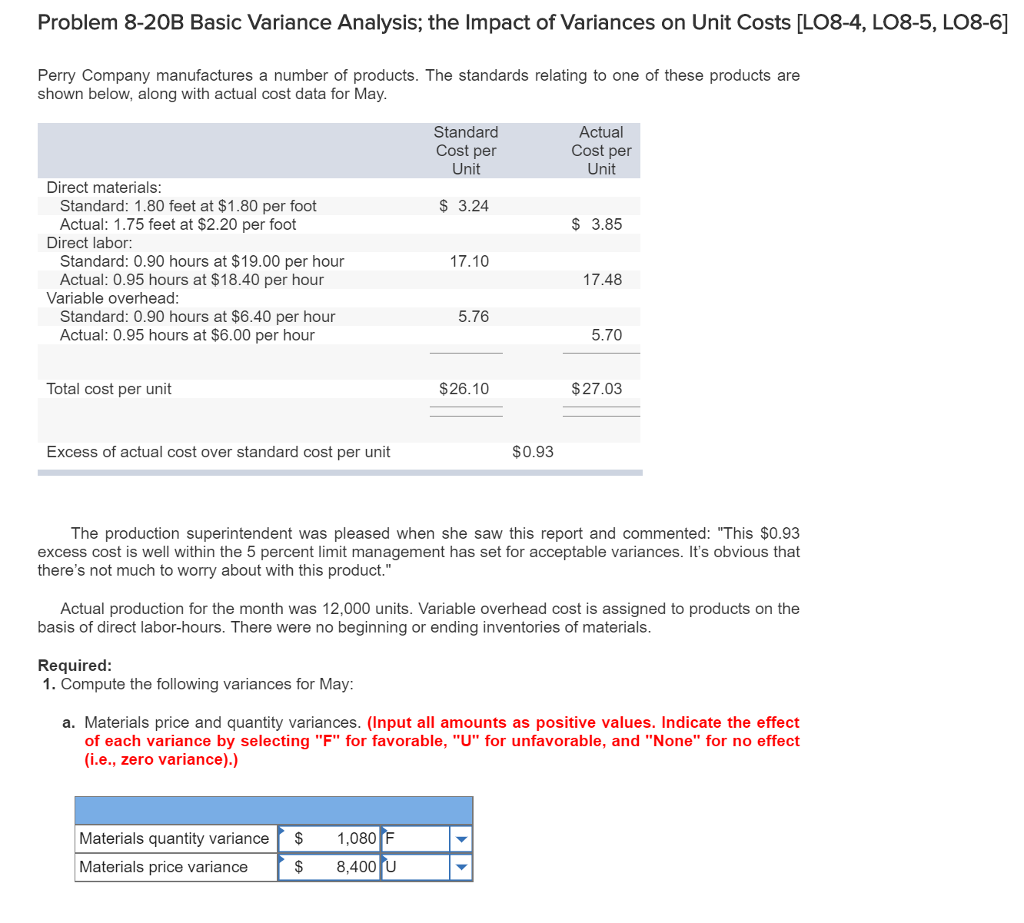

Please use the following to answer question 8! (Only question 8)

Please use the following to answer question 8! (Only question 8)

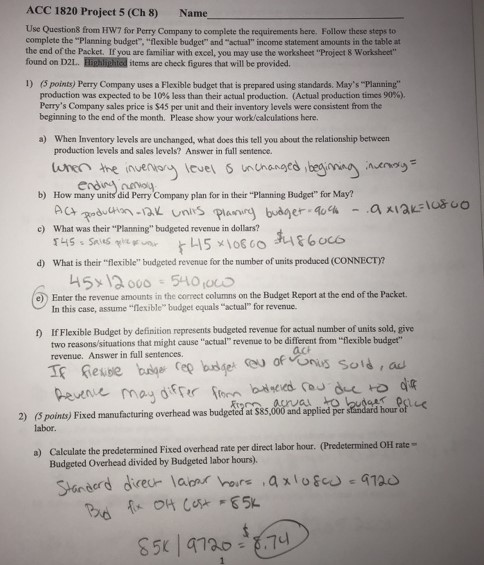

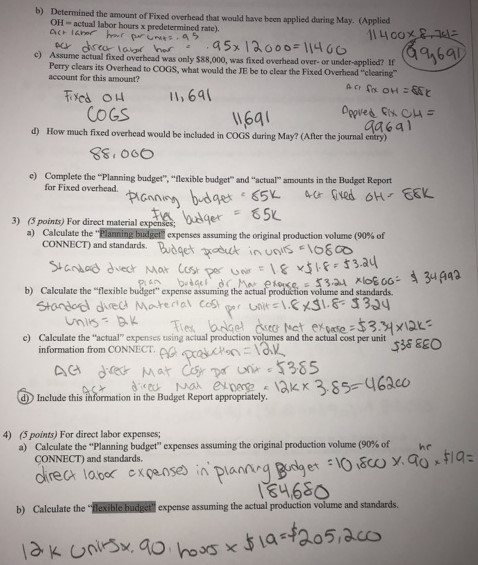

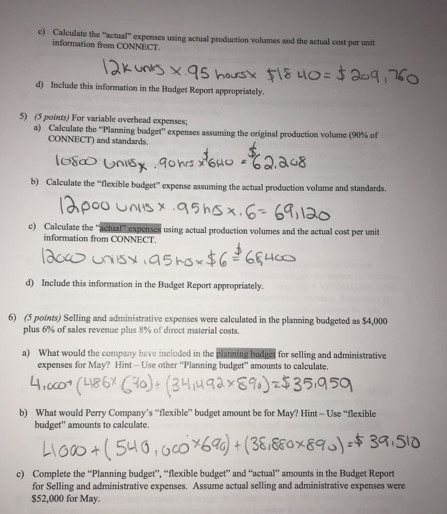

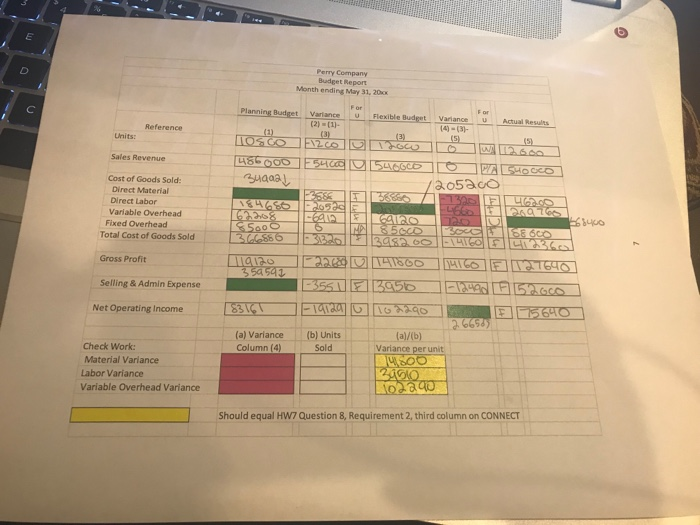

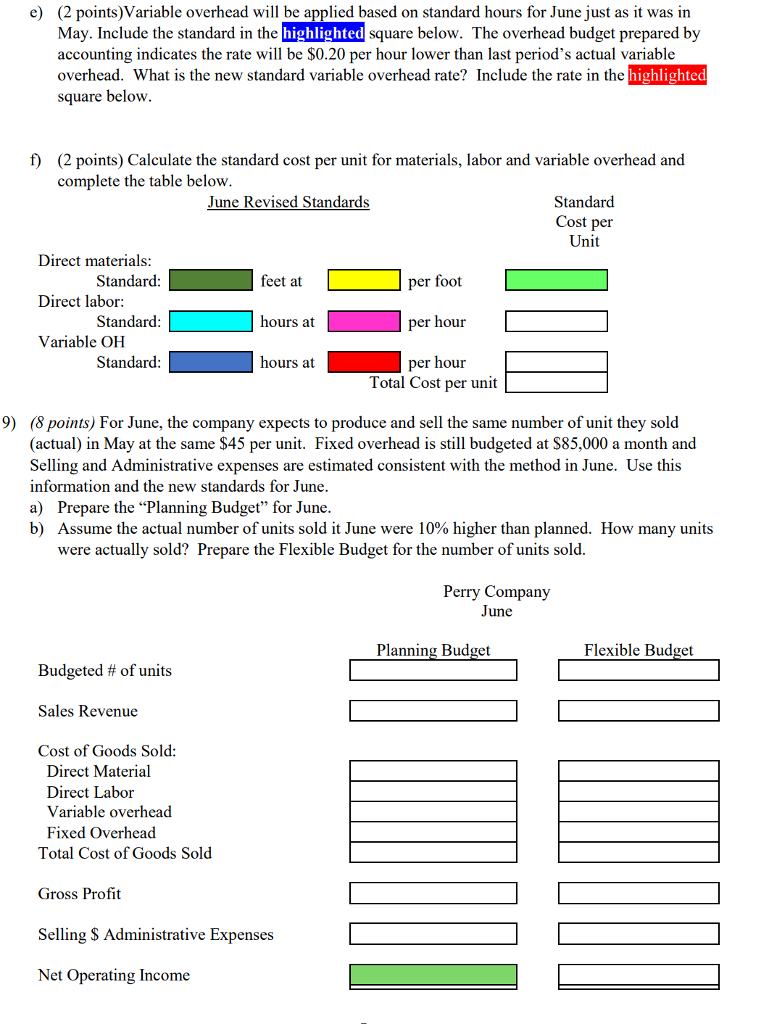

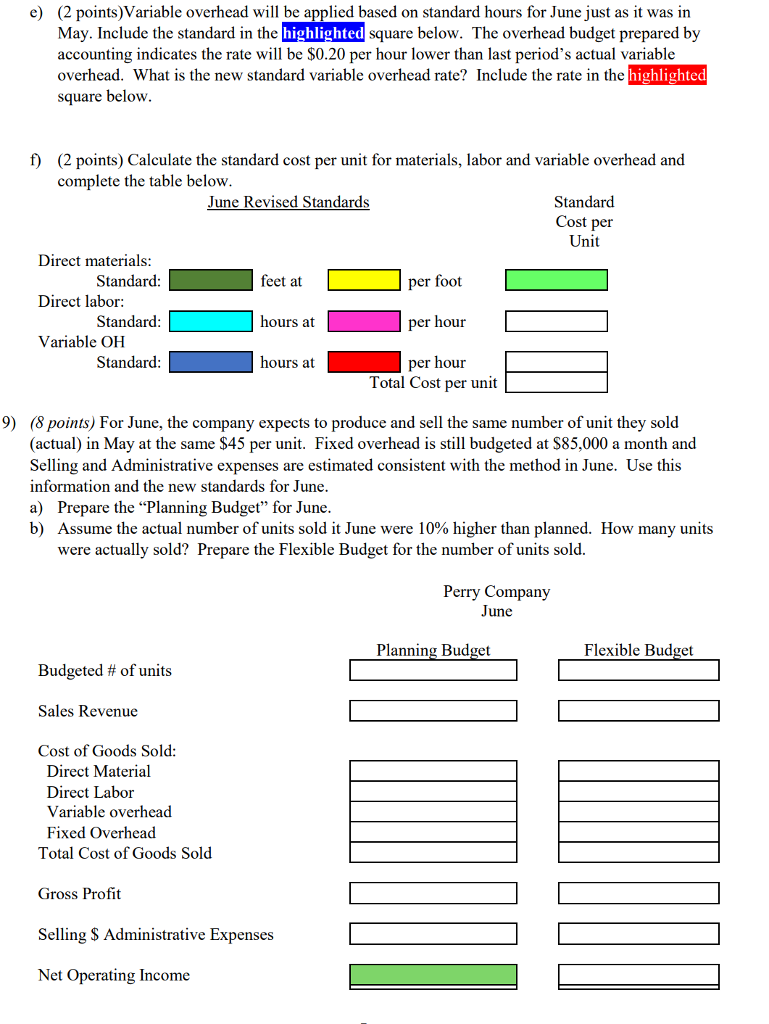

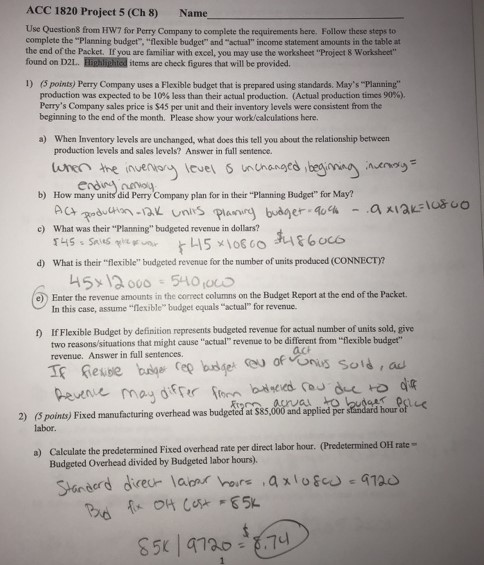

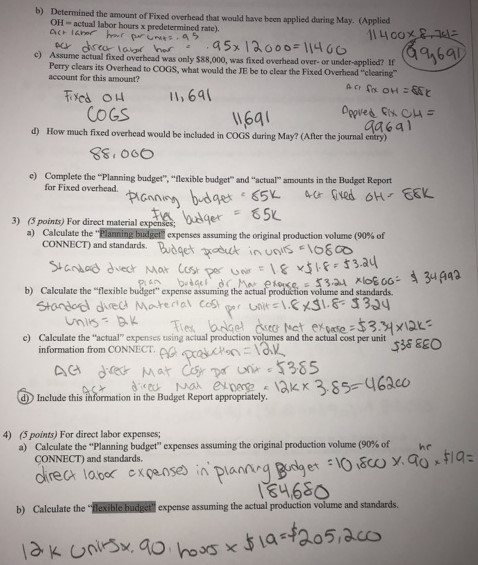

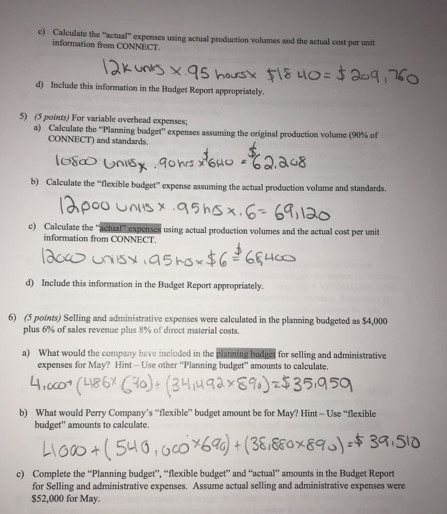

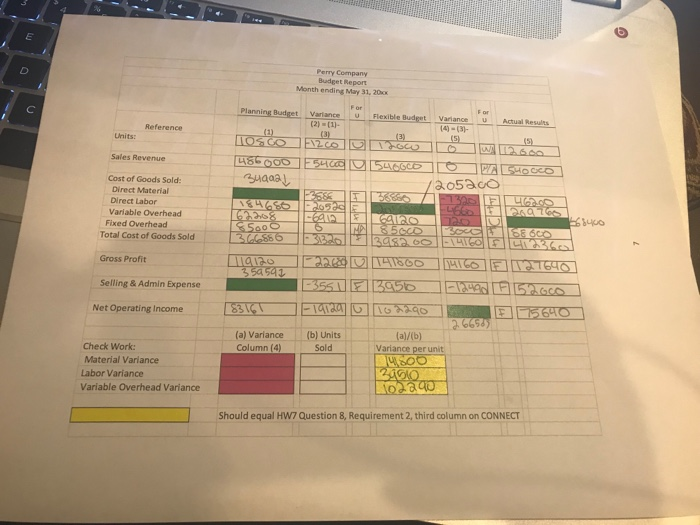

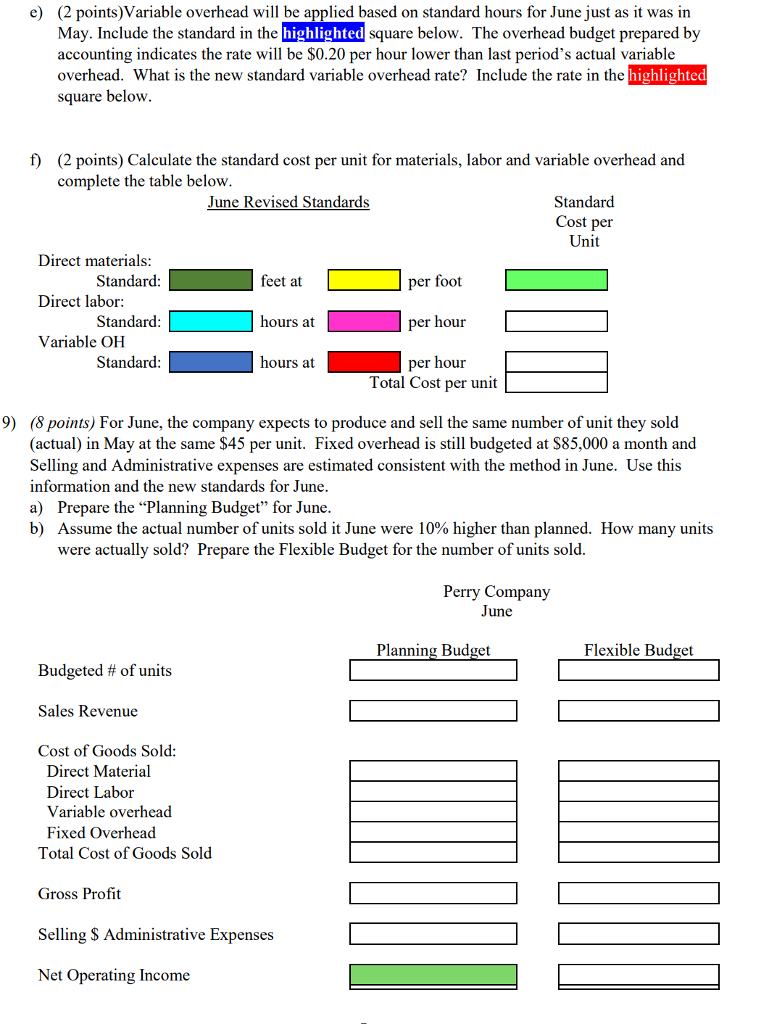

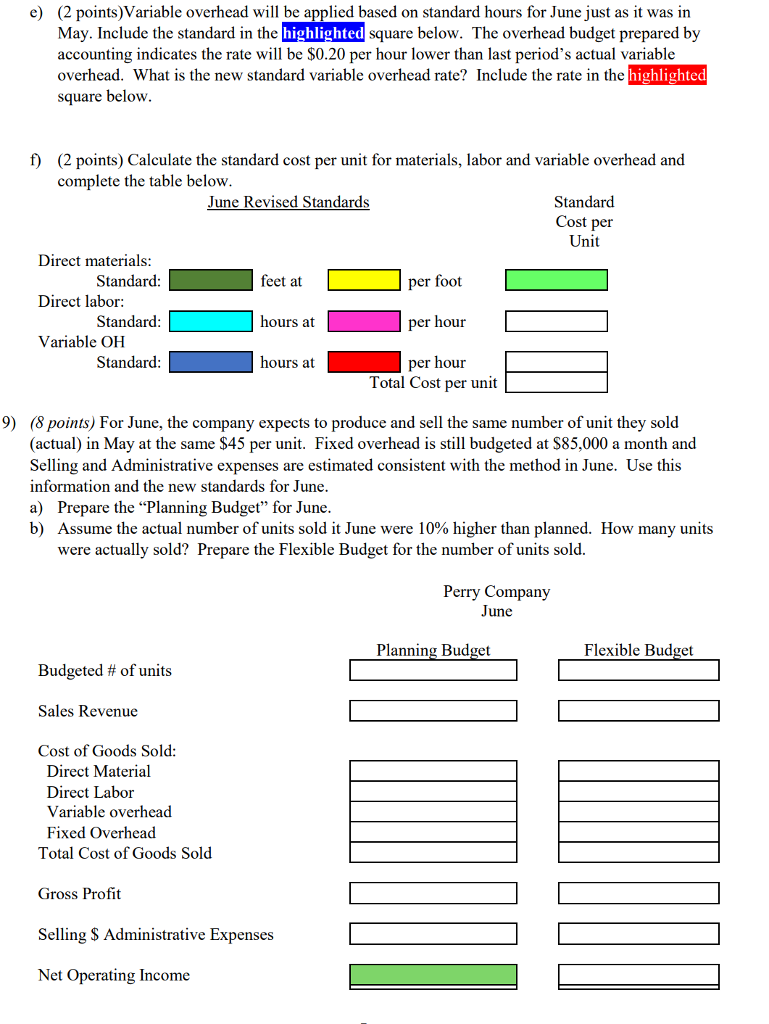

ACC 1820 Project 5 (Ch 8) Name Use Question8 from HW7 for Perry Company to complete the requirements here. Follow these steps to complete the "Planning budget", "flexible budget" and "actual" income statement amounts in the table at the end of the Packet. If you are familiar with excel, you may use the worksheet "Project & Worksheet" found on D2L. ERalia stea items are check figures that willbe provided 1) (5 points) Perry Company uses a Flexible budget that is prepared using standards. May's "Planning" production was expected to be 10% less than their actual production. (Actual production times 90%). Perry's Company sales price is $45 per unit and their inventory levels were consistent from the beginning to the end of the month. Please show your work/calculations here. When Inventory levels are unchanged, what does this tell you about the relationship between production levels and sales levels? Answer in full sentence. a) b) How many units did Perry Company plan for in their "Planning Budget" for May? What was their "Planning" budgeted revenue in dollars? What is their "flexible" budgeted revenue for the number of units produced (CONNECT)? c) d) e)) Enter the revenue amounts in the correct columns on the Budget Report at the end of the Packet In this case, assume "lexible" badget equals "actual" for revenue. If Flexible Budget by definition represents budgeted revenue for actual number of units sold, give two reasons/situations that might cause "actual" revenue to be different from "flexible budget revenue. Answer in full sentences. ) ach 2) (5 points) Fived manufacturing overhead ,00n applied per labor. Calculate the predetermined Fixed overhead rate per direct labor hour. (Predetermined OH rate- Budgeted Overhead divided by Budgeted labor hours) a) ACC 1820 Project 5 (Ch 8) Name Use Question8 from HW7 for Perry Company to complete the requirements here. Follow these steps to complete the "Planning budget", "flexible budget" and "actual" income statement amounts in the table at the end of the Packet. If you are familiar with excel, you may use the worksheet "Project & Worksheet" found on D2L. ERalia stea items are check figures that willbe provided 1) (5 points) Perry Company uses a Flexible budget that is prepared using standards. May's "Planning" production was expected to be 10% less than their actual production. (Actual production times 90%). Perry's Company sales price is $45 per unit and their inventory levels were consistent from the beginning to the end of the month. Please show your work/calculations here. When Inventory levels are unchanged, what does this tell you about the relationship between production levels and sales levels? Answer in full sentence. a) b) How many units did Perry Company plan for in their "Planning Budget" for May? What was their "Planning" budgeted revenue in dollars? What is their "flexible" budgeted revenue for the number of units produced (CONNECT)? c) d) e)) Enter the revenue amounts in the correct columns on the Budget Report at the end of the Packet In this case, assume "lexible" badget equals "actual" for revenue. If Flexible Budget by definition represents budgeted revenue for actual number of units sold, give two reasons/situations that might cause "actual" revenue to be different from "flexible budget revenue. Answer in full sentences. ) ach 2) (5 points) Fived manufacturing overhead ,00n applied per labor. Calculate the predetermined Fixed overhead rate per direct labor hour. (Predetermined OH rate- Budgeted Overhead divided by Budgeted labor hours) a)

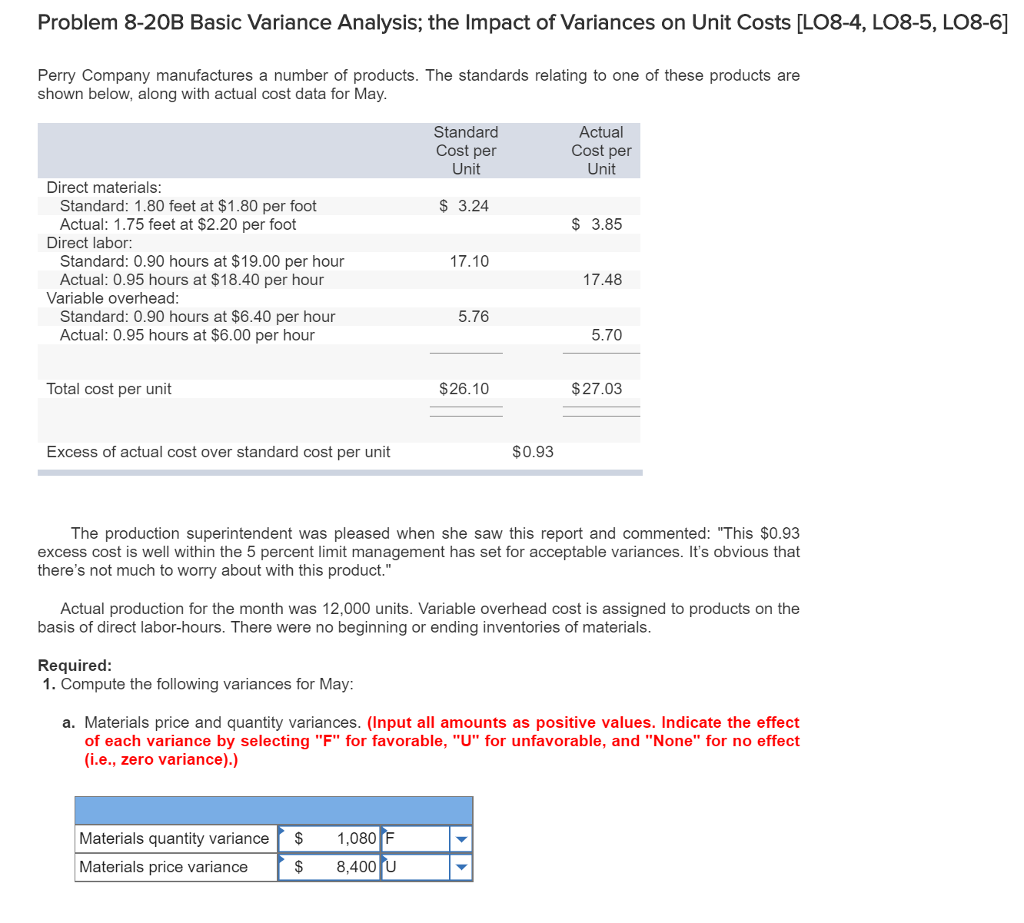

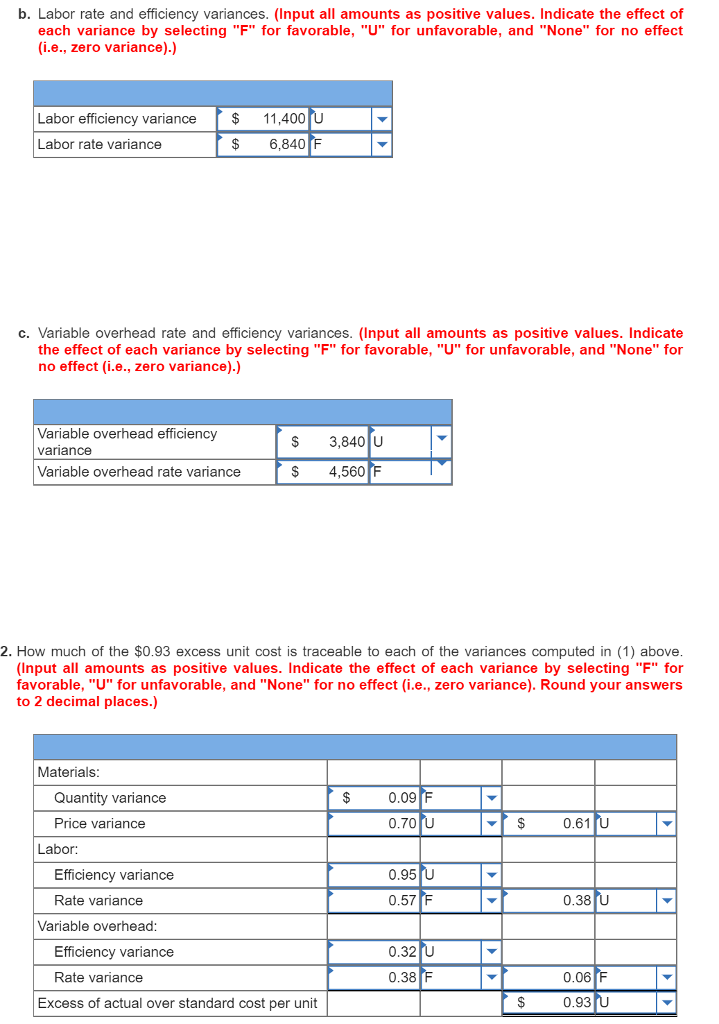

Please use the following to answer question 8! (Only question 8)

Please use the following to answer question 8! (Only question 8)