Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve for A and B. Please explain your reasoning. Please show your work. Consider a 6-month European call option on a stock that pays

Please solve for A and B.

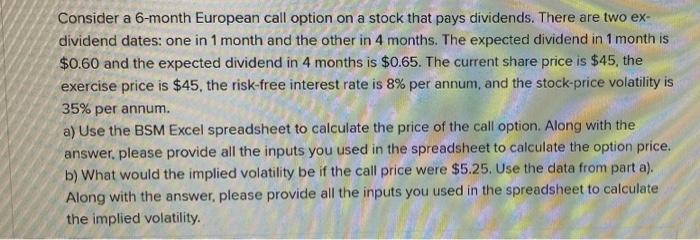

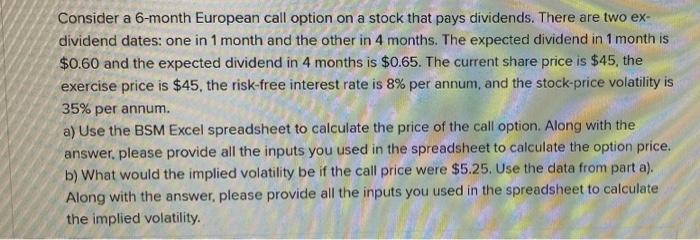

Consider a 6-month European call option on a stock that pays dividends. There are two ex- dividend dates: one in 1 month and the other in 4 months. The expected dividend in 1 month is $0.60 and the expected dividend in 4 months is $0.65. The current share price is $45, the exercise price is $45, the risk-free interest rate is 8% per annum, and the stock-price volatility is 35% per annum. a) Use the BSM Excel spreadsheet to calculate the price of the call option. Along with the answer, please provide all the inputs you used in the spreadsheet to calculate the option price. b) What would the implied volatility be if the call price were $5.25. Use the data from part a). Along with the answer, please provide all the inputs you used in the spreadsheet to calculate the implied volatility. Consider a 6-month European call option on a stock that pays dividends. There are two ex- dividend dates: one in 1 month and the other in 4 months. The expected dividend in 1 month is $0.60 and the expected dividend in 4 months is $0.65. The current share price is $45, the exercise price is $45, the risk-free interest rate is 8% per annum, and the stock-price volatility is 35% per annum. a) Use the BSM Excel spreadsheet to calculate the price of the call option. Along with the answer, please provide all the inputs you used in the spreadsheet to calculate the option price. b) What would the implied volatility be if the call price were $5.25. Use the data from part a). Along with the answer, please provide all the inputs you used in the spreadsheet to calculate the implied volatility Please explain your reasoning.

Please show your work.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started