Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show work and steps The Toronto Maple Laughs unexpectedly announced that they will reduce next year's annual dividend to $1.75 from the $3 they

Please show work and steps

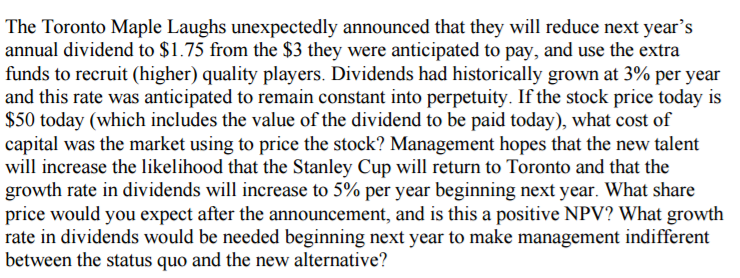

The Toronto Maple Laughs unexpectedly announced that they will reduce next year's annual dividend to $1.75 from the $3 they were anticipated to pay, and use the extra funds to recruit (higher) quality players. Dividends had historically grown at 3% per year and this rate was anticipated to remain constant into perpetuity. If the stock price today is $50 today (which includes the value of the dividend to be paid today), what cost of capital was the market using to price the stock? Management hopes that the new talent will increase the likelihood that the Stanley Cup will return to Toronto and that the growth rate in dividends will increase to 5% per year beginning next year. What share price would you expect after the announcement, and is this a positive NPV? What growth rate in dividends would be needed beginning next year to make management indifferent between the status quo and the new alternative

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started