Answered step by step

Verified Expert Solution

Question

1 Approved Answer

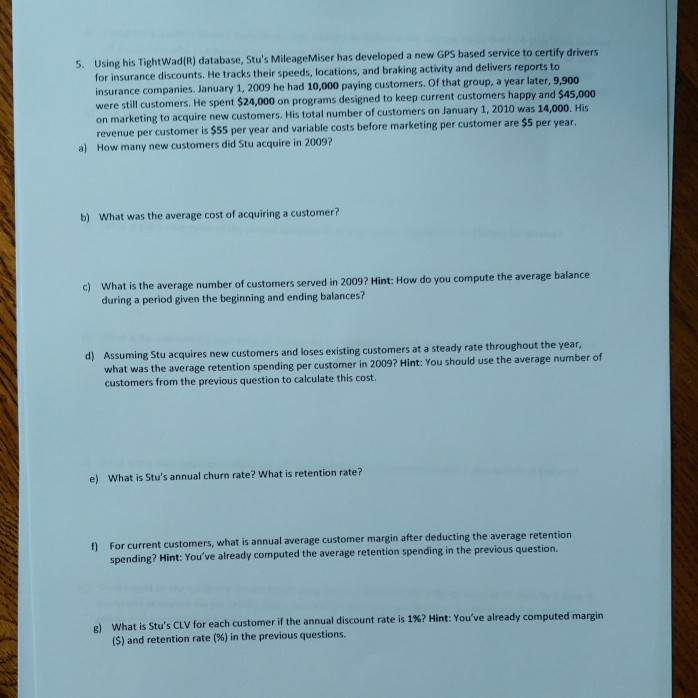

please show work! thank you 5. Using his TightWad(R) database, Stu's MileageMiser has developed a new GPS based service to certify drivers for insurance discounts.

please show work! thank you

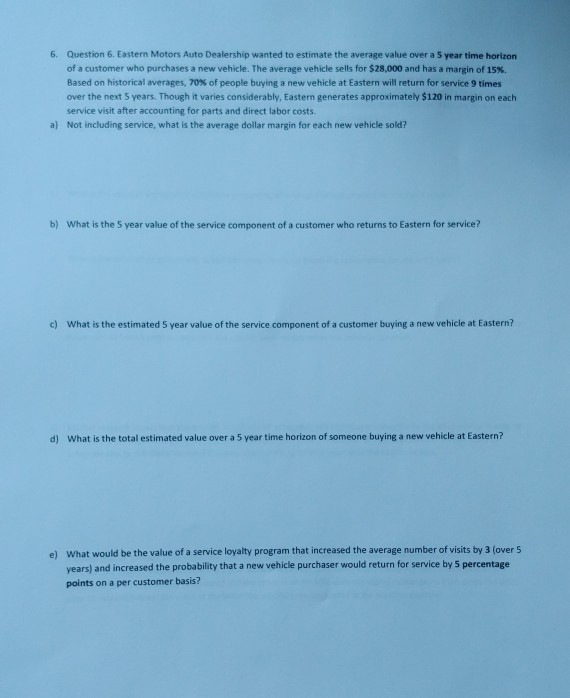

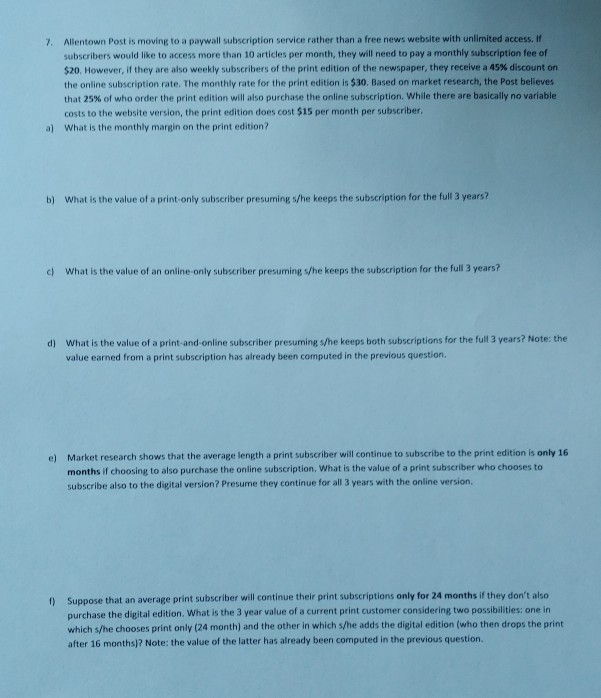

5. Using his TightWad(R) database, Stu's MileageMiser has developed a new GPS based service to certify drivers for insurance discounts. He tracks their speeds, locations, and braking activity and delivers reports t insurance companies. January 1, 2009 he had 10,000 paying customers. Of that group, a year later, 9,900 were still customers. He spent $24,000 on programs designed to keep current customers hap on marketing to acquire new customers. His total number of customers on January 1, 2010 was 14,000. His revenue per customer is $55 per year and variable costs before marketing per customer ar How many new customers did Stu acquire in 2009? py and $45,000 e $5 per year. a) b) What was the average cost of acquiring a customer? What is the average number of customers served in 2009? Hint: How do you compute the average balance during a period given the beginning and ending balances? d) ing Stu acquires new customers and loses existing customers at a steady rate throughout the year, what was the average retention spending per customer in 2009? Hint: You should use the average number of d) A ssumi customers from the previous question to calculate this cost. e) What is Stu's annual churn rate? What is retention rate? f) nnual average customer margin after deducting the average retention For current customers, what is a spending? Hint: You've already computed the average retention spending in the previous question. what is Stu's CLV for each customer if the annual discount rate is 1%? Hint: You've already computed margin (S) and retention rate (%) in the previous questions. g) Question 6. Eastern Motors Auto Dealership wanted to estimate the average value over a 5 year time horizon of a customer who purchases a new vehicle. The average vehicle sells for $28,000 and has a margin of 15%. Based on historical averages, 70% of people buying a new vehicle at Eastern will return for service 9 times over the next 5 years. Though it varies considerably, Eastern generates approximately $120 in margin on each service visit after accounting for parts and direct labor costs Not including service, what is the average dollar margin for each new vehicle sold? 6. a) b) What is the 5 year value of the service component of a customer who returns to Eastern for servicei? c) What is the estimated 5 year value of the service component of a customer buying a new vehicle at Eastern? d) What is the total estimated value over a 5 year time horizon of someone buying a new vehicle at Eastern? e) What would be the value of a service loyalty program that increased the average number of visits by 3 (over 5 ars) and increased the probability that a new vehicle purchaser would return for service by 5 percentage points on a per customer basis? 7. Allentown Post is moving to a paywall subscription service rather than a free news website with unlimited access. If subscribers would like to access more than 10 articles per month, they will need to pay a monthly subscription fee of $20. However, if they are also weekly subscribers of the print edition of the newspaper, they receive a 45% discount on the online subscription rate. The monthly rate for the print edition is $30. Based on market research, the Post believes that 25% of who order the print edition will also purchase the online subscription, while there are basically no variable costs to the website version, the print edition does cost $15 per month per subscriber What is the monthly margin on the print edition? a) b) What is the value of a print-only subscriber presuming s/he keeps the subscription for the full 3 years? c) What is the value of an online-only subscriber presuming s/he keeps the subscription for the full 3 years? d) What is the value of a print-and-online subscriber presuming s/he keeps both subscriptions for the full 3 years? Note: the value earned from a print subscription has already been computed in the previous question. Market research shows that the average length a print subscriber will continue to subscribe to the print edition is only 16 months if choosing to also purchase the online subscription, What is the value of a print subscriber who chooses to subscribe also to the digital version? Presume they continue for all 3 years with the online version, e) Suppose that an average print subscriber will continue their print subscriptions only for 24 months if they don't also purchase the digital edition. What is the 3 year value of a current print customer considering two possibilities: one in which s/he chooses print only (24 month) and the other in which s/he adds the digital edition (who then drops the print after 16 months)? Note: the value of the latter has already been computed in the previous question. f)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started