Question

PLEASE SHOW WORK FOR EVERYTHING!! Financial statement data of Greatland Engineering include the following items: Cash $26,000 Accounts payable $107,000 Short-term investments 36,000 Accrued liabilities

PLEASE SHOW WORK FOR EVERYTHING!!

Financial statement data of Greatland Engineering include the following items:

Financial statement data of Greatland Engineering include the following items:

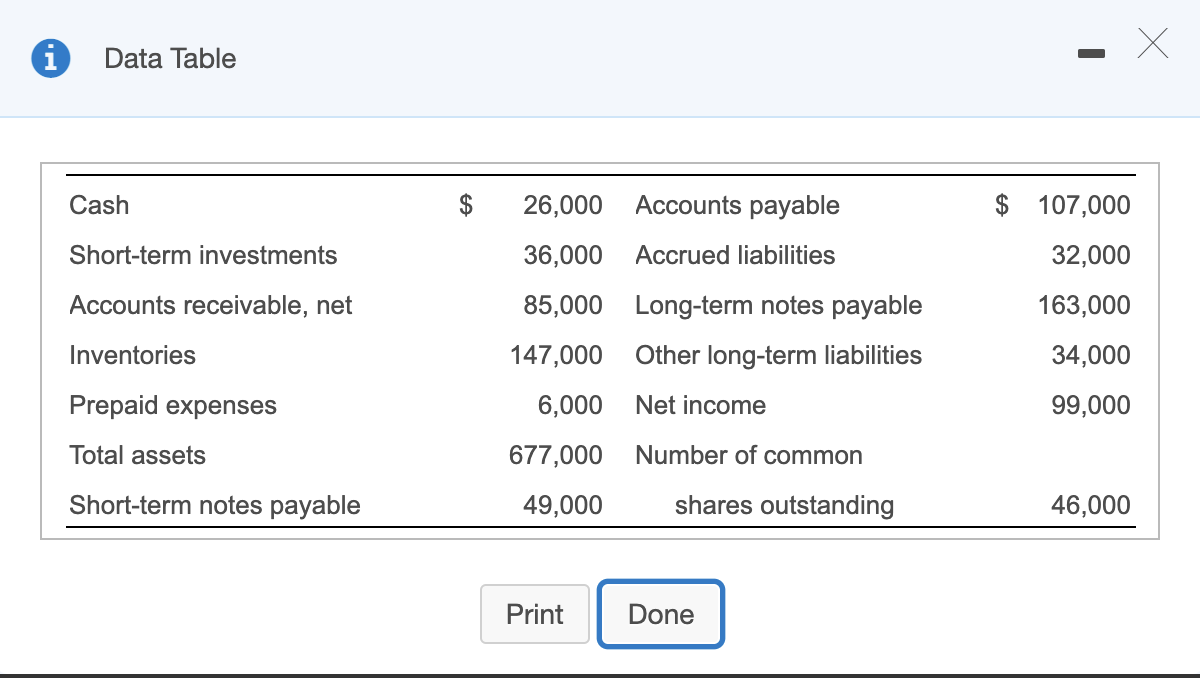

Cash $26,000

Accounts payable $107,000

Short-term investments 36,000

Accrued liabilities 32,000

Accounts receivable, net 85,000

Long-term notes payable 163,000

Inventories 147,000

Other long-term liabilities 34,000

Prepaid expenses 6,000

Net income 99,000

Total assets 677,000

Short-term notes payable 49,000

Number of common shares outstanding 46,000

REQUIREMENTS:

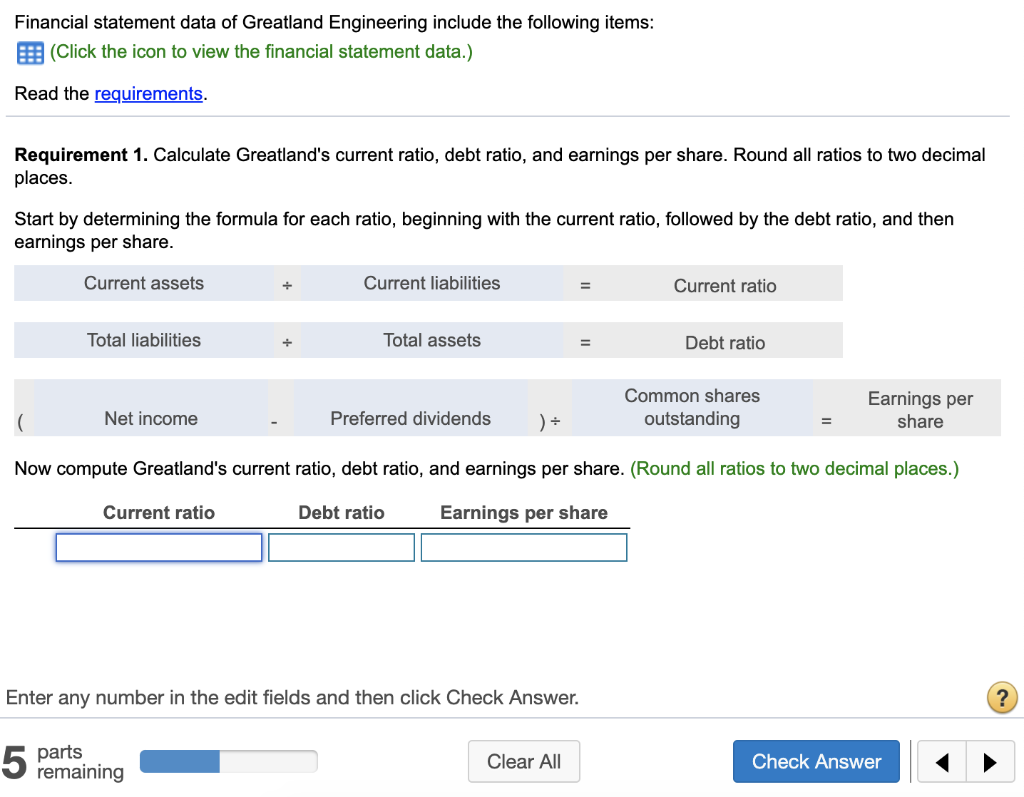

| 1. | Calculate Greatland's current ratio, debt ratio, and earnings per share. Round all ratios to two decimal places. | |

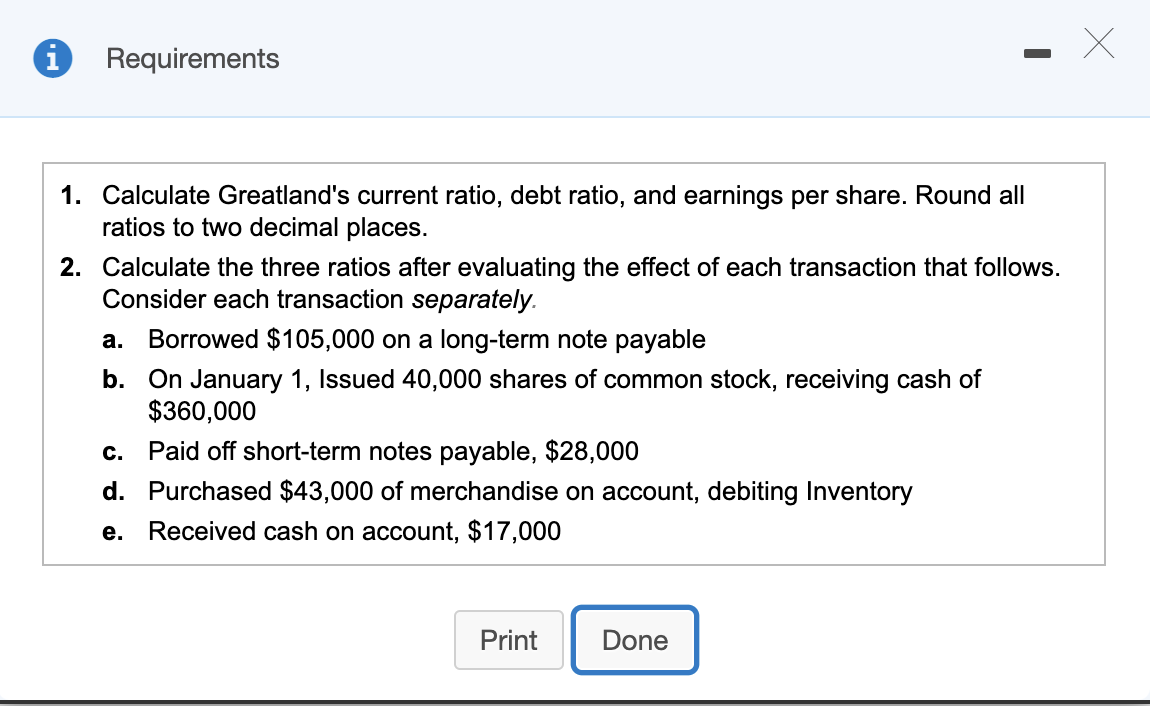

| 2. | Calculate the three ratios after evaluating the effect of each transaction that follows. Consider each transaction separately. | |

| a. | Borrowed $105,000 on a long-term note payable | |

| b. | On January 1, Issued 40,000 shares of common stock, receiving cash of $360,000 | |

| c. | Paid off short-term notes payable, $28,000 | |

| d. | Purchased $43,000 of merchandise on account, debiting Inventory | |

| e. | Received cash on account, $17,000 | |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started