Please solve it by using the computer and every question are alone like:

( Under each question write the slove for it )

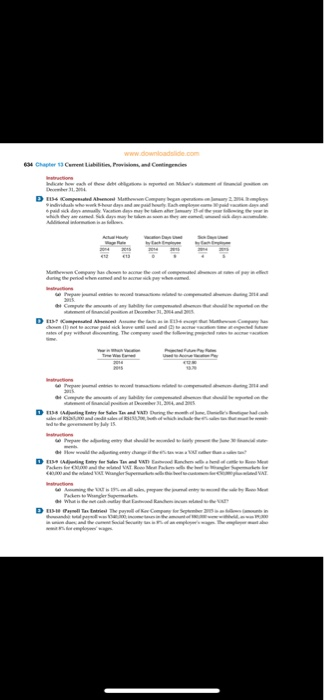

from this page i need 13-7 only

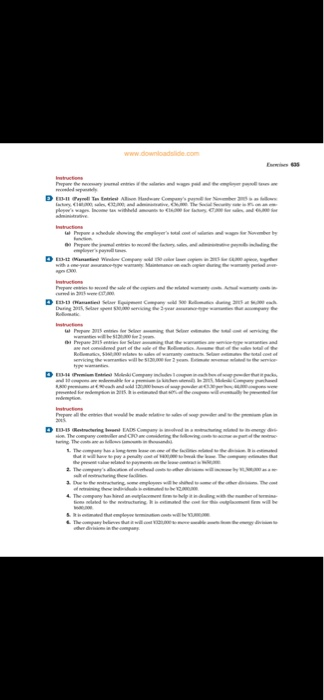

from this one 13-11 and 13-13

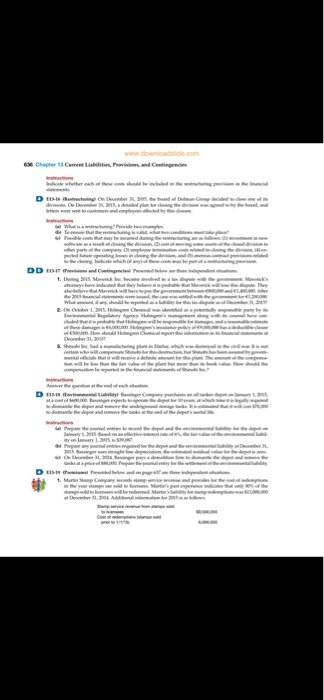

this one 13-18

solve it by a computer

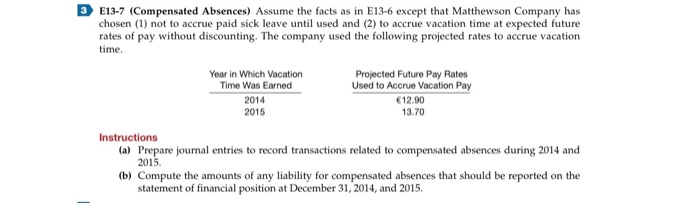

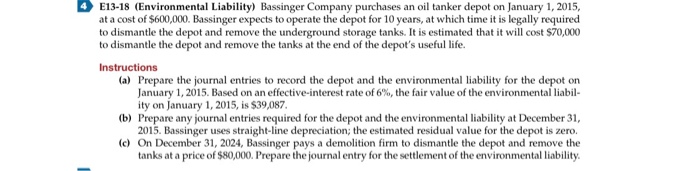

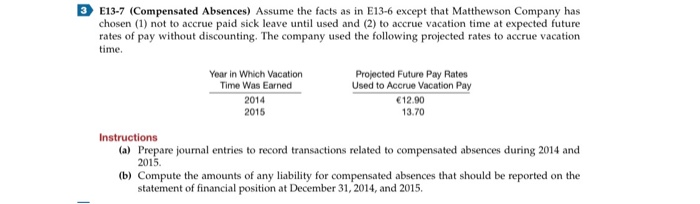

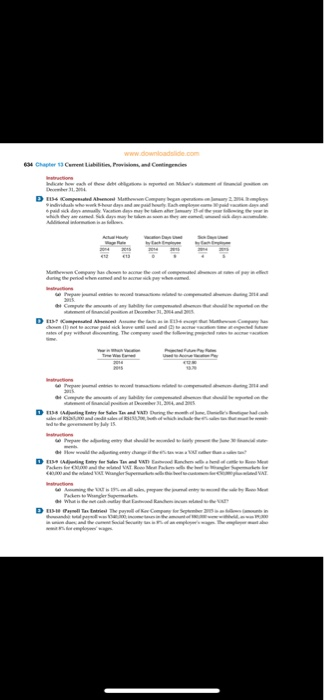

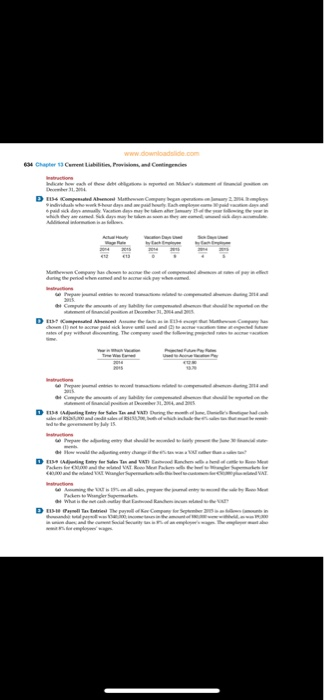

D E13.11 Payroll Tax Entries Alle Haware Company's payroll for November 2015 as follows t for at for a nd the for ployees wage Income tax withhel Prepare a schedule showing the l ' and was for November by als, and administrative proindlading the the are the on e s to record they employee's pelle 13-13 (Warranties Seler Equipment Company During 2015 S rpen 200 ming the year Relomaties during 2015 56.000 ch ance-type wants that company the Pare 2015 enes for Sering the Seas the cost of servicing the wames will 1 00 for 2 years thi Prepare 2015 for Selet ing that the warranties are writype warned are not considered part of the sale of the Rollmatic Aume that of the sales total of the Roma , Sl a te sales of warranty contacts Selaer estimate the total cost of vicinthe warranties will forear male related the 3 E13-7 (Compensated Absences) Assume the facts as in E13-6 except that Matthewson Company has chosen (1) not to accrue paid sick leave until used and (2) to accrue vacation time at expected future rates of pay without discounting. The company used the following projected rates to accrue vacation time. Year in which Vacation Time Was Earned 2014 2015 Projected Future Pay Rates Used to Accrue Vacation Pay 12.90 13.70 Instructions (a) Prepare journal entries to record transactions related to compensated absences during 2014 and 2015. (b) Compute the amounts of any liability for compensated absences that should be reported on the statement of financial position at December 31, 2014, and 2015. 4 E13-18 (Environmental Liability) Bassinger Company purchases an oil tanker depot on January 1, 2015, at a cost of $600,000. Bassinger expects to operate the depot for 10 years, at which time it is legally required to dismantle the depot and remove the underground storage tanks. It is estimated that it will cost $70,000 to dismantle the depot and remove the tanks at the end of the depot's useful life. Instructions (a) Prepare the journal entries to record the depot and the environmental liability for the depot on January 1, 2015. Based on an effective interest rate of 6%, the fair value of the environmental liabil ity on January 1, 2015, is $39,087. (b) Prepare any journal entries required for the depot and the environmental liability at December 31, 2015. Bassinger uses straight-line depreciation; the estimated residual value for the depot is zero. (c) On December 31, 2024, Bassinger pays a demolition firm to dismantle the depot and remove the tanks at a price of $80,000. Prepare the journal entry for the settlement of the environmental liability 3 E13-7 (Compensated Absences) Assume the facts as in E13-6 except that Matthewson Company has chosen (1) not to accrue paid sick leave until used and (2) to accrue vacation time at expected future rates of pay without discounting. The company used the following projected rates to accrue vacation time. Year in which Vacation Time Was Earned 2014 2015 Projected Future Pay Rates Used to Accrue Vacation Pay 12.90 13.70 Instructions (a) Prepare journal entries to record transactions related to compensated absences during 2014 and 2015. (b) Compute the amounts of any liability for compensated absences that should be reported on the statement of financial position at December 31, 2014, and 2015. D E13.11 Payroll Tax Entries Alle Haware Company's payroll for November 2015 as follows t for at for a nd the for ployees wage Income tax withhel Prepare a schedule showing the l ' and was for November by als, and administrative proindlading the the are the on e s to record they employee's pelle 13-13 (Warranties Seler Equipment Company During 2015 S rpen 200 ming the year Relomaties during 2015 56.000 ch ance-type wants that company the Pare 2015 enes for Sering the Seas the cost of servicing the wames will 1 00 for 2 years thi Prepare 2015 for Selet ing that the warranties are writype warned are not considered part of the sale of the Rollmatic Aume that of the sales total of the Roma , Sl a te sales of warranty contacts Selaer estimate the total cost of vicinthe warranties will forear male related the D ch e Am that is what we w e tow paid leave until we and to expected tutan ay wielding. The company the following w Into premalento das compending and Completed from the won the financial and 2015 D ie Libing Company p o con ingrepetstoperate the door an dporary L. d hede and then the end of the depos ite e de were the motheo the w Bonnective health wwwwwwwwww O dplade Chapter 3 Current bitti Pro d owings whethew w w during the wh este and Time al powder D ana Window Compac t Chapter 3 Current Liabilities Pri n ting D E13.11 Payroll Tax Entries Alle Haware Company's payroll for November 2015 as follows t for at for a nd the for ployees wage Income tax withhel Prepare a schedule showing the l ' and was for November by als, and administrative proindlading the the are the on e s to record they employee's pelle 13-13 (Warranties Seler Equipment Company During 2015 S rpen 200 ming the year Relomaties during 2015 56.000 ch ance-type wants that company the Pare 2015 enes for Sering the Seas the cost of servicing the wames will 1 00 for 2 years thi Prepare 2015 for Selet ing that the warranties are writype warned are not considered part of the sale of the Rollmatic Aume that of the sales total of the Roma , Sl a te sales of warranty contacts Selaer estimate the total cost of vicinthe warranties will forear male related the 3 E13-7 (Compensated Absences) Assume the facts as in E13-6 except that Matthewson Company has chosen (1) not to accrue paid sick leave until used and (2) to accrue vacation time at expected future rates of pay without discounting. The company used the following projected rates to accrue vacation time. Year in which Vacation Time Was Earned 2014 2015 Projected Future Pay Rates Used to Accrue Vacation Pay 12.90 13.70 Instructions (a) Prepare journal entries to record transactions related to compensated absences during 2014 and 2015. (b) Compute the amounts of any liability for compensated absences that should be reported on the statement of financial position at December 31, 2014, and 2015. 4 E13-18 (Environmental Liability) Bassinger Company purchases an oil tanker depot on January 1, 2015, at a cost of $600,000. Bassinger expects to operate the depot for 10 years, at which time it is legally required to dismantle the depot and remove the underground storage tanks. It is estimated that it will cost $70,000 to dismantle the depot and remove the tanks at the end of the depot's useful life. Instructions (a) Prepare the journal entries to record the depot and the environmental liability for the depot on January 1, 2015. Based on an effective interest rate of 6%, the fair value of the environmental liabil ity on January 1, 2015, is $39,087. (b) Prepare any journal entries required for the depot and the environmental liability at December 31, 2015. Bassinger uses straight-line depreciation; the estimated residual value for the depot is zero. (c) On December 31, 2024, Bassinger pays a demolition firm to dismantle the depot and remove the tanks at a price of $80,000. Prepare the journal entry for the settlement of the environmental liability 3 E13-7 (Compensated Absences) Assume the facts as in E13-6 except that Matthewson Company has chosen (1) not to accrue paid sick leave until used and (2) to accrue vacation time at expected future rates of pay without discounting. The company used the following projected rates to accrue vacation time. Year in which Vacation Time Was Earned 2014 2015 Projected Future Pay Rates Used to Accrue Vacation Pay 12.90 13.70 Instructions (a) Prepare journal entries to record transactions related to compensated absences during 2014 and 2015. (b) Compute the amounts of any liability for compensated absences that should be reported on the statement of financial position at December 31, 2014, and 2015. D E13.11 Payroll Tax Entries Alle Haware Company's payroll for November 2015 as follows t for at for a nd the for ployees wage Income tax withhel Prepare a schedule showing the l ' and was for November by als, and administrative proindlading the the are the on e s to record they employee's pelle 13-13 (Warranties Seler Equipment Company During 2015 S rpen 200 ming the year Relomaties during 2015 56.000 ch ance-type wants that company the Pare 2015 enes for Sering the Seas the cost of servicing the wames will 1 00 for 2 years thi Prepare 2015 for Selet ing that the warranties are writype warned are not considered part of the sale of the Rollmatic Aume that of the sales total of the Roma , Sl a te sales of warranty contacts Selaer estimate the total cost of vicinthe warranties will forear male related the D ch e Am that is what we w e tow paid leave until we and to expected tutan ay wielding. The company the following w Into premalento das compending and Completed from the won the financial and 2015 D ie Libing Company p o con ingrepetstoperate the door an dporary L. d hede and then the end of the depos ite e de were the motheo the w Bonnective health wwwwwwwwww O dplade Chapter 3 Current bitti Pro d owings whethew w w during the wh este and Time al powder D ana Window Compac t Chapter 3 Current Liabilities Pri n ting