Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work 14. In its production facilities for picture frames, Take A Picture pays the following wages $1,750 to employees who repair production facility

Please show work

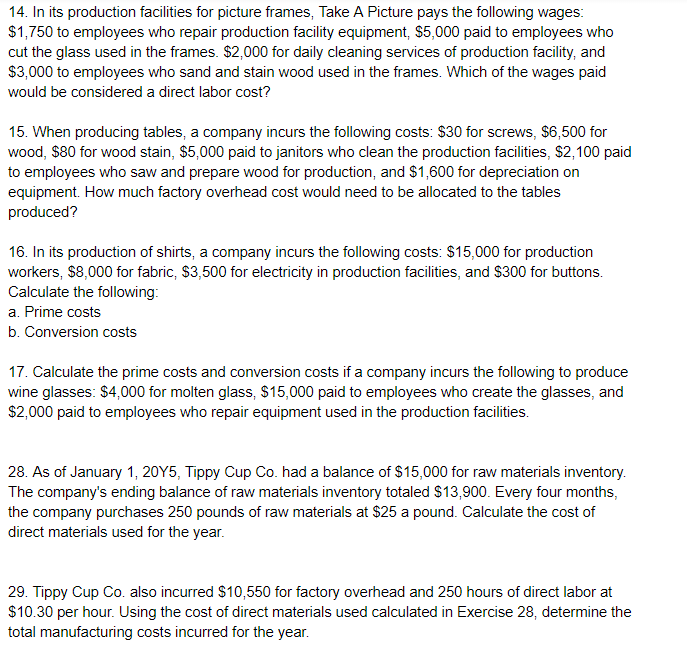

14. In its production facilities for picture frames, Take A Picture pays the following wages $1,750 to employees who repair production facility equipment, S5,000 paid to employees who cut the glass used in the frames. $2,000 for daily cleaning services of production facility, and $3,000 to employees who sand and stain wood used in the frames. Which of the wages paid would be considered a direct labor cost? 15. When producing tables, a company incurs the following costs: $30 for screws, $6,500 for wood, $80 for wood stain, $5,000 paid to janitors who clean the production facilities, $2,100 paid to employees who saw and prepare wood for production, and $1,600 for depreciation on equipment. How much factory overhead cost would need to be allocated to the tables produced? 16. In its production of shirts, a company incurs the following costs: $15,000 for production workers, $8,000 for fabric, $3,500 for electricity in production facilities, and $300 for buttons. Calculate the following a. Prime costs b. Conversion costs 17. Calculate the prime costs and conversion costs if a company incurs the following to produce wine glasses: $4,000 for molten glass, $15,000 paid to employees who create the glasses, and $2,000 paid to employees who repair equipment used in the production facilities 28. As of January 1, 20Y5, Tippy Cup Co. had a balance of $15,000 for raw materials inventory. The company's ending balance of raw materials inventory totaled $13,900. Every four months, the company purchases 250 pounds of raw materials at $25 a pound. Calculate the cost of direct materials used for the year. 29. Tippy Cup Co. also incurred $10,550 for factory overhead and 250 hours of direct labor at $10.30 per hour. Using the cost of direct materials used calculated in Exercise 28, determine the total manufacturing costs incurred for the year. 14. In its production facilities for picture frames, Take A Picture pays the following wages $1,750 to employees who repair production facility equipment, S5,000 paid to employees who cut the glass used in the frames. $2,000 for daily cleaning services of production facility, and $3,000 to employees who sand and stain wood used in the frames. Which of the wages paid would be considered a direct labor cost? 15. When producing tables, a company incurs the following costs: $30 for screws, $6,500 for wood, $80 for wood stain, $5,000 paid to janitors who clean the production facilities, $2,100 paid to employees who saw and prepare wood for production, and $1,600 for depreciation on equipment. How much factory overhead cost would need to be allocated to the tables produced? 16. In its production of shirts, a company incurs the following costs: $15,000 for production workers, $8,000 for fabric, $3,500 for electricity in production facilities, and $300 for buttons. Calculate the following a. Prime costs b. Conversion costs 17. Calculate the prime costs and conversion costs if a company incurs the following to produce wine glasses: $4,000 for molten glass, $15,000 paid to employees who create the glasses, and $2,000 paid to employees who repair equipment used in the production facilities 28. As of January 1, 20Y5, Tippy Cup Co. had a balance of $15,000 for raw materials inventory. The company's ending balance of raw materials inventory totaled $13,900. Every four months, the company purchases 250 pounds of raw materials at $25 a pound. Calculate the cost of direct materials used for the year. 29. Tippy Cup Co. also incurred $10,550 for factory overhead and 250 hours of direct labor at $10.30 per hour. Using the cost of direct materials used calculated in Exercise 28, determine the total manufacturing costs incurred for the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started