Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show me the EXCEL calculations to answer the Question Marks in PART C only. I REPEAT SHOW ME THE EXCEL CALCULATIONS FOR PERIODS 2-5

Please show me the EXCEL calculations to answer the Question Marks in PART C only. I REPEAT SHOW ME THE EXCEL CALCULATIONS FOR PERIODS 2-5 in PART C.

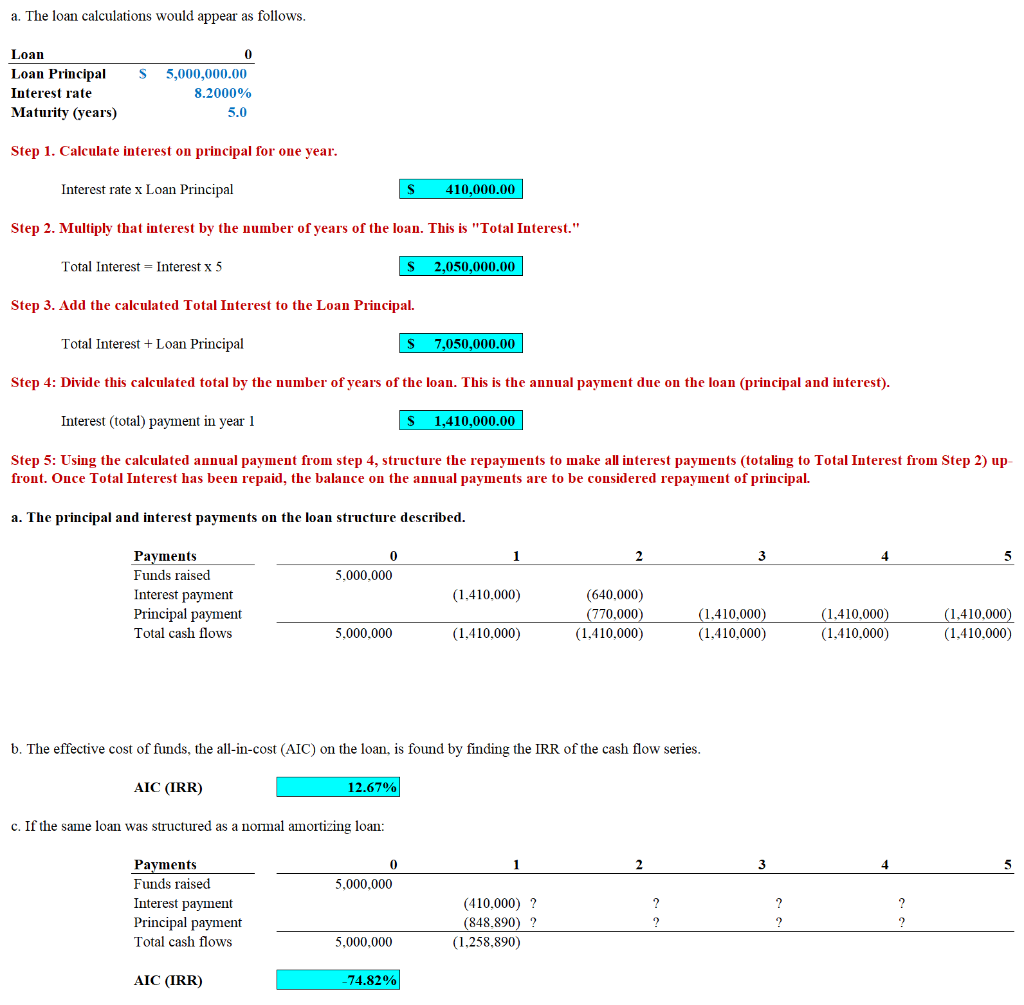

a. The loan calculations would appear as follows. 0 S Loan Loan Principal Interest rate Maturity (years) 5,000,000.00 8.2000% 5.0 Step 1. Calculate interest on principal for one year. Interest rate x Loan Principal S 410,000.00 Step 2. Multiply that interest by the number of years of the loan. This is "Total Interest." Total Interest - Interest x 5 S 2,050,000.00 Step 3. Add the calculated Total Interest to the Loan Principal. Total Interest + Loan Principal 7,050,000.00 Step 4: Divide this calculated total by the number of years of the loan. This is the annual payment due on the loan (principal and interest). Interest (total) payment in year 1 1,410,000.00 Step 5: Using the calculated annual payment from step 4, structure the repayments to make all interest payments (totaling to Total Interest from Step 2) up front. Once Total Interest has been repaid, the balance on the annual payments are to be considered repayment of principal. a. The principal and interest payments on the loan structure described. 3 4 0 5.000.000 Payments Funds raised Interest payment Principal payment Total cash flows (1,410,000) (640,000) (770,000) (1,410,000) (1,410,000) (1,410,000) (1,410,000) (1.410,000) (1,410.000) (1,410,000) 5,000,000 (1.410,000) b. The effective cost of funds, the all-in-cost (AIC) on the loan, is found by finding the IRR of the cash flow series. AIC (IRR) 12.67% c. If the same loan was structured as a normal amortizing loan: 0 2 3 4 5,000,000 Payments Funds raised Interest payment Principal payment Total cash flows (410,000) ? (848.890) ? (1.258,890) ? ? ... 5,000,000 AIC (IRR) -74.82%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started