Please solve the problems tnx.

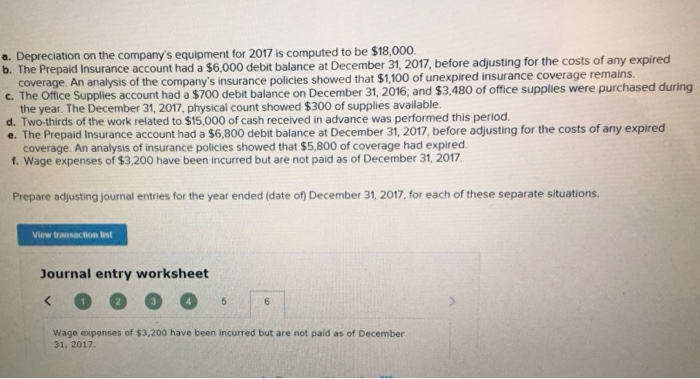

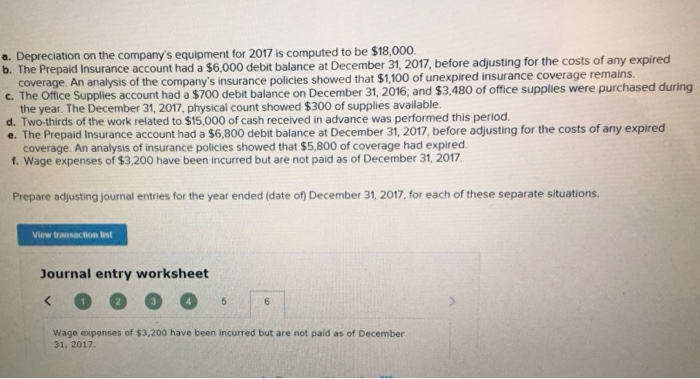

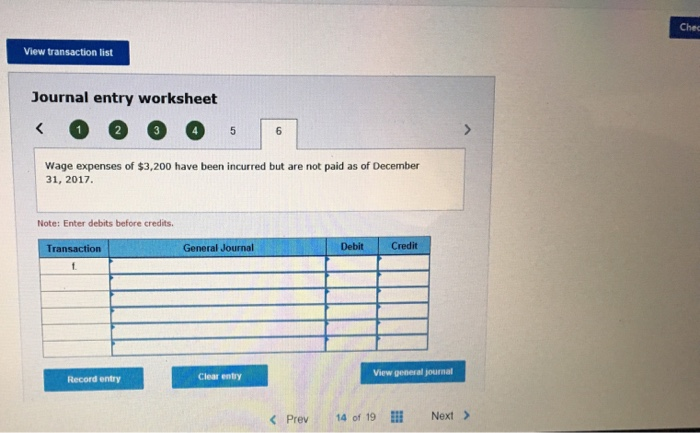

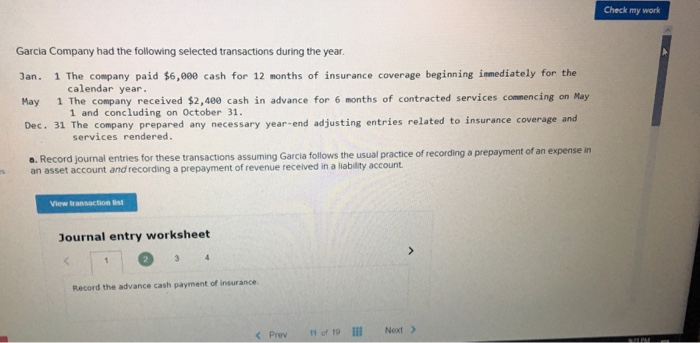

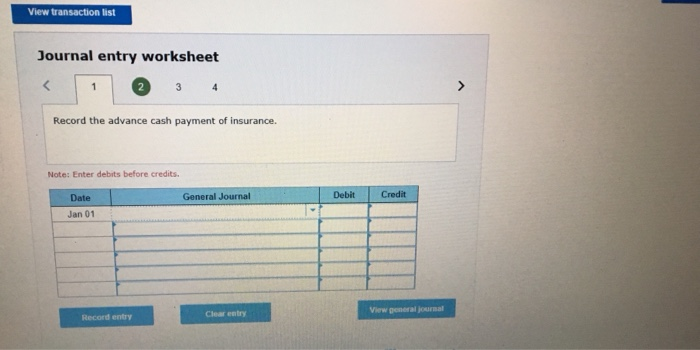

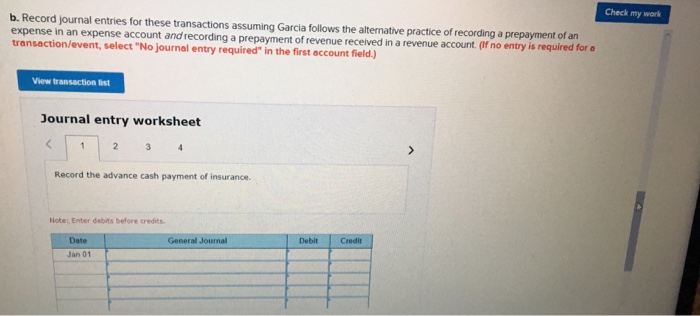

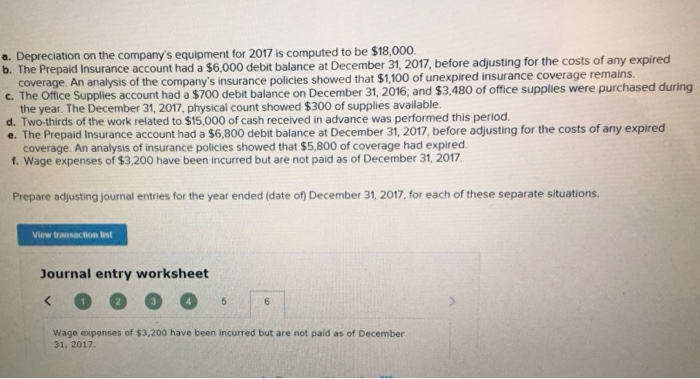

a. Depreciation on the company's equipment for 2017 is computed to be $18,000o b. The Prepaid Insurance account had a $6,000 debit balance at December 31, 2017, before adjusting for the costs of any expired coverage. An analysis of the company's insurance policies showed that $1,100 of unexp c. The Office Suppli ies account had a $700 debit balance on December 31, 2016; and $3,480 of office supplies were purchased during the year. The December 31, 2017, physical count showed $300 of supplies available. d. Two-thirds of the work related to $15,000 of cash received in advance was performed this period. e. The Prepaid Insurance account had a $6,800 debit balance at December 31, 2017, before adjusting for the costs of any expired coverage. An analysis of insurance policies showed that $5,800 of coverage had expired f. Wage expenses of $3,200 have been incurred but are not paid as of December 31, 2017 Prepare adjusting journal entries for the year ended (date of) December 31, 2017, for each of these separate situations View transaction list Journal entry worksheet Wage expenses of $3,200 have been incurred but are not paid as of December 31, 2017 Che View transaction list Journal entry worksheet 2 Wage expenses of $3,200 have been incurred but are not paid as of December 31, 2017. Note: Enter debits before credits. General Journal Debit Credit ransaction Clear entry View general journal Record entry K Prev 14 of 19 Next View transaction list Journal entry worksheet Record the advance cash payment of insurance. Note: Enter debits before credits Date General Journal Debit Credit Jan 01 View goneral jourmal Record entry Clear entry Check my wark b. Record journal entries for these transactions assuming Garcia follows the alternative practice of recording a prepayment of an expense in an expense account andrecording a prepayment of revenue received in a revenue account (If no entry is transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the advance cash payment of insurance. Note: Enter debits before credits. General Journal Debit Credit Date Jan 01