Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve Required information [The following information applies to the questions displayed below] A recent annual report for Celtic Air Lines included the following note:

please solve

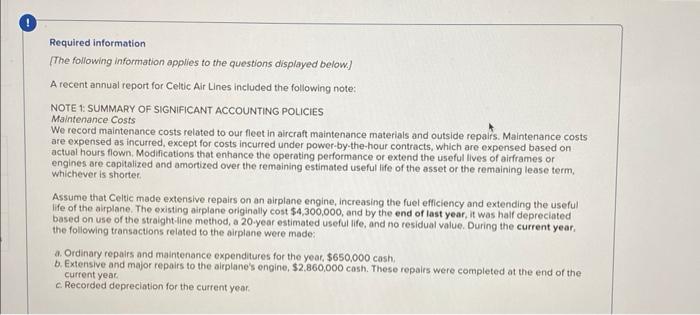

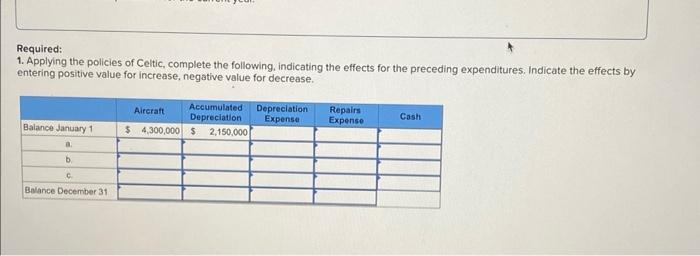

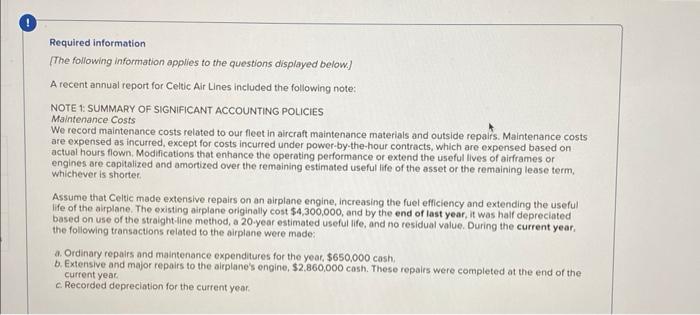

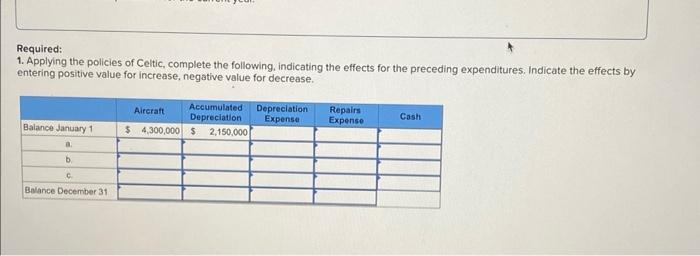

Required information [The following information applies to the questions displayed below] A recent annual report for Celtic Air Lines included the following note: NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Maintenance Costs We record maintenance costs related to our fleet in aircraft maintenance materials and outside repairs. Maintenance costs are expensed as incutred, except for costs incurred under power-by-the-hour contracts, which are expensed based on actual hours flown. Modifications that enhance the operating performance or extend the useful llives of airframes of engines are capitalized and amortized over the remaining estimated useful life of the asset or the remaining lease term, whichever is shortet. Assume that Celtic made extensive repairs on an airplane engine, increasing the fuel efficiency and extending the useful life of the airplane. The existing airplane originally cost $4,300,000, and by the end of last year, it was half depreciated based on use of the straight-line method, a 20-year estimated useful life, and no residual value. During the current year. the following transactions felated to the airplane were made: a. Ordinary repairs and maintenance expenditures for the yeat, $650,000cash. b. Extensive and major repairs to the airplane's engine, $2,860,000 cash. These repairs were completed at the end of the current year. c. Recorded depreciation for the curtent year. Required: 1. Applying the policies of Celtic, complete the following, indicating the effects for the preceding expenditures. Indicate the effects by entering positive value for increase, negative value for decrease

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started