Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please show your work so I can understand how you got the answer and give you a thumbs up! Thank you. 5 Jiminy's Cricket Farm

Please show your work so I can understand how you got the answer and give you a thumbs up! Thank you.

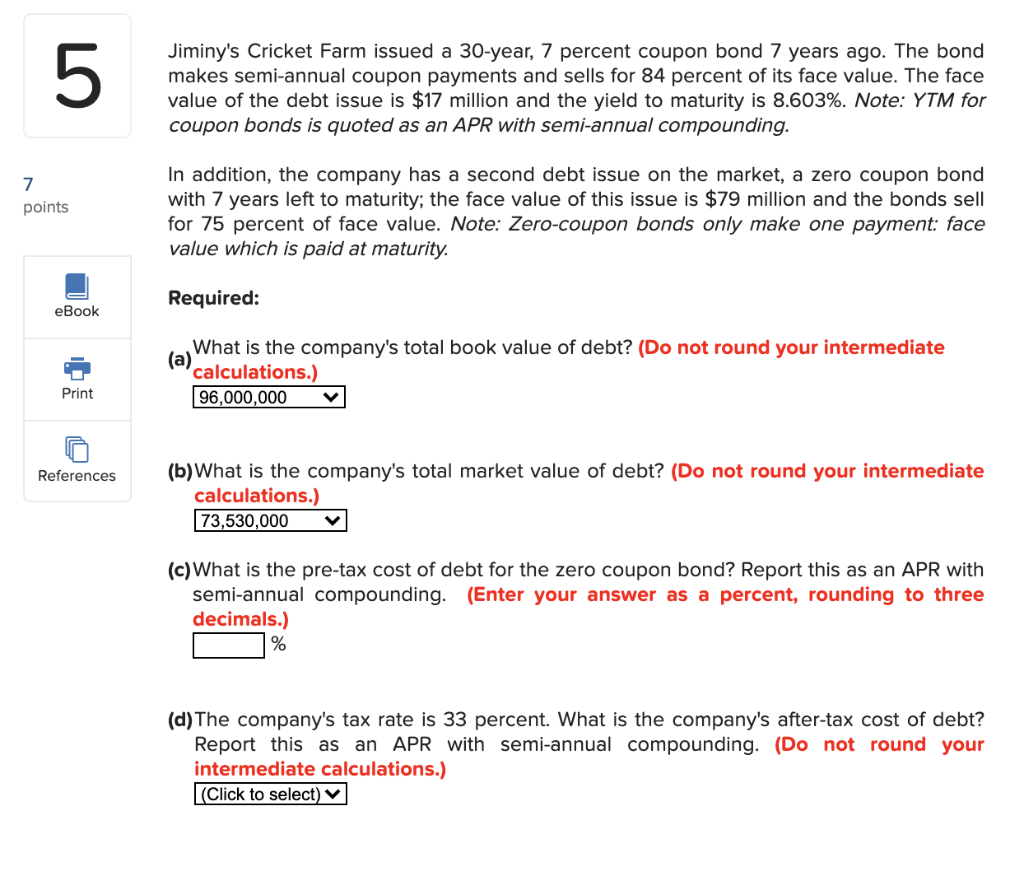

5 Jiminy's Cricket Farm issued a 30-year, 7 percent coupon bond 7 years ago. The bond makes semi-annual coupon payments and sells for 84 percent of its face value. The face value of the debt issue is $17 million and the yield to maturity is 8.603%. Note: YTM for coupon bonds is quoted as an APR with semi-annual compounding. 7 points In addition, the company has a second debt issue on the market, a zero coupon bond with 7 years left to maturity; the face value of this issue is $79 million and the bonds sell for 75 percent of face value. Note: Zero-coupon bonds only make one payment: face value which is paid at maturity. Required: eBook (a) What is the company's total book value of debt? (Do not round your intermediate 'calculations.) 96,000,000 Print References (b) What is the company's total market value of debt? (Do not round your intermediate calculations.) 73,530,000 (c) What is the pre-tax cost of debt for the zero coupon bond? Report this as an APR with semi-annual compounding. (Enter your answer as a percent, rounding to three decimals.) % (d) The company's tax rate is 33 percent. What is the company's after-tax cost of debt? Report this as an APR with semi-annual compounding. (Do not round your intermediate calculations.) Click to selectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started