Income Income Taxes Net Income NVIDIA Corporation Income Statement (RM in Millions) For the Years 2015 to 2020 Jan-20 Jan-19 Jan-18 Jan-17 6,910 5,010 4.682 4,130 2,648 2,002 1.862 1.623 4,262 3,008 2,820 2,507 1.463 1.331 1,360 1.336 641 532 443 436 187 197 220 239 2 0 0 0 1.969 948 796 496 50 43 42 24 58 47 46 10 56 201 37 0 1,905 743 755 510 239 129 124 70 1,666 614 631 440 Jan-16 4.280 1.828 2,453 1.147 431 226 0 648 17 3 0 662 100 563 2,255 984 398 204 0 669 7 3 9 663 82 581 Dividends per Share Shares Outstanding Tax Rate 0.49 649.00 0.40 569.00 0.34 563.07 0.31 594.52 0.08 624.96 0.00 616.37 12.41% 12.55% 17.36% 16.46% 13.77% 15.03% NVIDIA Corporation Balance Sheet (RM in Millions) For the Years 2015 to 2020 Jan-20 Jan-19 Jan-18 Jan-17 Jan-16 Jan-13 596 Assets Cash Short-Term Investments Accounts Receivable Inventories Other Current Assets Total Current Assets Gross Plant & Equipment Accumulated Depreciation Net Plant & Equipment Other Assets Total Assets Liabilities & Shareholders' Equity ST Debt & Current Portion LT Debt Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Other Liabilities Total Liabilities Common Equity Total Liabilities & Shareholders' Equity 1,766 5,032 826 794 118 8,536 1.191 670 521 784 9,841 50S 418 93 6,053 1.100 634 466 851 497 4,127 474 483 133 5,713 1.179 622 557 931 7,201 1.151 3,521 426 388 139 5,625 1.283 700 583 1,043 7,251 431 3.297 454 420 173 4.775 1.289 713 576 1.061 6,412 253 2.876 336 340 99 3,905 1.157 596 560 1,087 5,553 7,370 0.0 0.0 800.0 485.0 503.0 1,788.0 2,020 271 4,079 5,762 9,841 1.413.0 296.0 642.0 2,351.0 97 453 2,901 4.469 7,370 293.2 602.8 896.0 1.398 489 2.9 324.4 621.1 9-48.4 1,371 475 2,794 4,456 356.4 619.8 976.2 19 589 1,585 4.828 6,412 0.0 335.1 594.9 9.30.0 21 456 1,407 4,146 5,553 2,783 4,418 7,201 7,251 a) Use your judgement to forecast the items on the income statement and balance sheet with the percent of sales method. What is the discretionary financing needed in 2021? Is this a surplus or deficit? Assume that the dividends per share will be RM0.54 and the number of shares will be the same as in 2020. (20 marks) b) Assume that DFN will be absorbed by long-term debt and that the interest rate is 2.5% of the sum of LTD and short-term debt. Set up an iterative worksheet to eliminate it

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started