Answered step by step

Verified Expert Solution

Question

1 Approved Answer

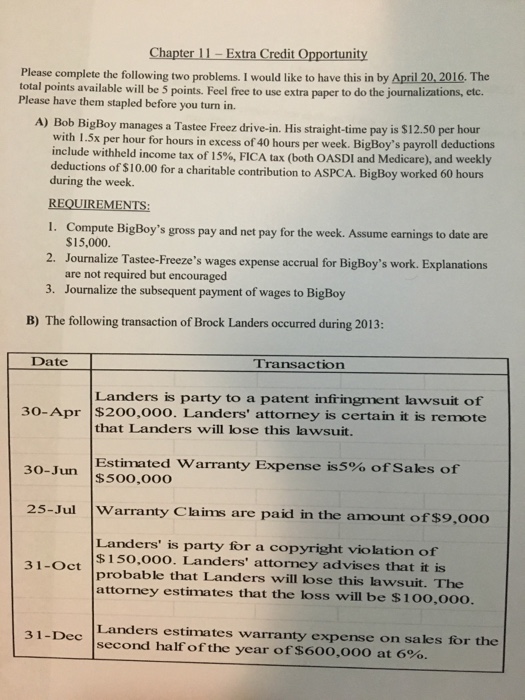

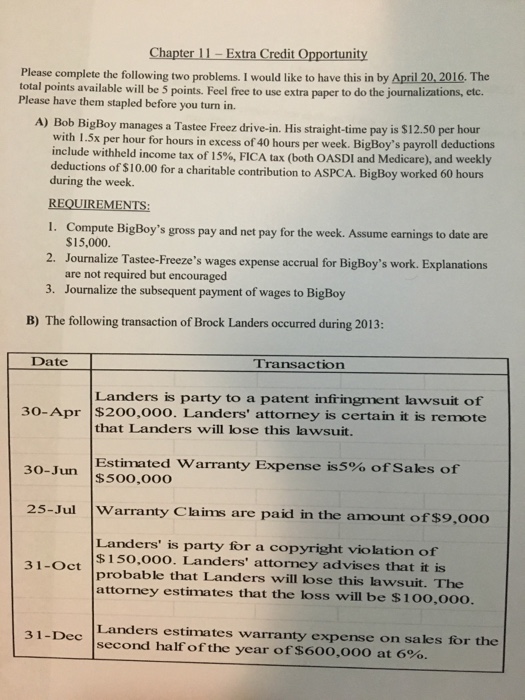

Please show work. Thanks guys. Chapter 11-Extra Credit Opportunity Please complete the following two problems. I would like to have this in by April 20,2016.

Please show work. Thanks guys.

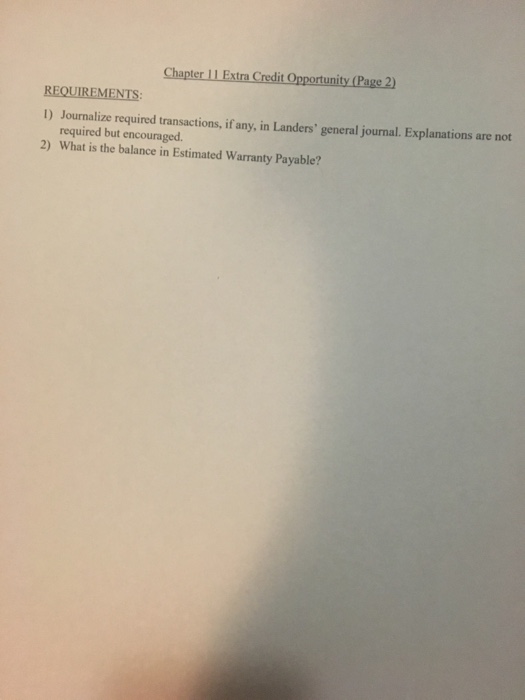

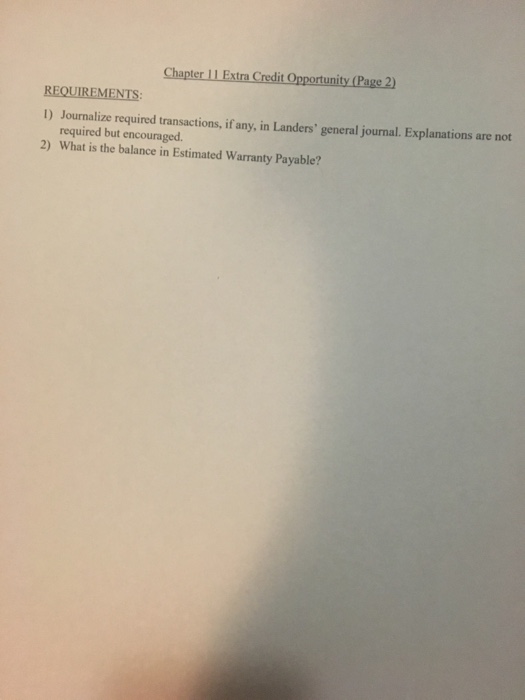

Chapter 11-Extra Credit Opportunity Please complete the following two problems. I would like to have this in by April 20,2016. The I points available will be 5 points. Feel free to use extra paper to do the journalizations, etc. Please have them stapled before you turn in. A) Bob BigBoy manages a Tastee Freez drive-in. His straight-time pay is $12.50 per hour with 1-5x per hour for hours in excess of40 hours per week. BigBoy's payroll include withheld income tax of 15%, FICA tax (both OASDI and Medicare), and weekly deductions of S10.00 for a charitable contribution to ASPCA. BigBoy worked 60 hours during the week. REQUIREMENTS Compute BigBoy's gross pay and net pay for the week. Assume earnings to date are $15,000 I. 2. Journalize Tastee-Freeze's wages expense accrual for B alize Tastee-Freeze's wages expense accrual for BigBoy's work. Explanations are not required but encouraged Journalize the subsequent payment of wages to BigBoy 3. B) The following transaction of Brock Landers occurred during 2013: Date Transaction Landers is party to a patent infringment lawsuit of that Landers will lose this lawsuit. Estimated warranty Expense is5% orsales of 30-Apr $200,00o. Landers' attorney is certain it is remote 30-Jun $500,00o 25-Jul Warranty Claims are paid in the amount ofs9,000 Landers' is party for a copyright violation of $ 150,000. Landers' attorney advises that it is probable that Landers will lose this lawsuit. The 3 1-Oct attorney estimates that the loss will be $100,000. 31-Dec second Landers estimates warranty expense on sales for the second half ofthe year of$600,000 at 6%. 3 1-Dec

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started