Answered step by step

Verified Expert Solution

Question

1 Approved Answer

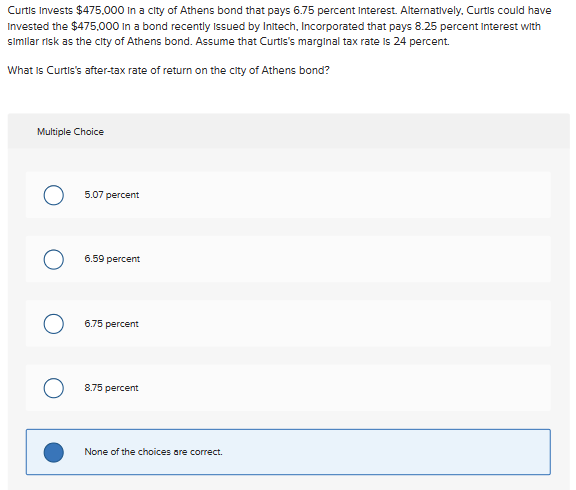

Curtls Invests $475.000 In a clty of Athens bond that pays 6.75 percent Interest. Alternatlvely. Curtls could have Invested the $475,000 in a bond recently

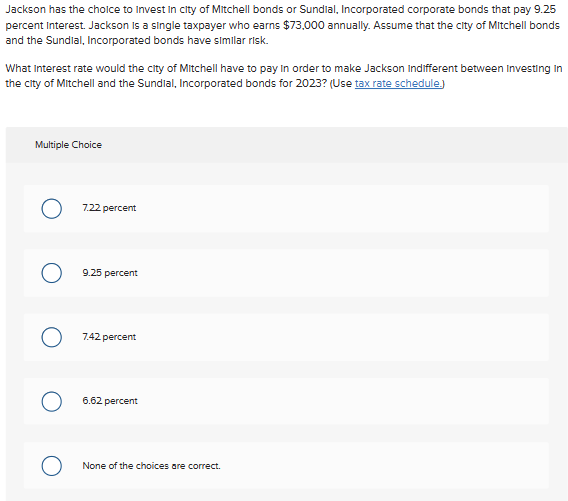

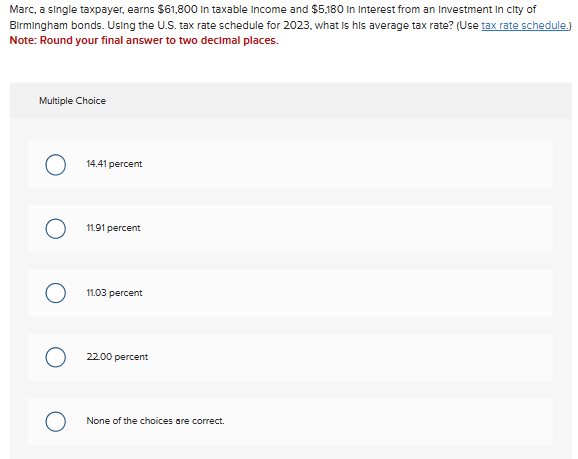

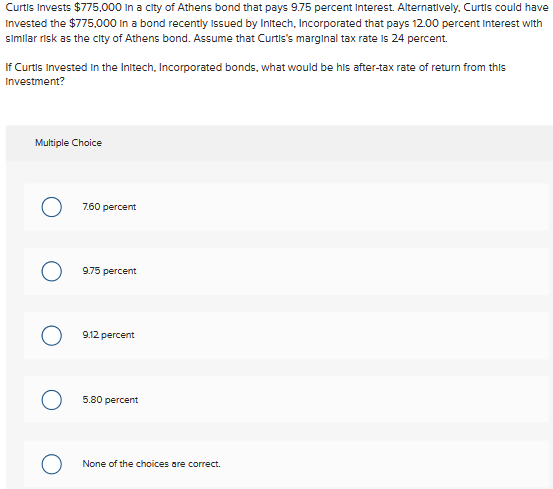

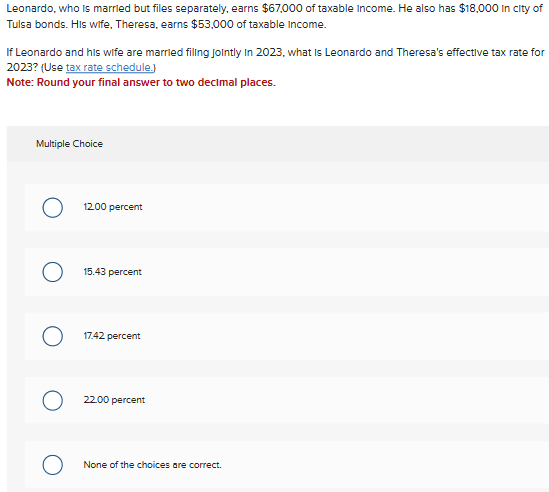

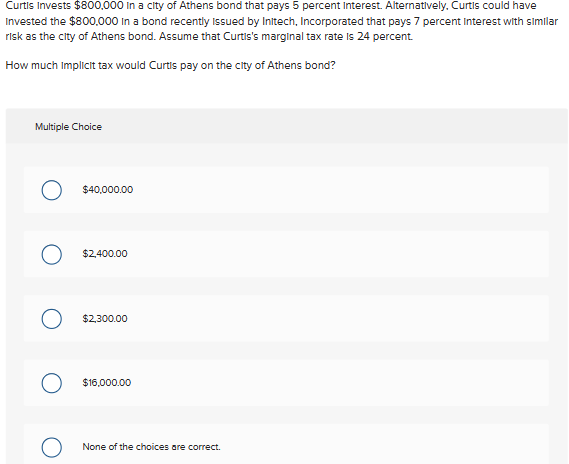

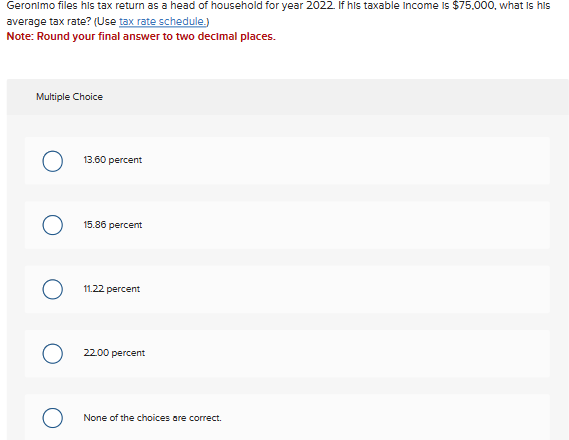

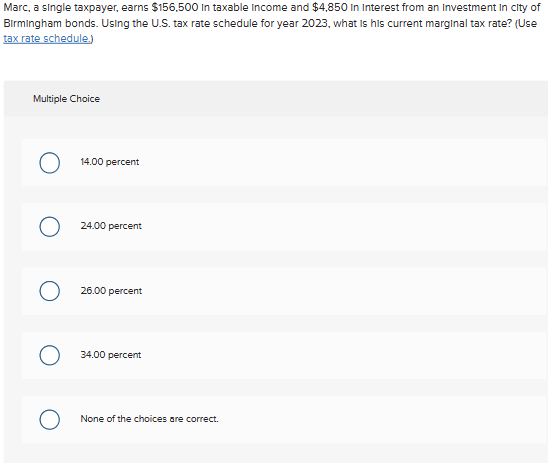

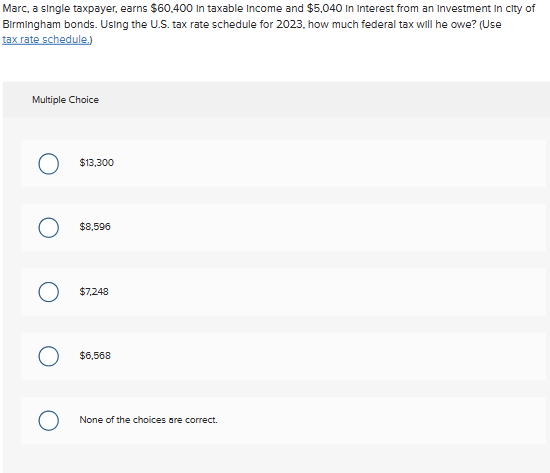

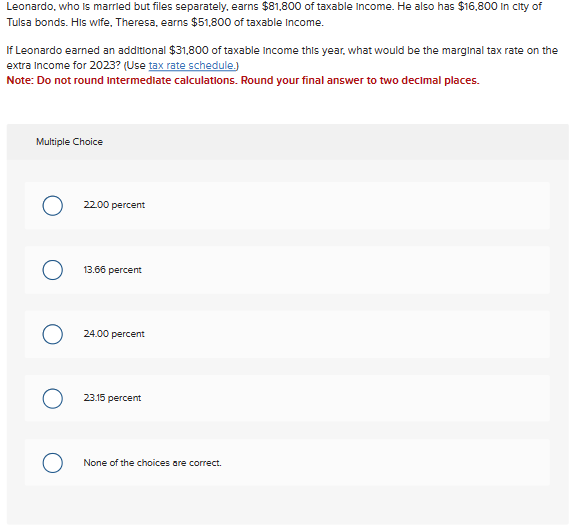

Curtls Invests $475.000 In a clty of Athens bond that pays 6.75 percent Interest. Alternatlvely. Curtls could have Invested the $475,000 in a bond recently Issued by Initech, Incorporated that pays 8.25 percent Interest with similar risk as the city of Athens bond. Assume that Curtis's marginal tax rate is 24 percent. What is Curtis's after-tax rate of return on the city of Athens bond? Multiple Choice 5.07 percent 6.59 percent 6.75 percent 8.75 percent None of the choices are correct. Jackson has the choice to Invest In clty of Mitchell bonds or Sundlal, Incorporated corporate bonds that pay 9.25 percent Interest. Jackson is a single taxpayer who earns $73,000 annually. Assume that the city of Mitchell bonds and the Sundlal, Incorporated bonds have similar risk. What Interest rate would the city of Mitchell have to pay in order to make Jackson Indifferent between Investing in the city of Mitchell and the Sundlal, Incorporated bonds for 2023 ? (Use Multiple Choice 7.22 percent 9.25 percent 7.42 percent 6.62 percent None of the choices are correct. Marc, a single taxpayer, earns $61,800 In taxable income and $5,180 in interest from an Investment in city of Birmingham bonds. Using the U.S. tax rate schedule for 2023, what is his average tax rate? (Use Note: Round your final answer to two decimal places. Multiple Choice 14.41 percent 11.91 percent 11.03 percent 2200 percent None of the choices are correct. Curtls Invests $775,000 In a city of Athens bond that pays 9.75 percent interest. Alternatlvely. Curtls could have Invested the $775,000 in a bond recently Issued by Inltech, Incorporated that pays 12.00 percent Interest with similar risk as the city of Athens bond. Assume that Curtis's marginal tax rate is 24 percent. If Curtls Invested In the Initech, Incorporated bonds, what would be his after-tax rate of return from this Investment? Multiple Choice 7.60 percent 9.75 percent 9.12 percent 5.80 percent None of the choices are correct. Leonardo, who is marrled but files separately, earns $67,000 of taxable income. He also has $18,000 In city of Tulsa bonds. His wife, Theresa, earns $53,000 of taxable income. If Leonardo and his wife are marrled filling Jointly in 2023, what is Leonardo and Theresa's effectlve tax rate for 2023? (Use tax rate schedule.) Note: Round your final answer to two decimal places. Multiple Choice 1200 percent 15.43 percent 17.42 percent 2200 percent None of the choices are correct. Curtis invests $800,000 In a clty of Athens bond that pays 5 percent interest. Alternatlvely. Curtis could have Invested the $800,000 In a bond recently Issued by Initech, Incorporated that pays 7 percent Interest with similar risk as the city of Athens bond. Assume that Curtis's marginal tax rate is 24 percent. How much Implicit tax would Curtls pay on the city of Athens bond? Multiple Choice $40,000.00 $2,400.00 $2,300.00 $16,000.00 None of the choices are correct. Geronlmo files his tax return as a head of household for year 2022 . If his taxable income is $75,000, what is his average tax rate? (Use tax rate schedule.) Note: Round your final answer to two declmal places. Multiple Choice 13.60 percent 15.86 percent 11.22 percent 2200 percent None of the choices are correct. Marc, a single taxpayer, earns $156.500 In taxable Income and $4,850 In Interest from an Investment in clty of Birmingham bonds. Using the U.S. tax rate schedule for year 2023, what is his current marginal tax rate? (Use tax rate schedule.) Multiple Choice 14.00 percent 24.00 percent 26.00 percent 34.00 percent None of the choices are correct. Marc, a single taxpayer, earns $60,400 in taxable Income and $5,040 In Interest from an Investment in clty of Birmingham bonds. Using the U.S. tax rate schedule for 2023, how much federal tax will he owe? (Use tax rate schedule.) Multiple Choice $13,300 $8,596 $7,248 $6,568 None of the choices are correct. Leonardo, who is marrled but files separately, earns $81,800 of taxable income. He also has $16,800 in city of Tulsa bonds. His wife, Theresa, earns $51,800 of taxable Income. If Leonardo earned an additional $31,800 of taxable Income this year, what would be the marginal tax rate on the extra income for 2023 ? (Use Note: Do not round intermediate calculations. Round your final answer to two decimal places. Multiple Choice 2200 percent 13.66 percent 24.00 percent 23.15 percent None of the choices are correct

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started