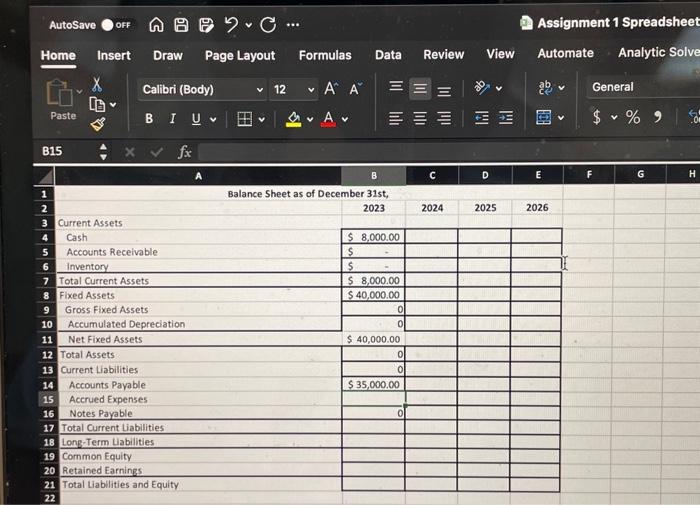

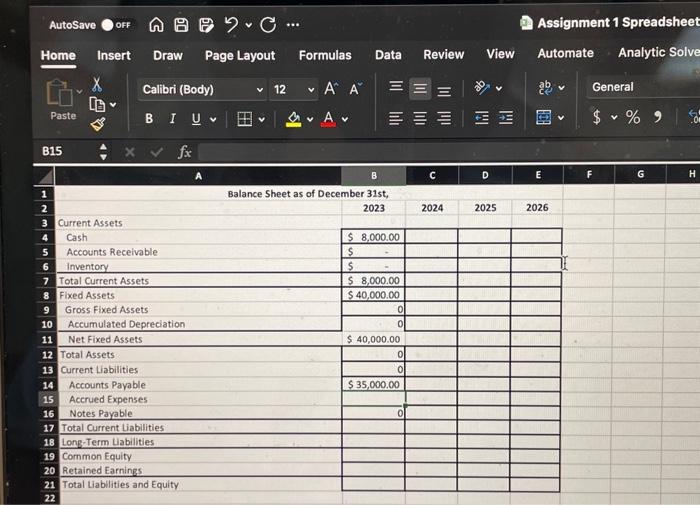

please use the pictures with the year activities to put together a balance sheet as included below.

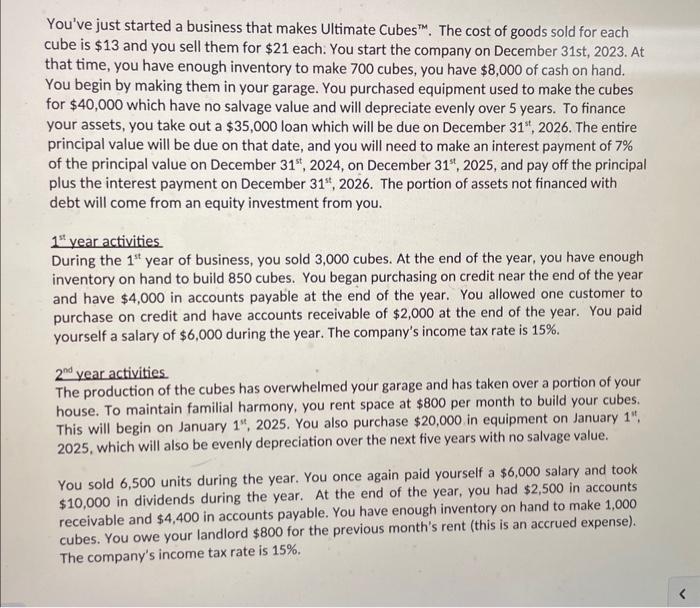

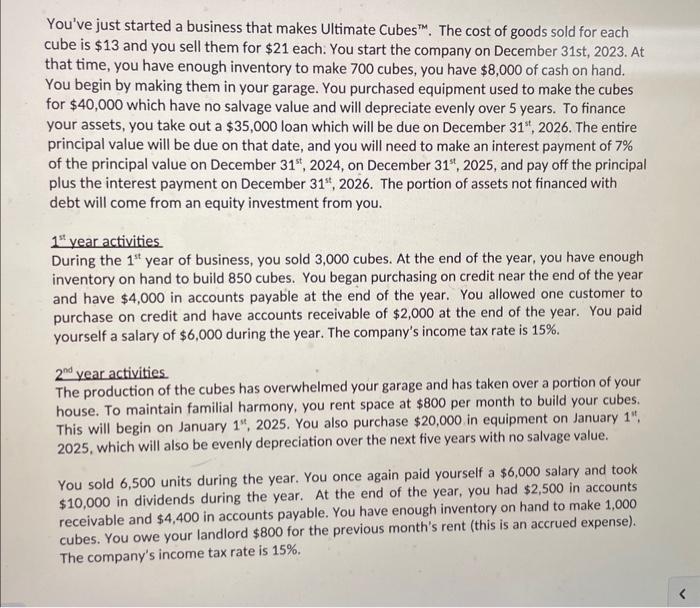

\begin{tabular}{l} Home Insert Draw Page Layout Formulas Data \\ \hline Review \end{tabular} You've just started a business that makes Ultimate Cubes TM. The cost of goods sold for each cube is $13 and you sell them for $21 each: You start the company on December 31st, 2023. At that time, you have enough inventory to make 700 cubes, you have $8,000 of cash on hand. You begin by making them in your garage. You purchased equipment used to make the cubes for $40,000 which have no salvage value and will depreciate evenly over 5 years. To finance your assets, you take out a $35,000 loan which will be due on December 31st,2026. The entire principal value will be due on that date, and you will need to make an interest payment of 7% of the principal value on December 31st,2024, on December 31st,2025, and pay off the principal plus the interest payment on December 31st,2026. The portion of assets not financed with debt will come from an equity investment from you. 1st year activities During the 1tt year of business, you sold 3,000 cubes. At the end of the year, you have enough inventory on hand to build 850 cubes. You began purchasing on credit near the end of the year and have $4,000 in accounts payable at the end of the year. You allowed one customer to purchase on credit and have accounts receivable of $2,000 at the end of the year. You paid yourself a salary of $6,000 during the year. The company's income tax rate is 15%. 2nd year activities The production of the cubes has overwhelmed your garage and has taken over a portion of your house. To maintain familial harmony, you rent space at $800 per month to build your cubes. This will begin on January 1t,2025. You also purchase $20,000 in equipment on January 1t, 2025 , which will also be evenly depreciation over the next five years with no salvage value. You sold 6,500 units during the year. You once again paid yourself a $6,000 salary and took $10,000 in dividends during the year. At the end of the year, you had $2,500 in accounts receivable and $4,400 in accounts payable. You have enough inventory on hand to make 1,000 cubes. You owe your landlord $800 for the previous month's rent (this is an accrued expense). The company's income tax rate is 15%. 3rd year activities During the third year, your sales increased to 12,000 units. You increased your pay to $40,000 per year and the company owed you $20,000 of that at the end of the year. You have enough inventory to produce 1,200 units at the end of the year. Once again, you owe your landlord $800 at the end of the year and your rent amount remained at $800 per month. Accounts Receivable were $5,000 at the end of the year and accounts payable were $6,000. You pay off the $35,000 loan on December 30th,2026. The company's income tax rate is 15%. You pay yourself $30,000 in dividends during the year